In this article, you’ll find:

1. Can closing costs be rolled into a mortgage

2. What are closing costs?

3. What mortgages allow you to roll in closing costs?

4. What can seller concessions be used for?

5. Non-eligible closing costs.

6. How to include closing costs into your mortgage?

Can you roll closing costs into your mortgage?

Yes, you can roll closing costs into your mortgage, but it’s a double-edged sword. While this reduces your upfront cash requirement at closing, it results in higher monthly payments and increased total interest paid over the loan’s duration. Consult your lender to understand their specific policies, the regulations governing this practice, and which closing costs are eligible for inclusion in your mortgage.

Explore your mortgage options and get a personalized rate with us at Redfin Mortgage Calculator.

What are closing costs?

Closing costs are fees and expenses you pay when you finalize a real estate transaction, whether you’re buying or selling a property. These costs represent the expenses incurred when transferring property ownership. These costs are in addition to the purchase price of the home (if you’re buying) or the proceeds from the sale (if you’re selling).

Understanding typical closing costs

Let’s say you’re buying a house for $200,000. Your closing costs might range from 2% to 5% of the purchase price, so in this case, between $4,000 and $10,000. Here’s a simplified breakdown of what some of those costs might be (these are just examples; actual costs vary widely):

- Loan origination fee: $1,000

- Appraisal fee: $500

- Title insurance: $750

- Property taxes (prepaid): $1,500

- Recording fees: $200

Your actual closing costs could be higher or lower depending on the specifics of your transaction. Specifically, it’s crucial to get a detailed breakdown of closing costs from your lender and/or real estate agent before closing.

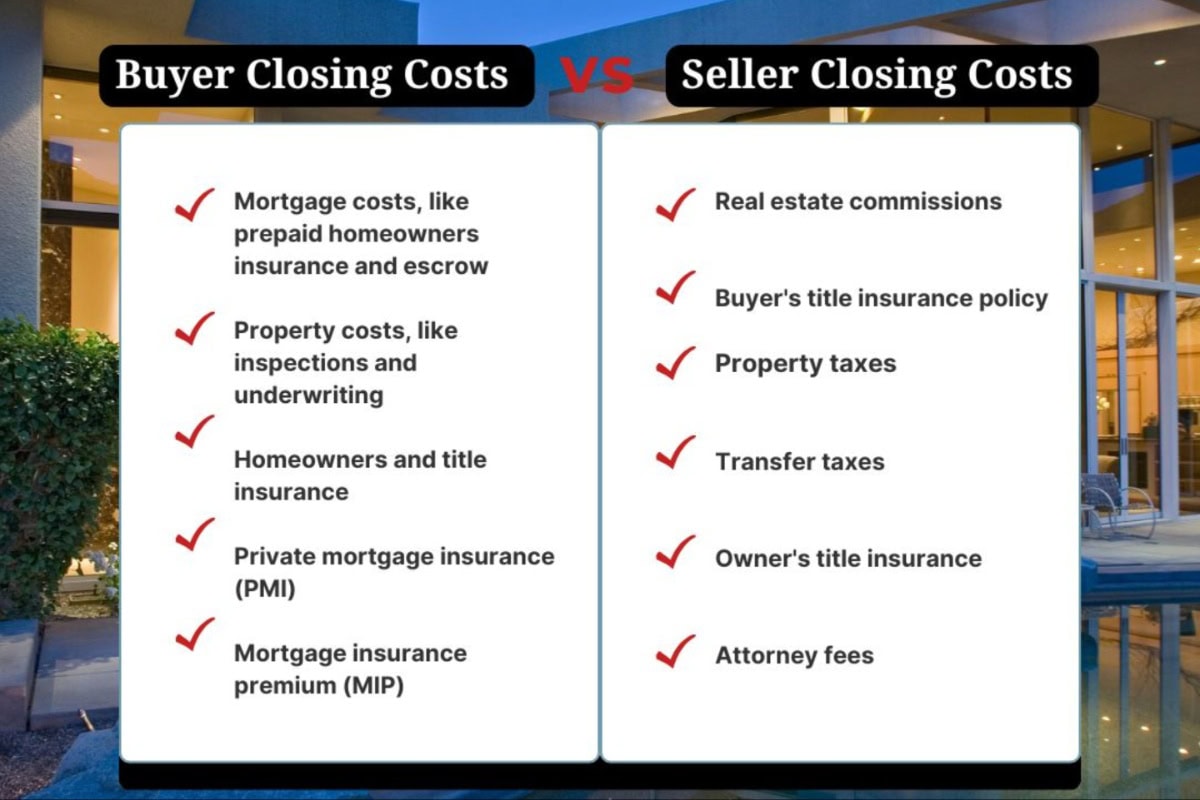

What kind of costs are included? Closing costs can cover a wide range of things, including but not limited to and depending on whether you are the buyer or the seller:

- Origination fees: What the lender charges for processing and underwriting the loan.

