-

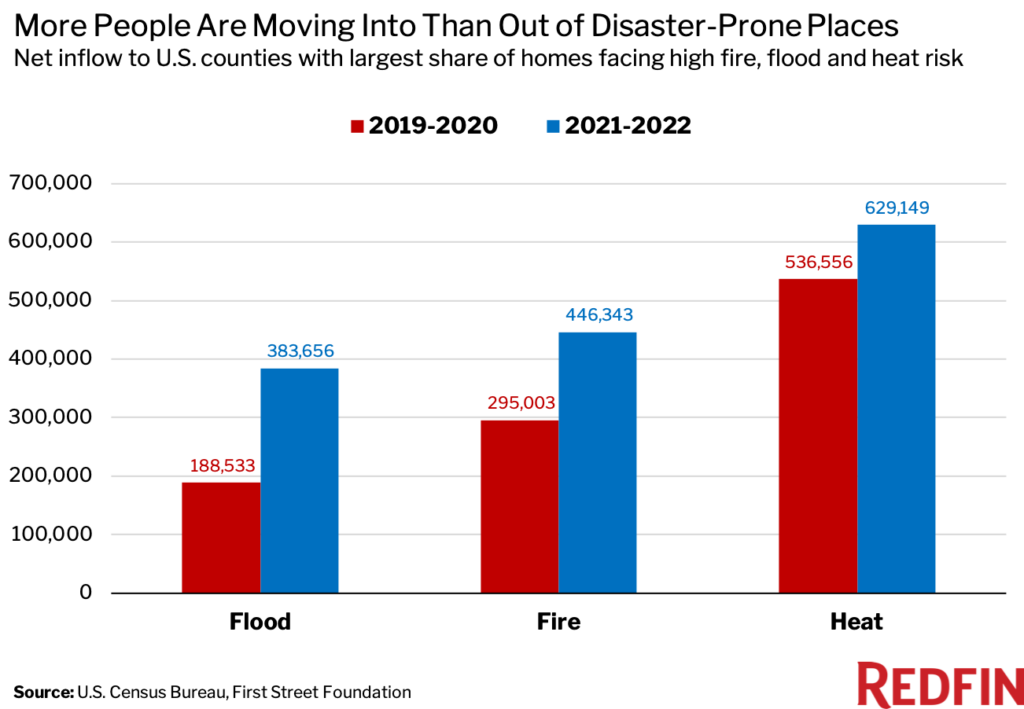

Nearly 400,000 more people moved into than out of the most flood-prone counties in 2021 and 2022—a 103% increase from the prior two years.

-

The counties most vulnerable to wildfires and heat have also seen more people move in than out as the housing affordability crisis pushes Americans into disaster-prone areas.

-

New Orleans and Paradise, CA buck the trend; more people are leaving than moving in following extreme devastation from hurricanes and fires.

The most flood-prone U.S. counties saw 384,000 more people move in than out in 2021 and 2022—a 103% increase from the prior two years, when 189,000 more people moved in than out. The same trend took hold in the places most vulnerable to wildfires and heat as the pandemic homebuying boom and a housing affordability crisis pushed Americans into disaster-prone areas.

The counties with the highest wildfire risk saw 446,000 more people move in than out over the past two years, a 51% increase from 2019 and 2020. And the counties with the highest heat risk saw 629,000 more people move in than out, a 17% uptick.

This is according to a Redfin analysis of domestic migration data from the U.S. Census Bureau and climate-risk scores from First Street Foundation. We analyzed the counties in the contiguous U.S. that rank in the top 10% for flood and fire risk and the top 33% for heat risk, as measured by the share of residential properties at high risk.

Remote work and record-low mortgage rates during the pandemic prompted scores of Americans to leave expensive coastal cities like San Francisco and New York for the Sun Belt in search of more affordable housing, warm weather and/or lower taxes. States including Florida, Texas and Arizona exploded in popularity despite increasing risk from storms, drought, wildfires and extreme heat.

