There was a lot to like in February’s jobs report. Employers added 242,000 workers to their payrolls, more than economists had anticipated. More people joined the workforce, a sign of confidence in the labor market and the economy, and unemployment held at 4.9 percent.

We’ve had a good run of strong job creation for a while now, which has boosted demand for homes and apartments, pushing up the cost of both.

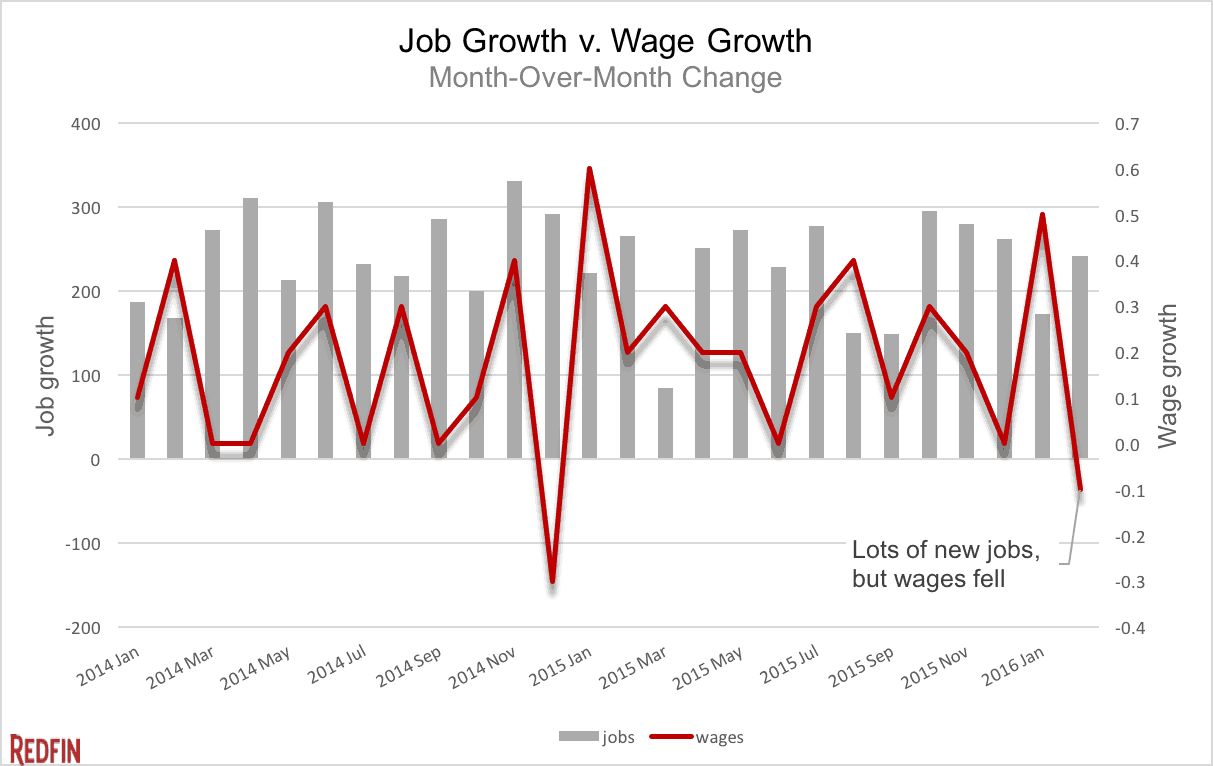

Which brings us to the bad news. Even though hiring is brisk, wages aren’t going up as fast as they should be and February’s job surge didn’t translate into higher pay. In fact, average wages fell 0.1 percent from January, according to the Labor Department, the first month-over-month decline since December 2014. The economy isn’t getting the same bang for the buck from job creation as it it used to.

So we have a dilemma. With houses in high demand, the cost of homeownership is rising in most of the country, but incomes aren’t keeping up.

Housing demand has outpaced supply since early 2015, when inventory began to drop sharply, fueling strong price growth. In January, the median home sale price was up 7.7 percent from a year earlier. By contrast, wages grew about 2.2 percent last month from the same time last year.

“Headline job growth is old news. The real story is wages. They’re stuck,” Redfin chief economist Nela Richardson said. “The mismatch between fast-growing home prices and slow-growing incomes continues to be a huge obstacle for would-be buyers.”

What about interest rates?

Federal Reserve policymakers raised short-term interest rates in December for the first time in seven years. As they prep for their March 16 meeting, they’re watching employment data for signs of strength or weakness in the economy. A healthy economy would give them a reason to raise rates again, but today’s report gave conflicting signals at best.

“They’re seeing strong job growth and in normal times that would be an automatic reason to raise interest rates,” Richardson said. “But behind the hiring there’s little wage inflation. The headline number is saying yes but the wage number is saying no way.”

No one expects the Fed to raise short-term interest rates this month, and today’s report strengthened that consensus. For now, Janet Yellen & Co. are still playing it by ear, with no data-driven path to a rate increase.

Don’t forget, the Fed doesn’t control mortgage rates, though they can influence them. Home loans are still cheap and probably will stay that way for a while.

United States

United States Canada

Canada