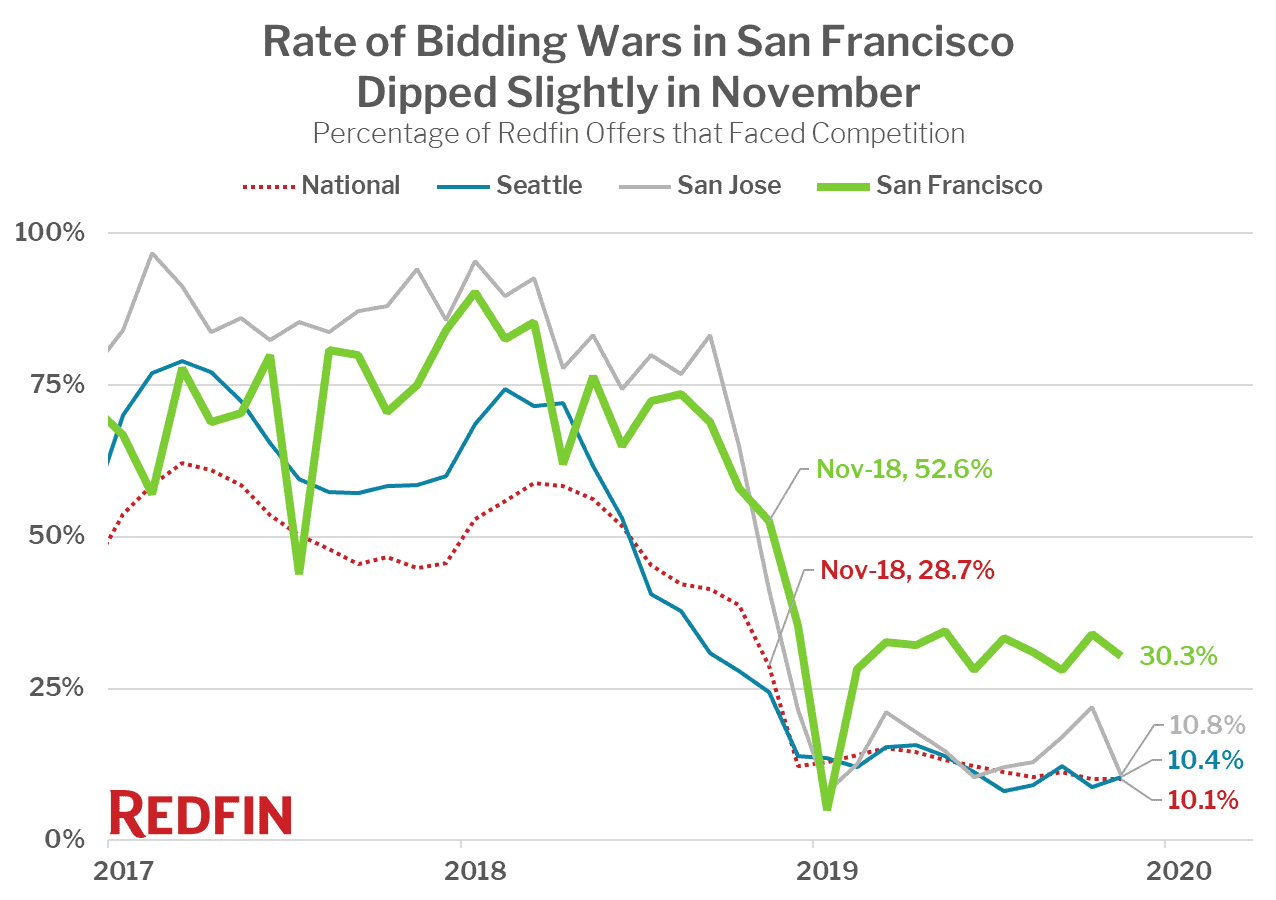

Just 10% of Redfin offers faced competition nationwide; in San Francisco, the rate was 30%.