“It’s human nature to focus on current benefits, like waterfront views or a low cost of living, over costs that could rack up in the long run, like property damage or a decrease in property value,” said Redfin Chief Economist Daryl Fairweather. “It’s also human nature to discount risks that are tough to measure, like climate change.”

Many disaster-prone areas are relatively affordable because homebuyers and renters have a larger pool of homes to choose from. America is increasingly building housing in places endangered by climate change; more than half (55%) of homes built so far this decade face fire risk, while 45% face drought risk, a separate Redfin analysis found. By comparison, just 14% of homes built from 1900 to 1959 face fire risk and 37% face drought risk. New homes are also more likely than older homes to face heat and flood risk.

“The consequences of climate change haven’t fully sunk in for many Americans because oftentimes, homeowners and renters don’t foot the whole bill when disaster strikes,” Fairweather said. “Insurers and government programs frequently subsidize the cost of rebuilding after storms hit, and mortgages mean homeowners are ceding some risk to lenders—especially if their house goes into foreclosure after a storm. But with natural disasters intensifying and insurers pulling out of disaster-prone areas including Florida and California, Americans may start feeling a greater sense of urgency to mitigate climate dangers—especially if their home’s value is at risk of declining.”

Nearly half (48.7%) of people who moved in the last year believe the increasing frequency or intensity of natural disasters, extreme temperatures, and/or rising sea levels will likely impact home values in their area in the next 10 years. That’s according to a survey of roughly 2,000 U.S. residents commissioned by Redfin and conducted by Qualtrics in May and June 2023. Still, only about 5% of people who moved in the last year or plan to move in the next year listed climate change as a reason for their relocation.

Redfin.com publishes climate-risk data for nearly every for sale and off-market U.S. home to help house hunters make more informed decisions.

