Homes are selling the fastest in swing counties, a reflection of rising interest in the suburbs as the pandemic drives homebuyers to prioritize space.

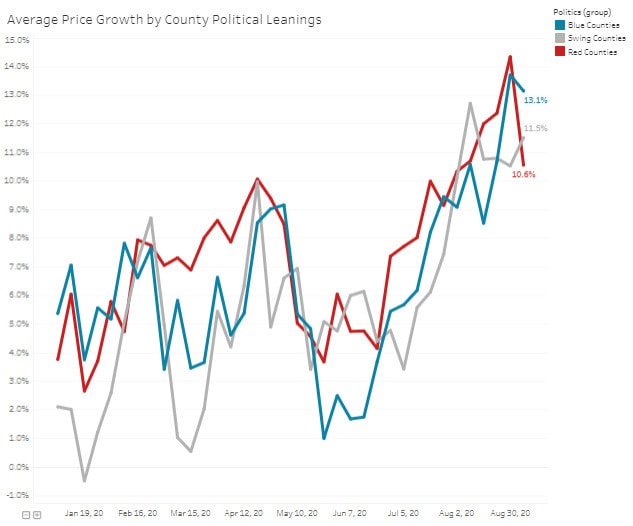

The median home price in blue counties nationwide rose 13.1% from a year earlier to $346,000 during the four weeks ending September 6. Prices rose 11.5% to $259,500 in swing counties, and they were up 10.6% to $209,000 in red counties.

For this analysis, counties were classified as “blue” if the 2016 Democratic presidential candidate won by more than 10 percentage points, and classified as “red” if the 2016 Republican candidate won by more than 10 percentage points. Counties were classified as “swing” if neither candidate received more than 55% of all votes.

Blue counties are typically expensive urban areas and tech hubs in both red and blue states, including San Francisco County and Travis County (Austin). Red counties tend to be home to mostly rural, relatively affordable areas, including many neighborhoods in red states but also rural parts of blue states such as Yakima County in Washington, about two hours east of Seattle. Swing counties are often made up largely of suburban neighborhoods. Examples include Orange County, about 35 miles south of Los Angeles, and Nassau and Suffolk counties on Long Island, east of New York City.

“Homeowners in counties of all colors—blue, red and purple—are benefiting from a strong housing market even during this deep recession,” said Redfin chief economist Daryl Fairweather. “Home values are up, which is all great financial news if you’re a homeowner, regardless of your politics.”

“But rising prices and tight supply mean it’s a tough landscape for first-time homebuyers,” Fairweather continued. “Many of them have long been priced out of urban blue counties and are searching in suburban swing counties and more rural areas. This trend is being exacerbated by the pandemic-driven work-from-home culture, which is causing many homebuyers to place more emphasis on indoor and outdoor space and less on commute times.”

Housing supply is tightening most and homes are selling fastest in swing counties, but blue and red counties aren’t far behind

The total number of homes actively listed for sale was way down from a year earlier in all areas, with supply tightening the most in swing counties. Total housing supply dropped nearly 35% year over year in swing counties in the four weeks ending September 6, compared with a 32% dip in red counties and a 22.2% decline in blue counties.

“Supply is dropping the most in swing counties because they tend to be made up of suburban neighborhoods, where there are far more homebuyers than sellers right now,” Fairweather said.

New listings were up most in blue counties (12.4% year over year) in the four weeks ending September 6, while they were up 7.1% in swing counties and 3.8% in red counties. Pent-up selling demand is one reason why new listings rose most in blue counties in August: New listings for homes in blue areas plummeted to a low of -47% year over year in the four weeks ending April 26, bigger than the 36% dip for red areas and the 43% decline for swing counties.

Additionally, homes sold fastest in swing counties, with 43.5% of homes going under contract within two weeks during the four weeks ending September 6, versus 39.6% for blue counties and 35.3% for red counties. The typical home that sold during those four weeks went under contract in 43 days in blue counties, 44 days in swing counties and 62 days in red counties.

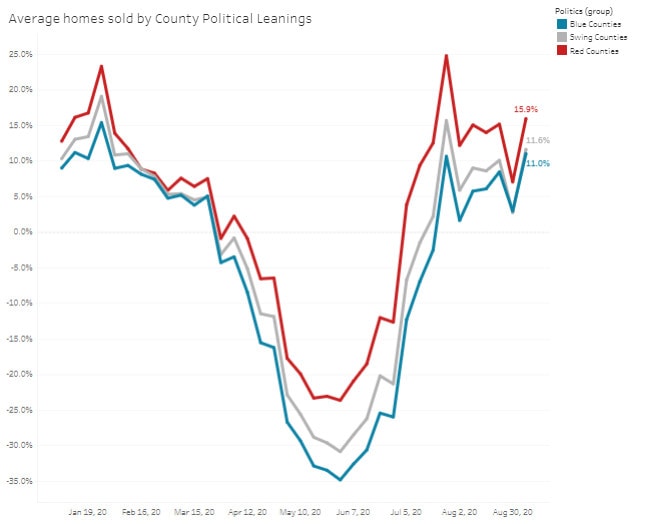

Sales were up most in red counties, but pending sales were up more in swing and blue counties

The number of homes sold in the four weeks ending September 6 rose most in red counties (15.9% year over year), compared with an 11.6% increase in swing counties and an 11% increase in blue counties.

Sales in blue counties were hit hardest at the beginning of the coronavirus pandemic, down 34.8% year over year in the four weeks ending May 31 versus a 30.9% decline in swing counties and a 23.7% decline for red counties.

Pending home sales rose most in swing counties, with a 29.6% year-over-year increase in the four weeks ending September 6, trailed closely by a 29% increase for blue counties. Pending sales were up 26.2% in red counties. The fact that pending sales are up more in swing and blue counties reflects the fact that sales in those areas took a bigger hit at the beginning of the pandemic and thus have more room to grow.

Homes in blue counties sold closest to their asking price

Homes in blue counties were slightly more competitive than other counties in the four weeks ending September 6, with the typical home selling for 99.3% of its list price, compared with 99.1% in swing counties and 97.5% in red counties.

The average sale-to-list ratio was up most from last year in swing counties, with a 1.5 percentage-point increase from the year before, compared with a 1.2-point increase for blue counties and a 1-point increase for red counties.

| Housing market summary for the four weeks ending September 6, divided along political lines

The metrics in this table are all averages of county-level housing market data. Counties are divided by political leanings. |

|||

| Blue counties | Swing counties | Red counties | |

| Median sale price | $345,935 | $259,500 | $209,363 |

| Median sale price, YoY | 13.1% | 11.5% | 10.6% |

| Homes sold, YoY | 11% | 11.6% | 15.9% |

| Pending sales, YoY | 29% | 29.6% | 26.2% |

| Active listings, YoY | -22.2% | -34.9% | -32% |

| New listings, YoY | 12.4% | 7.1% | 3.8% |

| Days on market | 43 | 44 | 62 |

| Share of listings off market in two weeks | 39.6% | 43.5% | 35.3% |

| Sale-to-list ratio | 99.3% | 98.9% | 97.5% |

| Sale-to-list ratio, percentage-point change from last year | +1.2 pts. | +1.5 pts. | +1 pt. |

United States

United States Canada

Canada