The economy added 292,000 jobs in December, more than anyone predicted, pushing 2015 into a robust year for employment growth. Builders in particular reported a spurt of hiring, a good sign for housing.

The good news

We’ve had two really strong back-to-back years for job creation. Wages are up 2.5 percent from a year ago, and more people joined the labor force in December, according to today’s report from the Labor Department. The economy is on solid footing.

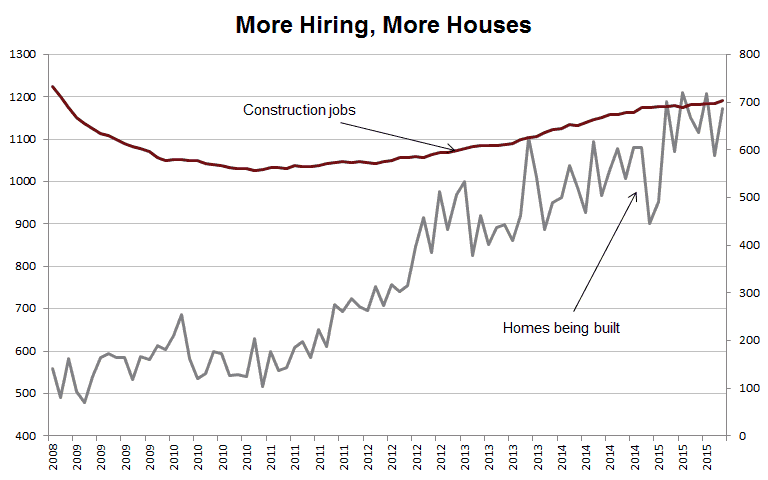

Housing is playing a starring role. Builders added 45,000 jobs in December after a 48,000 increase in November and construction workers put in longer hours last month.

“Warm weather drove construction employment higher for the third month in a row in December,” Redfin chief economist Nela Richardson said. “This was a boon to the huge increase in jobs overall and it bodes well for housing starts in the first quarter. The lack of workers has been a big impediment to new construction.”

The rest of the news

All those new construction jobs might have something to do with warm weather in much of the country and could be short lived. And wage growth is still slow compared to other economic recoveries, which doesn’t help the housing market.

And the surprising jump in employment suggests the Fed might move more quickly to raise interest rates than we first thought. While the central bank doesn’t control mortgages, we can expect home loans to get more expensive this year as the economy improves.

“Markets are desperate for good news, and now have it, but it comes with a caveat because better employment growth means the Fed will raise rates faster,” said Beth Ann Bovino, U.S. chief economist at Standard & Poor’s Ratings Services.

As of this morning, analysts and economists say there’s about a 40 percent chance the Fed will raise interest rates at their March meeting.

The upshot

Builders slowly are coming out of their funk, which eventually will help homebuyers frustrated with a lack of choice. Mortgage rates will rise this year, and we’d still like to see paychecks get bigger, faster.

United States

United States Canada

Canada