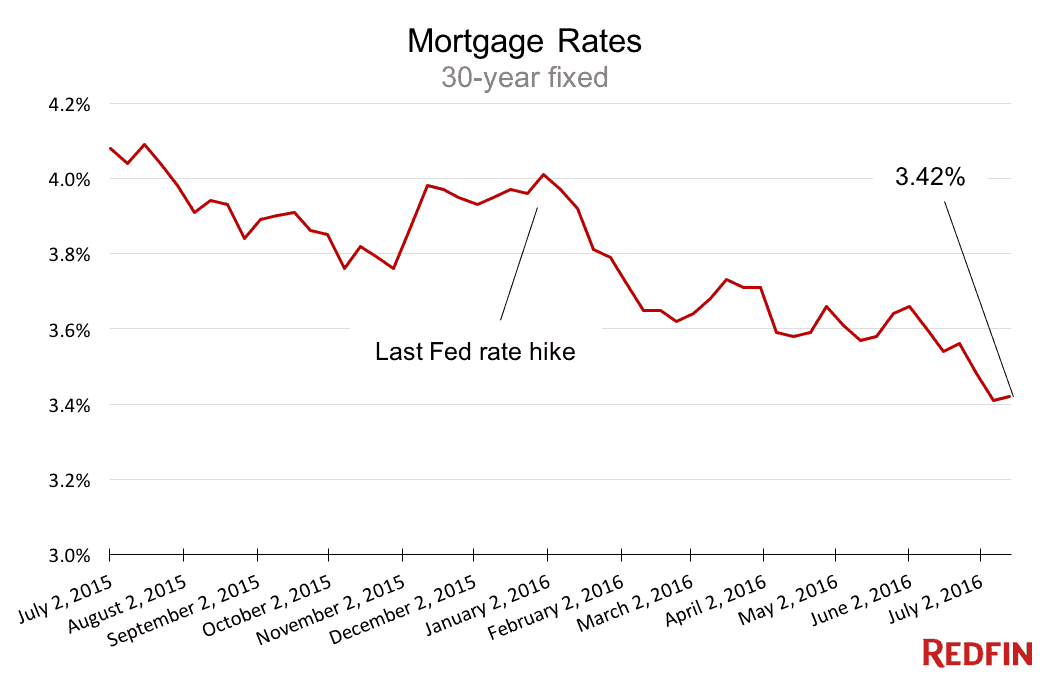

Mortgage rates held near their 2016 low last week, averaging 3.42 percent for a 30-year, fixed-rate loan. That’s up from 3.41 percent the week before. A year ago, rates averaged 4.09 percent, according to Freddie Mac’s weekly survey.

Rates have held below 4 percent for 28 straight weeks and odds are good they’ll extend that streak to beat the record 29-week run of 2014.

What’s going on?

U.S. homeowners have Britain, Japan and Germany and other countries to thank for our sustained run of cheap borrowing.

Mortgages typically get cheaper when interest paid by Treasury bonds – the yield — falls. And yields fall, typically, when people are worried about the economy. Treasury yields hit a 227-year low last week as worried investors scrambled to find safe havens in the confusion that followed Brexit, Britain’s surprise vote to leave the European Union.

But economic anxiety isn’t the only reason for today’s low rates. After all, the U.S. is still growing and creating jobs.

Here’s another reason. Some investors, such as pension funds and insurers, are required by law to hold bonds, even when bonds pay next to nothing in interest.

Treasuries are paying next to nothing, but that’s a better return than investors can get elsewhere. In Japan and Germany, for example, bondholders aren’t collecting any interest at all, and some have to actually pay interest.

It’s called a negative rate, which is like a bank taking money out of your savings account every month instead of paying you interest. You’d probably look for a better savings account. For investors, Treasuries are that better savings account and everyone wants in.

So what

That investor demand is keeping borrowing costs cheap, a boon to homeowners and buyers. Last week, lenders faced another rush of mortgage refinancing applications, the Mortgage Bankers Association reported.

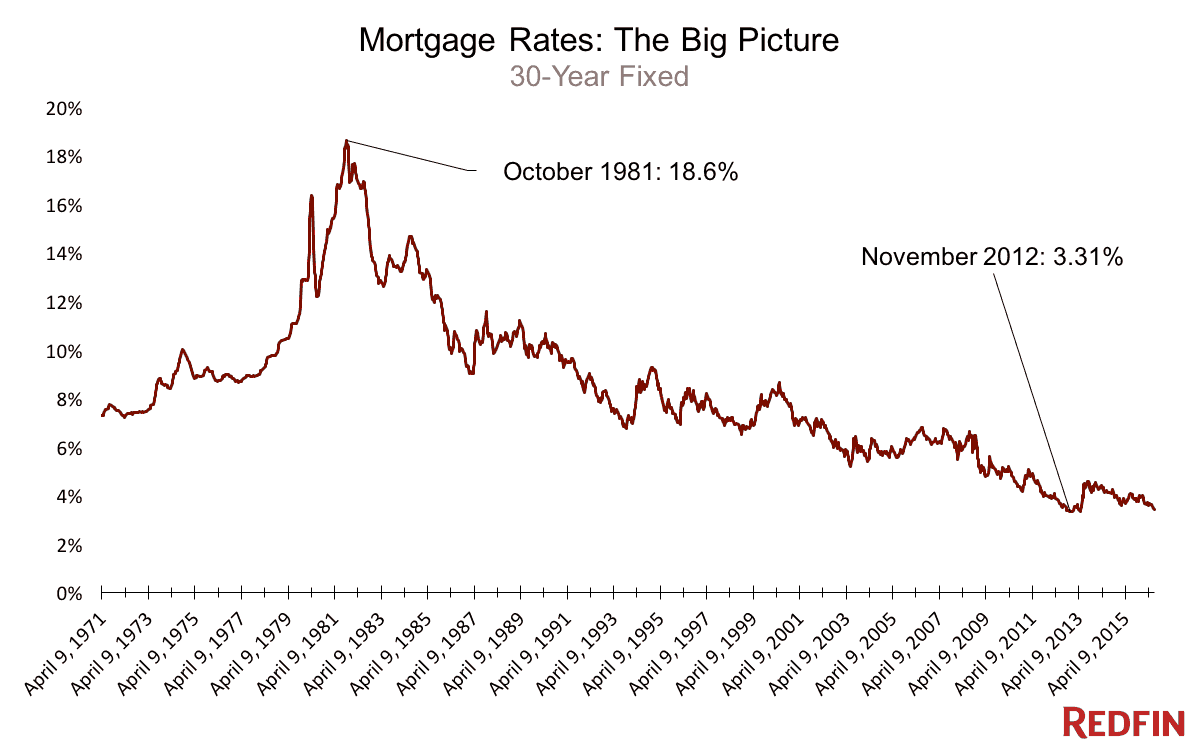

Mortgage rates will tick up and down week to week, but they’re holding near the record 3.31 percent and will stay there for the foreseeable future.

United States

United States Canada

Canada