San Francisco, San Diego and Boston were home to the most competitive markets in July, though the bidding war rate in each metro was less than half than it was a year earlier.

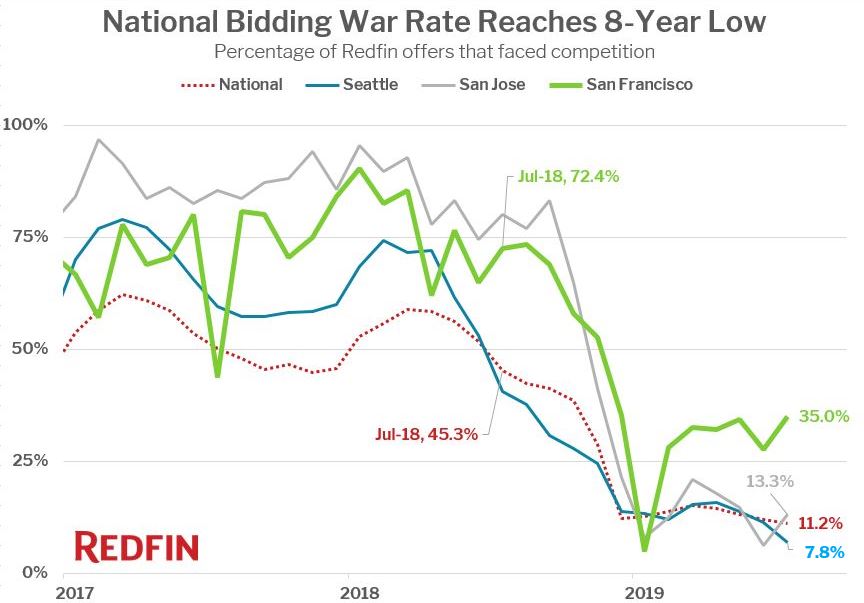

Only 11.2 percent of offers written by Redfin agents on behalf of their homebuying customers nationwide faced a bidding war in July. That’s down from more than 45 percent a year earlier and the lowest rate since at least 2011.

The national bidding war rate hasn’t surpassed 15 percent since November 2018, after falling steadily from a peak of 59 percent in March 2018.

“Mortgage rates have been mostly flat for the last month, and so has homebuyer competition, which was beginning a fast descent this time last year as mortgage rates were inching toward 5 percent,” said Redfin chief economist Daryl Fairweather. “On a local level, it’s noteworthy that some of 2018’s fiercely competitive markets—San Jose, Seattle, Los Angeles—have seen their bidding war rates plummet the most year over year. Home prices in these expensive markets have also been falling annually. Overall, I expect homebuyer demand to strengthen in the second half of the year as the housing market continues to stabilize, but we may not see a big pop in bidding wars until early next year.”

San Francisco—one of the most expensive markets in the country—was the most competitive in July, with 35 percent of Redfin offers facing a bidding war. That’s down from 72.4 percent a year earlier and up from 28 percent in June, mirroring the seven-percentage-point increase seen from June to July of last year.

“Although the market isn’t as hot as it was last year, this spring and summer have been busy in San Francisco. That’s partly because homebuyers are feeling pressure to move quickly due to the high-profile tech IPOs, whether that pressure is real or perceived,” said San Francisco Redfin agent Miriam Westberg. “Low interest rates are also a factor in increased homebuyer interest since the beginning of the year. The market has definitely picked up since the winter and it seems like prices and competition are slowly heading back to mid-2018 levels.”

San Diego was home to the second-most competitive market in July, with 21.3 percent of Redfin offers facing competition. It’s followed by Boston (16.4%), Los Angeles (16%), Philadelphia (14.3%) and Denver (14%). The bidding war rate in San Jose, San Francisco’s neighbor to the south, was just 13.3 percent, and in Seattle, another expensive West Coast market, the rate was only 7.8 percent.

Miami was the least competitive market in July, with just 1.3 percent of the offers submitted by Redfin agents facing competition. Next comes Houston, where 4.8 percent of offers faced competition, New York (6.3%), Dallas (6.6%) and Las Vegas (7.3%).

| Metro area | Share of Redfin offers that faced competition in July 2019 | Share of Redfin offers that faced competition in July 2018 | Share of Redfin offers that faced competition in June 2019 |

| San Francisco, CA | 35% | 72.4% | 28% |

| San Diego, CA | 21.3% | 61.5% | 19.4% |

| Boston, MA | 16.4% | 63.6% | 17.2% |

| Los Angeles, CA | 16% | 64.6% | 13.7% |

| Philadelphia, PA | 14.3% | 36.7% | 9.1% |

| Denver, CO | 14% | 48.8% | 12.3% |

| Phoenix, AZ | 13.6% | 47.6% | 10.9% |

| San Jose, CA | 13.3% | 80% | 10.5% |

| Sacramento, CA | 9.4% | 39.2% | 11.8% |

| Washington, D.C. | 9.1% | 40.1% | 9.9% |

| Raleigh, NC | 8.9% | 28.6% | 6.6% |

| Portland, OR | 8.7% | 36.6% | 11.8% |

| Chicago, IL | 8.1% | 31% | 10% |

| Seattle, WA | 7.8% | 40.6% | 11.5% |

| Atlanta, GA | 7.8% | 34.7% | 7.2% |

| Austin, TX | 7.8% | 39% | 8.7% |

| Las Vegas, NV | 7.3% | 31% | 11.5% |

| Dallas, TX | 6.6% | 43% | 5.3% |

| New York, NY | 6.3% | 40.8% | 15.1% |

| Houston, TX | 4.8% | 37.5% | 7.9% |

| Miami, FL | 1.3% | 29.6% | 0% |

| National | 11.2% | 45.5% | 12.3% |

Editor’s Note: Early in 2020 we discovered an issue with the data we had been collecting on bidding wars, which caused us to underestimate the rate of bidding wars in several markets. Redfin is currently in the process of fixing these data issues. Once complete, we will provide an updated estimate of the bidding wars for 2019.

United States

United States Canada

Canada