Here is Redfin’s monthly email newsletter, with a little about Redfin and a lot about what’s happening in the real estate market.

Happy holidays!

We have a lot to be thankful for don’t we?

After everyone gave up hope, the housing market emerged from the basement for the first time in six years, and is now the life of the party, guzzling Rockstars and kissing old men.

As we predicted in The Atlantic last October, this is a big reason the economy will get better too.

A Recovery Is Becoming a Rally

Pending home sales just hit a five-year high. The number of underwater homeowners refinancing their loans will double this year. Housing starts in October were up 42% over last year.

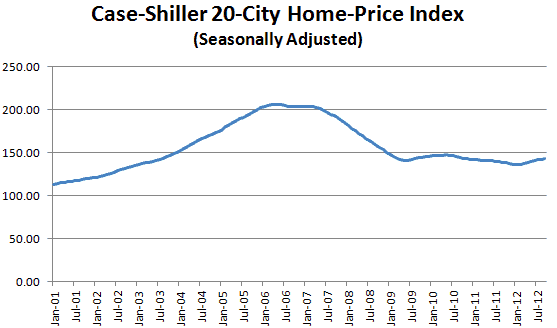

The bottom in prices that we first predicted in February is safely behind us, with the numbers rising every month this year. By October, prices had increased 8.4% over 2011.

Homes Are Still Cheap

But homes are still cheap, hovering between 1999 and 2000 prices. In the last six years, the typical American home-buyer’s mortgage payment has dropped $358 to $889: enough to go out to dinner every night.

Redfin on the Rampage

And Redfin is growing very fast. Redfin agents just hit a big milestone, with $100 million in fees refunded to our customers, based on $8 billion in home sales, with 97% customer satisfaction.

The number of people who sold a home through a Redfin agent doubled this year, mostly because we began promoting our listings through our website and our top-rated mobile tools. A Redfin listing gets double the traffic on Redfin.com that other listings do.

And our traffic set new records too. National TV and newspaper stories published the results of a Redfin study showing we have 20% more agent-listed properties than national portals like Trulia or Zillow, and that we get listings a week sooner.

2013 Predictions

This is why we’re hiring another 200 agents over the next few months, so our service should get much more local. It’s a big bet but we also see plenty of signs in the overall market that change is coming:

- Wake-up call: the builders we’re talking to now are promising a January 1 price increase.

- Spring thaw: we told would-be sellers this year to wait for higher prices. No one will say that in 2013, which will be the first year in seven starting with a broad consensus that prices will rise. After 18 months of fewer and fewer homes for sale, the trend will reverse.

- Move-up buyers: when people can sell their home, they can buy a bigger one. After five years of a market led by first-time buyers, demand will shift up-market, particularly now that government financing for first-time buyers is at risk.

- Move-down buyers: boomers who spent the last five years in an empty nest will finally sell.

- Jumping the bridge: more buyers are looking across the tracks because prices are rising.

- Exurbs: after years of small, in-city projects, builders are moving back to the edge of town, having run out of any other land to buy.

- Flips: more folks are putting money into homes before selling. Architect billings are at a two-year high.

- Foreclosures: will only spike if the U.S. starts taxing forgiven mortgage debt in January. Without a tax-break extension, any time a bank forgives debt, the homeowner pays the tax on it. Most owners will just wait for a foreclosure instead. This is a bigger threat to U.S. housing than the mortgage interest deduction.

- Lower fees: as fear dissipates, commissions will decline, after rising 8% since 2005. And it’s about time: half a billion dollars has been invested in real estate technology since then.

- Irrational exuberance: some folks will bet on a bigger recovery than the market can bear. Things will keep getting better, but not like 2005.

And if mortgage interest rates show any signs of rising near the end of the year, the market is going to freak out, like kids at a birthday bash that ran out of cake.

We’ve forgotten what it feels like to pay 5%.

What do you think will happen in 2013? Make your call in the comments section below! Or, if you need advice from Redfin, don’t hesitate to ask.

Happy holidays and thanks for your support!

Glenn Kelman | CEO, Redfin

Twitter | Blog

United States

United States Canada

Canada