Declines felt more acutely in tech hubs like the Bay Area, where more than a quarter of homebuyers report volatility has impacted their ability to afford a down payment

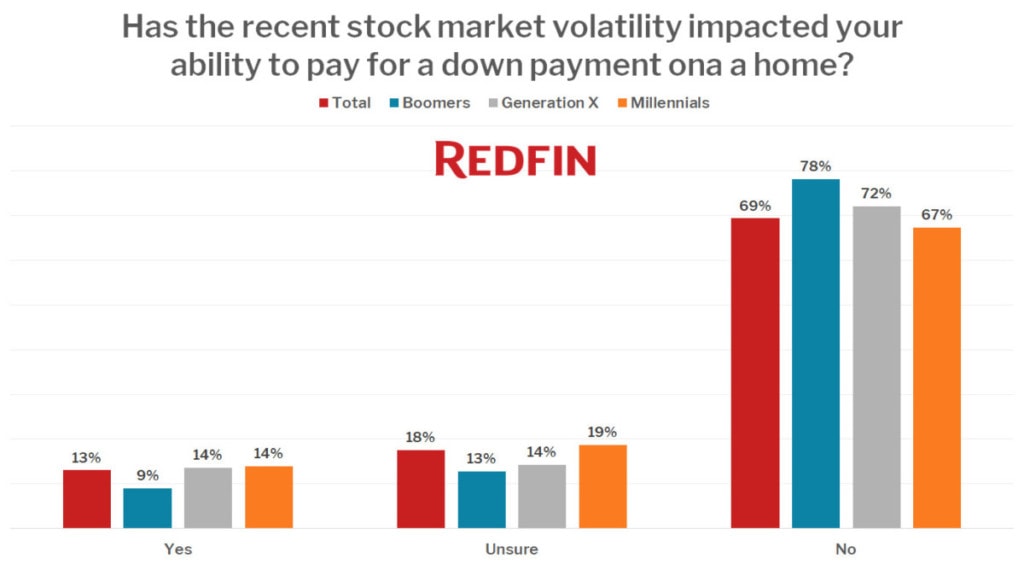

For 70% of homebuyers, the recent volatility in the stock market due to the novel coronavirus had not impacted their ability to afford a down payment in early March, according to a survey of more than 1,000 Redfin customers who plan to buy and/or sell a home in the next 12 months. While 17% of respondents were unsure of the impacts, 13% of respondents said the stock market volatility had impacted their ability to afford a down payment. The consumer survey was fielded March 9 to March 11, before the plunge into bear market territory on March 12. When the markets closed on March 11, the day Redfin’s survey closed, the Dow Jones Index was at 23,632. It had dropped more than 3,400 points by the close of the market on March 16. Redfin will continue to provide the latest data regarding how consumers are responding to the coronavirus and economic uncertainty.

“Buyers have been feeling a push and pull between stock market declines and lower mortgage rates,” said Redfin’s chief economist, Daryl Fairweather. On the one hand, buyers who had their downpayment ready in cash saw their purchasing power increase as mortgage rates declined to historic lows. On the other hand, buyers who were planning to liquidate their stock investments for a downpayment are watching the Wall Street rollercoaster and the drastic actions the Federal Reserve is taking to bolster the economy. Up until the most recent drop in the stock market March 16, it seemed low rates were the bigger motivating factor in the housing market. But, we’re continuing to monitor how the economic fallout from the coronavirus will impact home purchases. Every day new restrictions are being set that will help contain the virus, but will unfortunately also hurt people’s incomes and the economy. I anticipate that in the coming weeks and months the positive effect from low mortgage rates will wane as the negative economic impacts rise. Eventually, once the health crisis has been addressed, I believe the economy and housing market have the potential for a strong recovery.

In the San Francisco metro area, where the median home price is $1.3 million and many workers in tech and other industries receive some of their compensation in stock, the impact of the stock market declines is being felt more acutely. Among Bay Area homebuyers, 26% said the volatility has impacted their ability to afford a downpayment, twice the national average. About 1 in 5 buyers in Philadelphia and Chicago also said stock market turbulence has altered their plans.

“I had a listing go on the market on Thursday, March 5, got a ton of traffic at the open house, and ended Sunday with three strong offers. By the time I went to review them with my seller on Monday morning, two had withdrawn citing stock market concerns,” said Kalena Masching, a Redfin agent in Palo Alto. “In Silicon Valley, a majority of buyers use money from selling their employer’s stock for their down payment or pledge the stock to strengthen their loan backing, so many are in vastly different financial positions today than just a few days prior. For buyers with adequate cash resources, it’s a great time to get into the market because I believe you won’t be competing against as many buyers. A lot of folks don’t have that purchasing power, however, and have no choice but to sideline their searches until the stock markets recover a bit.”

Luxury Buyers Most Impacted by Stock Market

People who earn over $200,000 annually were more likely to say the recent volatility has impacted their ability to afford a downpayment, at 18% of respondents. Higher earners tend to have more invested in the stock markets, and therefore, would be more impacted by volatility.

Boomers’ Homebuying Plans Least Impacted By Stock Market

Only 9% of baby boomers said their ability to afford a down payment was impacted by the recent market volatility, compared to 14% of millennials and Gen Xers. Fairweather says this aligns with general financial guidance that retirees and people approaching retirement invest less of their wealth in the stock market in favor of more stable and less risky investments. It could also indicate that boomers are able to finance home purchases with other savings and equity from a current home as opposed to pulling cash from the capital markets.

Read all of the latest coronavirus and housing market updates from Redfin.

Methodology

Redfin conducted a survey in March 2020 of more than 1,000 customers who plan to buy and/or sell a home in the next 12 months. Respondents were asked about how the novel coronavirus, or COVID-19, is impacting their perspective on the housing market as well as their home buying and selling plans. Of all respondents, the 761 who said they were planning to buy or buy and sell a home in the next 12 months were asked whether “the recent stock market volatility impacted your ability to pay for a down payment on a home?”

For more information about the survey and its findings, contact press@redfin.com.

United States

United States Canada

Canada