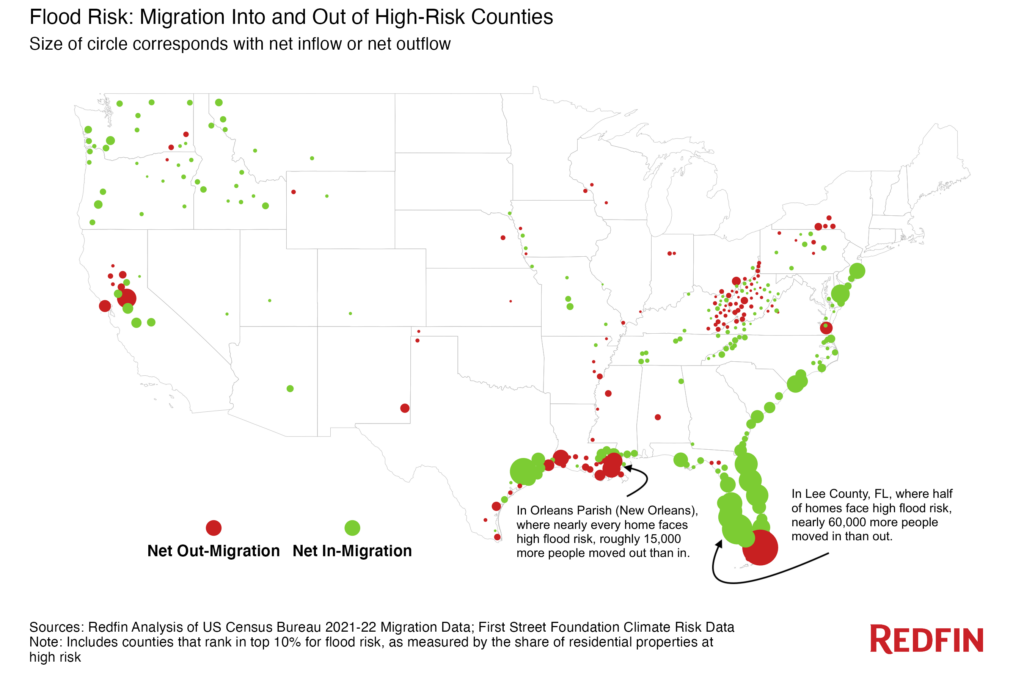

Coastal Florida Is Top Migration Destination Despite Increasing Flood Risk

In the past two years, nearly 60,000 more people moved into than out of Lee County, FL, which includes Fort Myers and Cape Coral and was ravaged by Hurricane Ian in September. That’s the largest net inflow of the 306 high-flood-risk counties Redfin analyzed, and represents an increase of about 65% from the prior two years.

Florida is home to eight of the 10 high-flood-risk counties that experienced the largest net inflows during the past two years. Half of homes in Lee County face high flood risk. Still, homebuilders continue to build and homebuyers continue to buy. The Cape Coral metro area has more than made up for the plunge in new listings caused by the storm, and home sales have also rebounded, a separate Redfin analysis found.

“Builders in Cape Coral have not stopped—they’re just building like nothing happened,” said local Redfin Premier real estate agent Isabel Arias-Squires. “That’s largely because there’s plenty of demand for new homes. Many folks who moved into Florida from the Northeast or the West during the pandemic are leaving, but they’re quickly being replaced by new out-of-staters. Some people just want to be on the water no matter what, and/or they want to move here for family, weather or political reasons. The Cape is not slowing down.”

Parts of coastal Florida may start to skew wealthier as the high cost of rebuilding after storms pushes lower-income residents to more affordable, inland areas, Fairweather said.

The good news is that homes being built in Florida today tend to be more resilient than older homes because they must adhere to stricter, modern building codes, and many areas are constructing more resilient infrastructure. In the Orlo Vista neighborhood near Orlando, for example, there’s a $23 million project underway to expand retention ponds and install new water pumps after the area faced significant flooding from Hurricane Ian.

People Are Leaving Storm-Prone Louisiana as Insurance Costs Soar

While people are still moving to Florida, they’re leaving flood-prone Louisiana, which has among the largest concentration of high-risk homes. Nearly every home in Orleans Parish and Jefferson Parish—the areas including and surrounding New Orleans—faces high flood risk. Both saw roughly 15,000 more people move out than in over the past two years, adding to outflows from the prior two years.

“The rise in homeowners insurance rates across Louisiana is decreasing the amount of money people have to put toward buying a home, diminishing their purchasing power,” said local Redfin Premier real estate agent Jes Menes. “Elevated insurance costs are also driving some landlords to increase rents, making housing more expensive for tenants.”

Louisiana’s insurance commissioner recently said the state’s insurance market is “in crisis” because so many insurers have either failed or backed out. Louisiana boosted premiums for its state-mandated insurance program 63% to an average of $4,700 a year in December, and also said it would subsidize private insurers in an attempt to get them to return.

