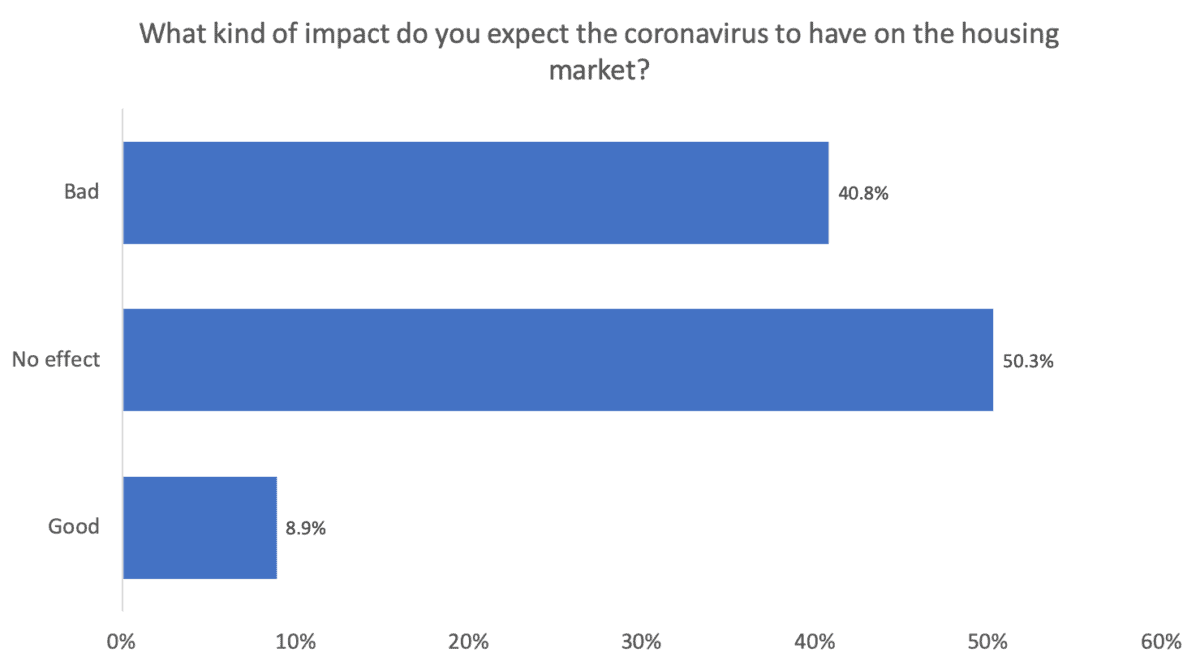

40% of survey respondents expect the outbreak to have a negative effect on the market, while 50% anticipate no impact.

About 40% of Americans anticipate that the recent spread of the novel coronavirus, also known as COVID-19, will have a negative effect on the housing market, according to a new survey conducted by Redfin.

While that represents 2 in 5 Americans, not all participants are concerned about the virus’ impact on real estate. Half of respondents expect no effect at all on the housing market, while 8.9% predict that it will have a positive impact—likely due to the recent drop in mortgage rates.

“Lower mortgage rates make homebuying more affordable, and that’s a certainty for buyers right now,” said Redfin chief economist Daryl Fairweather. “What’s much less certain is how much the economy will be hurt by the coronavirus and how long the pain will last. When impacts to people’s incomes and employment become more clear, we may see more people become pessimistic about buying a home.”

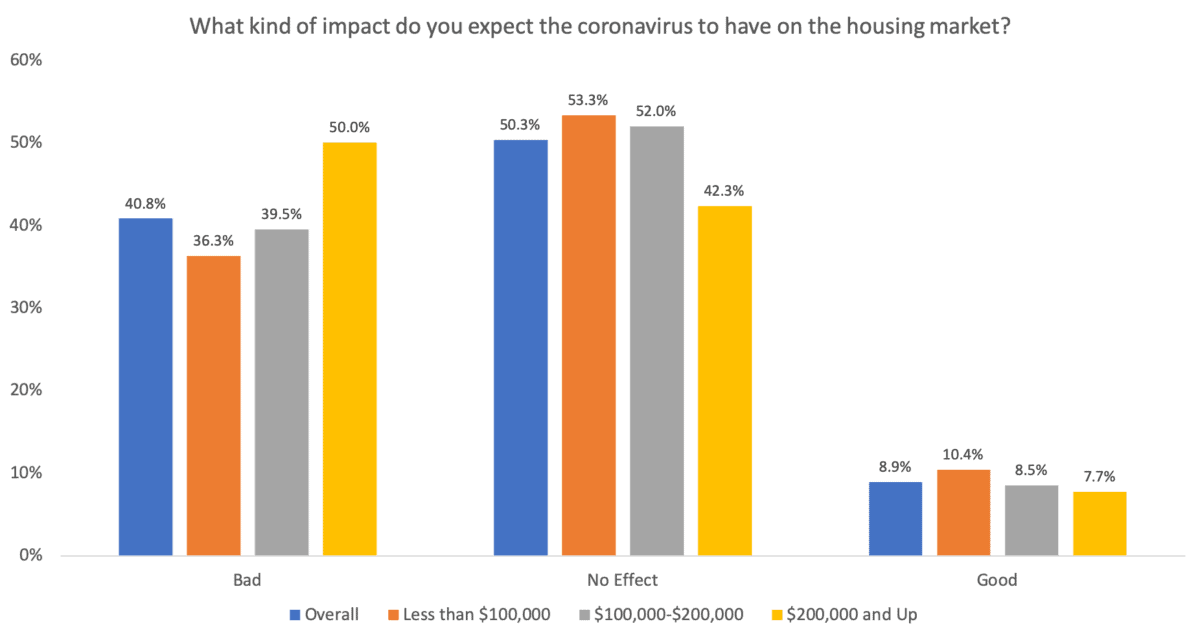

The results differed by income level, with respondents that have higher annual household incomes more likely to expect the coronavirus to have a negative impact on the housing market. Of respondents who make $200,000 or more, half expect COVID-19 to hurt the housing market, compared with about 40% overall. This is likely because wealthier people tend to hold more money in the stock market, which has fallen in value dramatically recently due to the uncertainty surrounding the coronavirus, impacting how much money they can cash out to pay for housing, according to Fairweather.