Just 10% of offers written by Redfin agents on behalf of their homebuying customers faced a bidding war in November, down from 29% a year earlier and hovering at the 10-year low for the 5th consecutive month. This rate is likely to remain low through the end of the year, and begin rising again in early 2020.

San Francisco was the only market that remained somewhat competitive in November. The bidding war rate there in November was 30%, down from 53% a year earlier and down from 34% in October. The month-over-month decline of 3.7 points was slightly below the 2010-2018 average October-to-November decline of 4.6 points.

“Almost every home for sale that is in a great location and priced competitively is still receiving multiple offers,” said San Francisco Redfin agent Miriam Westberg. “One home we made an offer on last week had 25 other offers! However, homebuyers definitely feel like they can be more selective this year, so homes that don’t check every single box may only get a single offer, and tend to take a longer time to sell.”

Competition was scarce everywhere else in the country, with no other market seeing a bidding war rate higher than 17%. The bidding war rate hit its lowest point in at least five years in November in Chicago, Houston, Portland, OR and Los Angeles.

“Even though the number of homes for sale has been falling faster than we normally see this time of year, buyers just aren’t feeling any sense of urgency right now,” said Redfin chief economist Daryl Fairweather. “The supply and demand data still says that it’s a seller’s market, but homebuyers working with Redfin agents in places like Portland and Denver are feeling and acting like they’re in control. Most of the homes that they are seeing are simply not worth getting into a bidding war over, so they’re more than willing to wait until the new year in the hopes that more homes will hit the market.“

2019 as a whole has been a welcome reprieve from the frenzied market of years prior, but with fewer new listings hitting the market and more homes selling quickly after being listed, 2020 may be shaping up to swing the pendulum back in the other direction.

Houston was the least competitive market in November, with just 1.4% of offers facing a bidding war there. Miami was barely above that at 1.7% and Raleigh was the third least competitive market with 2.6% of offers facing competition.

Rate of Bidding Wars by Metro Area: November 2019

| Metro Area | Share of Redfin Offers that Faced Competition November 2019 | Share of Redfin Offers that Faced Competition November 2018 | Share of Redfin Offers that Faced Competition October 2019 |

|---|---|---|---|

| San Francisco, CA | 30.3% | 52.6% | 34.0% |

| San Diego, CA | 16.8% | 36.2% | 15.8% |

| Denver, CO | 14.4% | 23.6% | 6.6% |

| New York, NY | 12.7% | 19.8% | 7.2% |

| Boston, MA | 12.2% | 34.3% | 12.0% |

| Atlanta, GA | 11.3% | 23.1% | 3.7% |

| Los Angeles, CA | 11.3% | 33.8% | 14.2% |

| San Jose, CA | 10.8% | 41.2% | 22.0% |

| Phoenix, AZ | 10.7% | 24.4% | 14.2% |

| Philadelphia, PA | 10.7% | 43.5% | 13.2% |

| Seattle, WA | 10.4% | 24.5% | 8.8% |

| Washington, D.C. | 9.4% | 34.9% | 8.9% |

| Dallas, TX | 7.1% | 23.2% | 6.7% |

| Portland, OR | 6.6% | 30.1% | 8.2% |

| Austin, TX | 5.5% | 20.0% | 7.6% |

| Las Vegas, NV | 5.4% | 18.5% | 6.7% |

| Chicago, IL | 5.2% | 23.2% | 6.2% |

| Sacramento, CA | 5.1% | 44.1% | 8.6% |

| Raleigh, NC | 2.6% | 15.2% | 10.4% |

| Miami, FL | 1.7% | 18.4% | 4.7% |

| Houston, TX | 1.4% | 21.7% | 8.4% |

| National | 10.1% | 28.7% | 10.1% |

Editor’s Note: Early in 2020 we discovered an issue with the data we had been collecting on bidding wars, which caused us to underestimate the rate of bidding wars in several markets. Redfin is currently in the process of fixing these data issues. Once complete, we will provide an updated estimate of the bidding wars for 2019.

United States

United States Canada

Canada