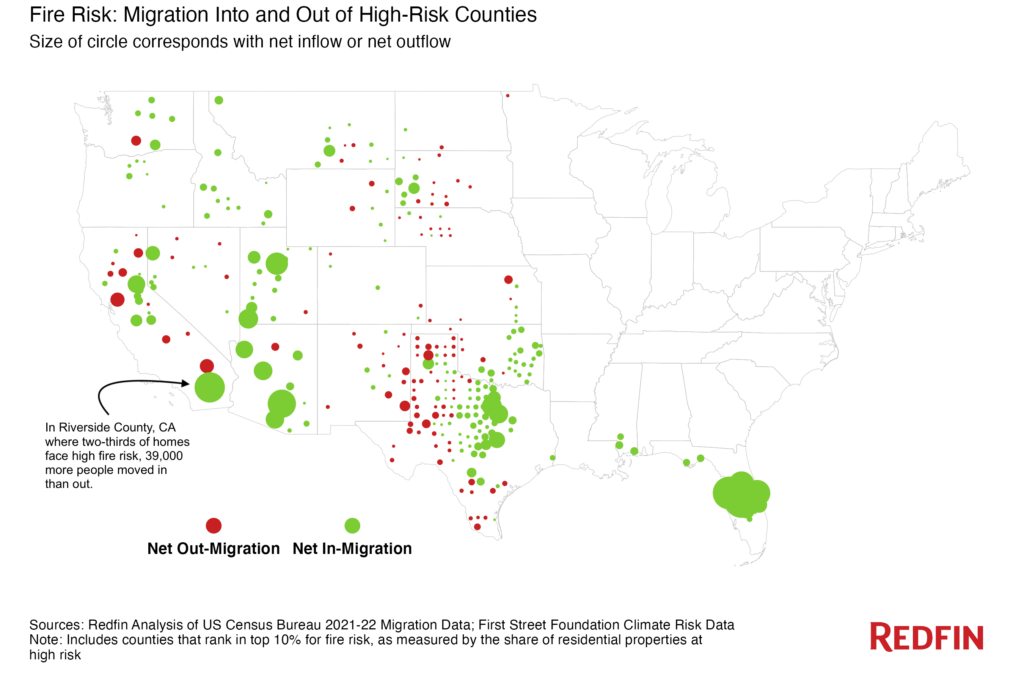

Inland California, Utah and Arizona See Populations Swell as Fire Risk Grows

In Riverside County, CA—home to Riverside and Palm Springs—nearly 600,000 homes face high wildfire risk. That’s the most among the 306 high-fire-risk counties Redfin analyzed, and represents two-thirds of the county’s total homes. Nearly 40,000 more people have moved into than out of Riverside County in the past two years—the third highest net inflow of the counties we analyzed and a 36% jump from the prior two years.

The Inland Empire has grown in popularity partly because it offers more affordable housing costs than coastal California cities including Los Angeles and San Francisco. Parts of Utah, Nevada and Arizona have seen their populations swell for the same reason.

In Washington County, UT, an area in the southwestern corner of Utah that includes Zion National Park and St. George, 95.5% of homes face high fire risk, and drought is also a major issue. It saw 15,000 more people move in than out over the past two years. The story is similar in Utah County, which is just south of Salt Lake City and includes Provo.

There is at least one part of the country that’s seeing a net outflow of residents in the wake of wildfires. Butte County, CA is home to the town of Paradise, most of which was destroyed by the Camp Fire in 2018. It lost nearly 2,000 more people than it gained in 2021 and 2022—one of the biggest declines among the 306 counties Redfin analyzed. During the prior two years, it had a net outflow of 17,000—more than any other county Redfin analyzed.

Redfin Chief Economist Daryl Fairweather has her own climate migration story. She left Seattle in 2020 to escape wildfire smoke and moved to Wisconsin. It was free from smoke for the first few years she was there, but this June was hit with four days of unhealthy smoke from wildfires in Canada.

“There’s nowhere to hide,” Fairweather said. “Every place on planet earth will have to deal with the ramifications of climate change. The midwest may be insulated from sea level rise, but it still faces risk from storms, heat waves and drought.”