- Mortgage points, also known as discount points, are upfront fees paid to lower the interest rate on the mortgage.

- Home appraisal fees: The cost to professionally evaluate the property before purchase.

- Home inspection fees: The cost to professionally check the property is up-to-code and in good, habitable condition.

- Title insurance fees: The title company costs to ensure the title is free of issues.

- Recording fees: To cover the official recording of the new deed and mortgage documents with local government offices.

- Attorney fees: To cover any legal costs associated with the home purchase.

- Mortgage insurance premiums: Your lender may require mortgage insurance, depending on the loan you choose and your down payment amount.

What mortgages allow you to roll in closing costs?

FHA loans

An FHA loan is a mortgage loan that’s insured by the Federal Housing Administration (FHA). This means the FHA guarantees the loan, which makes lenders more willing to offer mortgages to people who might not qualify for a traditional loan. FHA loans are popular with first-time homebuyers and those with lower credit scores or smaller down payments.

Here’s a breakdown of the key features of FHA loans:

- Lower credit score requirements: FHA loans generally have more lenient credit score requirements than conventional loans.

- Lower down payment: FHA loans require a minimum down payment of 3.5% of the purchase price, which is lower than many conventional loans.

- Mortgage insurance: FHA loans require mortgage insurance premiums (MIP), which protect the lender if you default on your loan. There’s an upfront MIP paid at closing and an annual MIP paid monthly.

Rolling closing costs into an FHA loan

With an FHA loan, you have the option to roll your closing costs into the loan itself. This is often referred to as a “no-closing-cost mortgage.” Here’s how it works:

Rather than upfront payment, closing costs are integrated into the total loan principal. This means you’ll borrow more money, but you won’t have to pay as much out of pocket at closing.

Benefits:

- Lower upfront costs: You’ll have less to pay at closing, which can be helpful if you have limited funds.

Drawbacks:

- Higher monthly payments: Since you’re borrowing more money, your monthly mortgage payments will be higher.

- Paying more interest overall: Over the life of the loan, you’ll end up paying more interest because you’re borrowing a larger amount.

USDA loans

USDA loans, formally known as USDA Rural Housing Loans, are mortgage loans offered by the U.S. Department of Agriculture (USDA) specifically designed to help low-to-moderate-income families purchase homes in rural areas. They’re a great option for those who qualify because they offer some significant advantages.

Key features of USDA loans:

- No down payment: One of the biggest benefits is that USDA loans typically require no down payment. This is a huge advantage for buyers who may not have saved a large sum of money for a down payment. You can finance up to 100% of the appraised value of the home.

- Low interest rates: USDA loans often have very competitive interest rates, sometimes even lower than conventional loans.

- Guaranteed by the USDA: The USDA guarantees these loans, which makes lenders more willing to offer them even to borrowers with less-than-perfect credit.

- Rural areas: These loans are specifically for properties located in designated rural areas. It’s important to check the USDA’s eligibility maps to see if a property qualifies. “Rural” is defined broadly and can include some suburban areas.

- Income limits: There are income limits to qualify for a USDA loan. These limits vary by location and household size. Eligibility for this program is determined by specific income thresholds.

Can you roll closing costs into a USDA mortgage?

Generally, yes, you can often roll closing costs into a USDA loan. This is similar to how it works with FHA loans, and it can be a significant benefit. By rolling the closing costs into the loan, you reduce the amount of cash you need upfront at closing. This can make homeownership more accessible, especially for those with limited savings.

Drawbacks

Increased loan amount: Because you’re financing the closing costs, your loan amount will be higher, and you’ll pay more interest over the life of the loan.

Higher monthly payments: While your upfront costs are lower, your monthly payments will be slightly higher because of the larger loan amount.

Appraisal: The amount you can roll in is limited to the difference between the sales price and the appraised value.

VA loans

A VA loan is a mortgage loan guaranteed by the U.S. Department of Veterans Affairs (VA). This benefit is exclusively available to eligible veterans, active-duty military personnel, and specific surviving spouses.