The findings of the survey also varied by location and occupation. Of respondents in the New York City area, 59% expect the coronavirus to have a negative impact on the housing market—the highest share of any eligible city we surveyed, followed by Las Vegas at 58.3% and San Francisco at 53.8%. Participants in the Orange County, CA area were most likely to predict COVID-19 will be good for the housing market (23.5%), followed by Albuquerque, NM and Charlotte, NC, both at 21.4%.

When broken down by industry, those who work in financial services were most likely to anticipate a negative impact on the housing market from COVID-19 (50.8%), followed by architecture (50.0%) and those who listed parenting as their line of work (48.5%). Respondents in the media industry were most likely to forecast a positive impact (19.0%) followed by those in the legal sector (18.2%) and the travel industry (15.8%).

How Does COVID-19 Impact Buyers and Sellers?

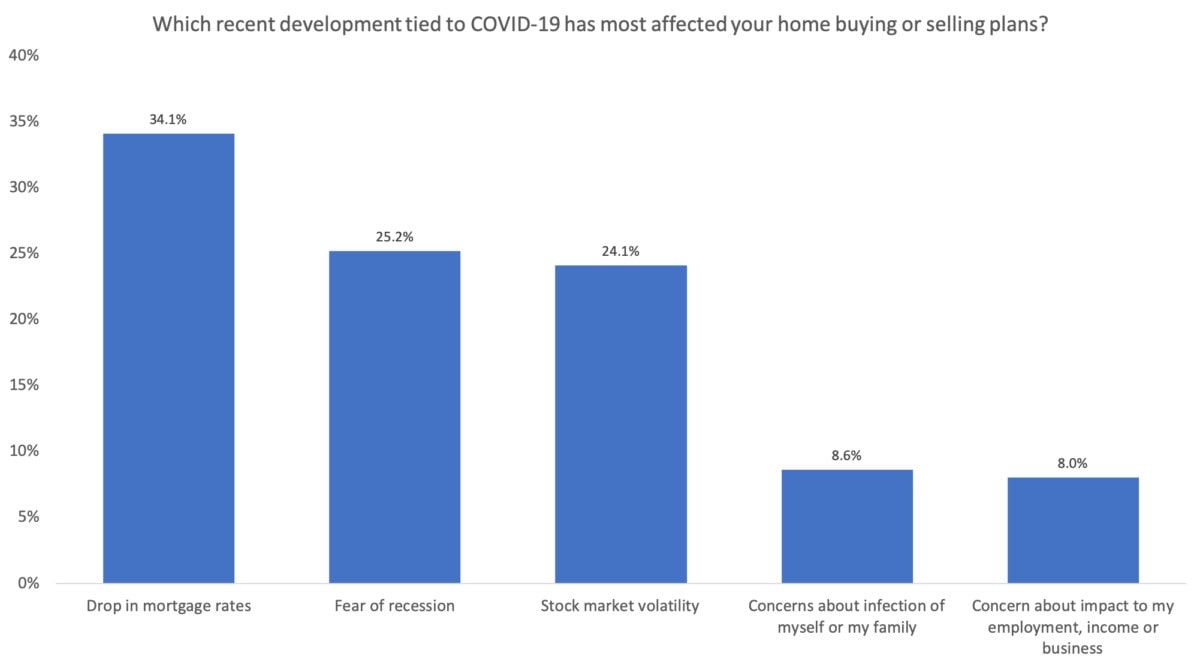

We asked participants to specify which coronavirus-related development has most impacted their homebuying or selling plans: a drop in mortgage rates, fear of recession, stock-market volatility, concerns about becoming infected, or concerns about their career and/or income. About three-quarters of respondents selected one of those choices, while around 25% selected “none of the above.” The chart below provides a breakdown of the results, excluding the “none of the above” option.

About one-third of participants said the recent drop in mortgage rates has had the biggest impact on their plans, followed by recession fears (25.2%) and stock-market volatility (24.1%).

Mortgage rates in the U.S. recently fell to the lowest on record amid concerns about the coronavirus outbreak—a boon for prospective buyers and homeowners who may want to refinance. Our survey found that more than half (53.9%) of prospective buyers have accelerated their homebuying plans in response to the decline in rates. Of the prospective sellers we surveyed, 20.2% said the recent drop in rates led them to consider refinancing and/or holding onto their home instead of selling.

“Low mortgage rates impact sellers differently,” Fairweather said. “A seller who was considering downsizing to lower their housing budget could now refinance to a lower monthly payment and be able to afford to remain in their current home. However, sellers who were considering upgrading to a more expensive home can now afford to increase their budgets under low mortgage rates.”

Methodology

Redfin conducted a survey in March 2020 of more than 1,000 customers who plan to buy and/or sell a home in the next 12 months. Respondents were asked about how the novel coronavirus, or COVID-19, is impacting their perspective on the housing market as well as their home buying and selling plans.

United States

United States Canada

Canada