Some say there is a great migration back into American cities, the reversal of American suburbanism. If that’s true, homebuyers are bucking the trend.

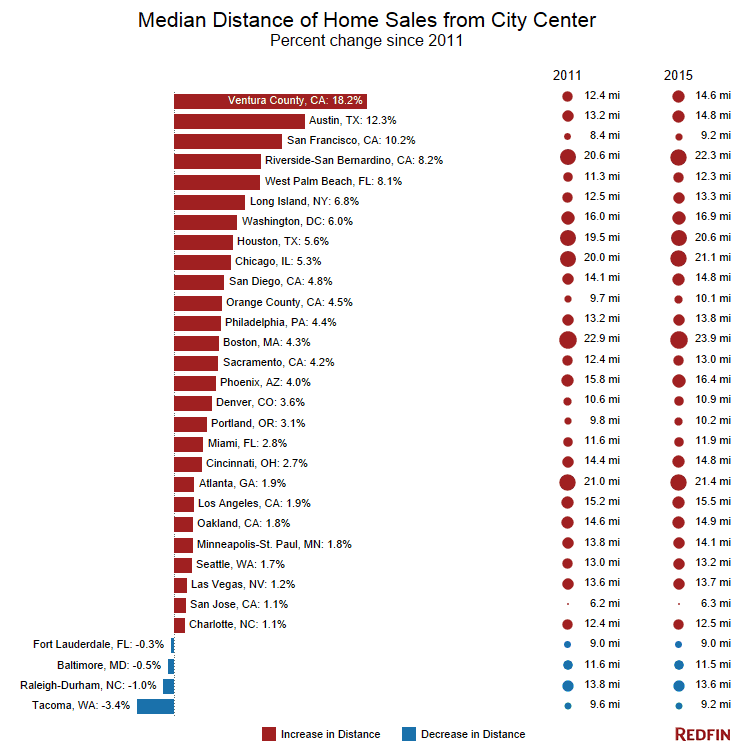

Last year, the typical home sold was about 4 percent farther from a city center than in 2011. That’s an increase of less than a mile on average, but in some metros, including Ventura County, Calif., Austin and San Francisco, the change was significant. Ventura County experienced the biggest increase in miles at 2.2 miles, followed by Riverside-San Bernardino and Austin with increases of 1.7 miles and 1.6 miles respectively.

Buyers are sending mixed signals about what they want. A recent survey by the National Association of Home Builders found that few buyers (less than one in 12) prefer a central city location. Yet educated millennials have been moving into city centers at a faster pace than their non-educated peers since 2000. Additionally, a growing proportion of empty-nester baby boomers are looking to settle into retirement in the city.

The result is a growing gap between city haves and have-nots. Increasingly, downtowns are becoming home to a whiter and more-educated population, with boomers and millennials showing the greatest participation in this change.

Indeed, for those who can afford it the benefits of urban living are many–shorter commutes, improved health, as well as having wider and deeper social networks.

Higher Prices Drive Many Farther Away

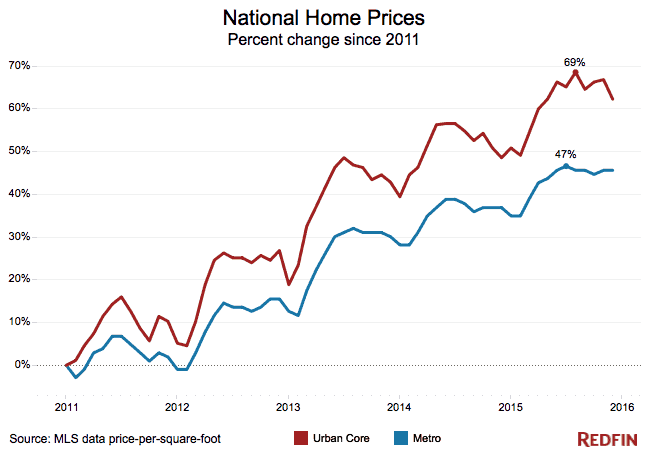

Across 30 metros we examined, prices grew almost 50 percent faster in the urban core than in the metro area as a whole–up 69 percent at the peak last year compared with 47 percent since 2011.

Buyers aren’t following jobs to the suburbs, which have tended to grow faster in city centers than surrounding suburbs. Also, the trend was apparent before oil prices tumbled and hasn’t changed much since.

A better explanation for why people are moving farther out is the scarcity of homes for sale and rising costs, especially in urban cores. Zoning is also partly to blame. Residents of Boston, for example, pay more than three times as much per square foot in order to live in the city center than they do in the metro area as a whole. In only a handful of markets was it actually cheaper per square foot to purchase a home downtown than farther out.

The Upshot

One concern with households moving farther from the city is increasing commute times in order to afford housing. One solution is equipping individuals with information to find affordable housing with reasonable commutes. As part of a White House open data initiative, Redfin is developing Opportunity Score, a tool to help people find homes within a 30-minute carless commute to good-paying jobs.

Methodology:

We first determined the city center of the primary city within each metropolitan statistical area using the polygon centroids of the city or local knowledge about each metro region. Then, using the data on more than 6 million home sales, we calculated the distance of every property sold to the city center of its metro. We calculated the median distance for each metro every year and viewed the percentage change each year. Testing the percentage change in distance since 2011 for statistical significance, we found the majority of metros (25 out of 30) were significant at the 95 percent level. We used this distance calculated to classify any property within 5 kilometers (i.e. 3.1 miles) of the city center, about a 15-minute bike ride, as the urban core of a metro. We used the median sale price per square foot for measuring changes in price between the metro and urban core.

United States

United States Canada

Canada