These loans offer some significant advantages:

- Financing options typically allow for 100% coverage of the home’s purchase price, thereby eliminating the necessity for a down payment. This is a huge benefit, especially for first-time homebuyers.

- No private mortgage insurance (PMI): With most loans where you put down less than 20%, you’ll be required to pay PMI. VA loans don’t require PMI, which can save you a significant amount of money over the life of the loan.

- Competitive interest rates: VA loans often have competitive interest rates, sometimes lower than conventional loans.

- Easier credit requirements: While you still need to qualify, VA loans can be more forgiving with credit scores than some other loan types.

- The VA strictly regulates permissible closing costs for veterans, ensuring protection against undue financial burdens.

Seller concessions (up to 4%)

Regarding seller concessions, it’s important to understand that when purchasing a property with a VA loan (or any other financing), the seller may agree to contribute to the buyer’s closing expenses. This is defined as a seller concession. VA loan regulations specify a maximum seller concession of 4% of the total loan price.

What can seller concessions be used for?

These concessions can be used to pay for a variety of things, including:

- Closing costs: things like appraisal fees, loan origination fees, title insurance, and other fees associated with closing the loan.

- Discount points: points you can buy to lower your interest rate.

- Prepaid taxes and insurance: Money to cover a portion of your property taxes and homeowner’s insurance upfront.

- Paying down debt: In some cases, seller concessions can even be used to pay down some of the buyer’s existing debt, which can help them qualify for the loan.

Why are seller concessions helpful?

Seller concessions can be very helpful for buyers, especially those with limited funds. They can reduce the amount of cash a buyer needs upfront to close on a home.

“Now, more than in the recent past, many sellers are open and willing to contribute towards closing costs with the burden of high interest rates, making homeownership tougher and less desirable for buyers.”-

Drawbacks:

- Higher monthly payments: Since you’re borrowing more money, your monthly mortgage payments will be higher

Non-eligible closing costs.

Note that while the inclusion of certain closing costs in your mortgage is permissible, other costs require mandatory upfront payment. These mandatory upfront expenses include prepaid items such as property taxes (typically covering a specific advance period), the initial homeowner’s insurance premium, and, in some cases, HOA dues. Lenders mandate these upfront payments to secure immediate expense coverage, thereby safeguarding their investment in the property.

Additionally, while not strictly required, an earnest money deposit is a common way to show your good faith to the seller when making an offer. Don’t hesitate to discuss this with your agent and explore options for negotiation.

How to include closing costs into your mortgage?

Rolling your closing costs into your mortgage can be a helpful strategy to reduce your upfront expenses when buying a home. Essentially, this means you’re financing those costs as part of your loan rather than paying them out of pocket at closing. This can appeal to those with limited savings or who prefer to preserve their cash reserves.

How do it work?

Here’s a general overview of how it works, but remember, you should always speak with your lender for personalized guidance, as the specifics can vary depending on your loan type and individual circumstances:

- Discuss it with your lender: This is the most crucial step. Your lender can explain the different options available to you, including whether rolling closing costs into your mortgage is feasible for your specific loan program (FHA, VA, USDA, Conventional, etc.). Furthermore, they will also be able to tell you how it will impact your loan amount, interest rate, and monthly payments.

- Determine eligible closing costs: Not all closing costs can be rolled into your mortgage. Your lender will help you identify which costs are eligible. These typically include things like loan origination fees, appraisal fees, title insurance, and some prepaid items.

- Calculate the impact: Your lender will provide you with a detailed breakdown of how rolling in the closing costs will affect your monthly payments and the total amount of interest you’ll pay over the life of the loan. This is essential for making an informed decision.

- Negotiate with the seller (if applicable): In some cases, you might be able to negotiate with the seller to contribute towards your closing costs. Ideally, this can further reduce your out-of-pocket expenses. Again, your lender and real estate agent can assist with this process.

- Finalize the loan: Once you’ve decided to roll in the closing costs and have worked out the details with your lender, they will incorporate these costs into your final loan amount.

Is it a good idea to roll closing costs into your mortgage?

Ultimately, the decision of whether or not to roll closing costs into your mortgage hinges on your financial situation and priorities. Therefore, while it can be a helpful tool for reducing upfront expenses, it’s crucial to weigh the long-term costs of higher monthly payments and increased interest.

Your lender is your best resource for navigating these complexities, explaining the specifics of your loan program, and helping you determine if this strategy aligns with your financial goals. Review your options and obtain personalized rates. Start your journey today with the Redfin Mortgage Calculator.