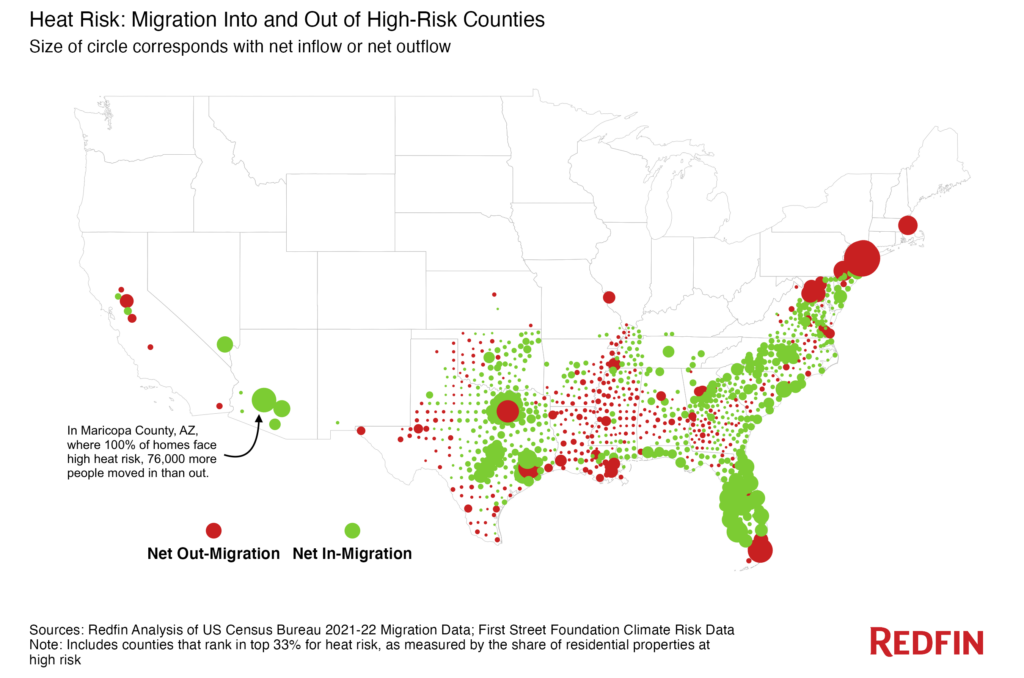

People Flock to Phoenix for Affordability, Stumbling Into Extreme Heat and Drought

In Maricopa County, AZ, home to Phoenix, 76,000 more people moved in than out during the past two years—the largest net inflow among the 1,019 high-heat-risk counties Redfin analyzed. In all of those counties, roughly 100% of homes face high heat risk.

Collin County, TX, just north of Dallas and home to Plano, saw the second biggest net inflow, at 61,000, followed by Lee County, at 57,000. Many parts of the U.S. are grappling with multiple climate risks at once. Lee County is a good example, facing high risk from both flooding and heat.

The explosion in Phoenix’s population has coincided with a dire climate crisis: a lack of water. Arizona recently said it will stop issuing homebuilding permits in some parts of the Phoenix area as migration and extensive development strains limited water resources. That will cap the number of new communities that can be built in the area, which could eventually increase the cost of housing.

Still, Maricopa County gained more residents than any other U.S. county in 2022, attracting scores of remote workers from expensive coastal cities like Seattle, where the cost of living is significantly higher. The influx of out-of-towners has caused home prices to surge, but Phoenix remains much more affordable than many major job hubs. The typical home in Phoenix sells for about $450,000—roughly half the $800,000 cost of the typical home in Seattle, the most common origin of people moving to Phoenix.

Phoenix has experienced more than 20 consecutive days of 110-degree-plus temperatures this summer, breaking the prior streak of 18 set in 1974. And it’s not just Phoenix; July 3-5 were the hottest days ever recorded on planet Earth.

Methodology

Climate risk data for fire, flood and heat comes from the First Street Foundation, which assigns six different climate-risk categories to properties across the U.S.—minimal, minor, moderate, major, severe and extreme. For this report, a “high-risk” property is one that falls into the major, severe and extreme category for a climate risk. The climate risk scores are based on a property’s current risk as well as how that risk is expected to grow over the next 30 years.

We identified counties in the contiguous U.S. that rank in the top 10% for flood and fire risk and the top 33% for heat risk, as measured by the share of residential properties at high risk. We chose the top 33% for heat risk because in all of these counties, nearly every property faces high heat risk. For every county identified, we calculated the net domestic migration during 2019-2020 and 2021-2022 using the U.S. Census Bureau’s Vintage Population Estimates data. Net domestic migration is the difference between the number of people moving into an area and the number moving out. A positive number indicates in-migration and a negative number indicates out-migration.

United States

United States Canada

Canada