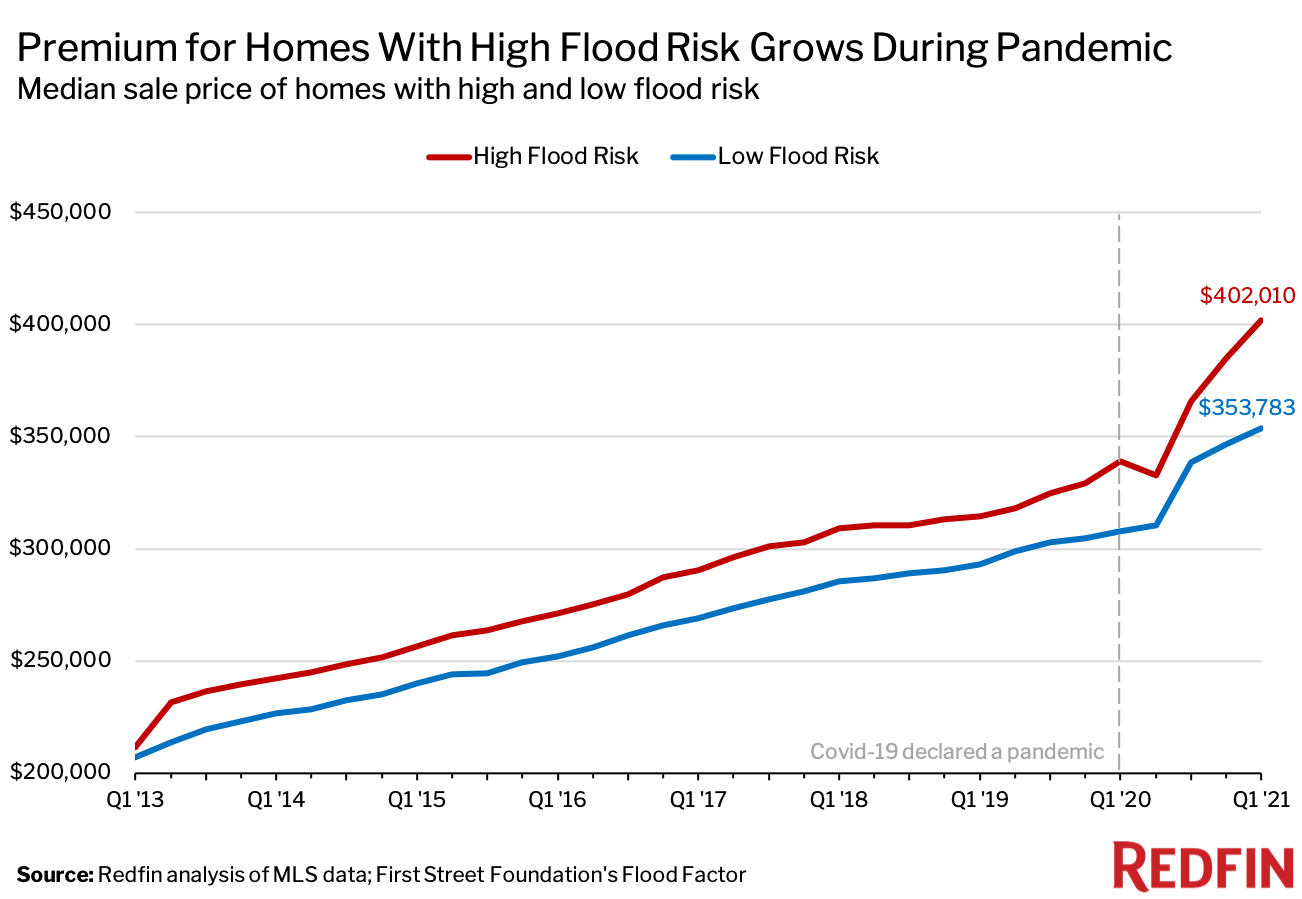

The typical home with high flood risk sold for $402,010 in the first quarter—a 14% premium over the typical home with low flood risk. That’s double the premium we saw before the pandemic.

The median sale price of homes with high flood risk was $402,010 in the first quarter, compared with $353,783 for homes with low flood risk. That means high-risk homes sold for a record 13.6% premium—up from a premium of 10.1% in the first quarter of 2020 and a premium of 7.2% in the first quarter of 2019.

Since 2013, homes with high flood risk have sold for about 7% more than homes with low flood risk on average, likely because many of them are luxury waterfront properties. That premium surged during the coronavirus pandemic, when many wealthy homebuyers started eyeing oceanfront or lakefront houses outside of major cities.

“Americans are buying the beach houses they always dreamed of because they have the flexibility to work from wherever they want,” said Redfin Senior Economist Sheharyar Bokhari. “While flood risk is intensifying in many parts of the country, it doesn’t seem to be a deal breaker for a lot of homebuyers. This may be because buyers aren’t aware they’re purchasing a home in a flood plain or just don’t view it as an immediate danger. Places with high flood risk are also often home to large concentrations of retirees, many of whom don’t see climate change as a threat they need to worry about in their lifetime. Florida is one example.”

Redfin and other real estate websites have started sharing property-level flood risk data online to help house hunters determine if the homes they’re interested in are located in flood plains and whether they should purchase flood insurance.

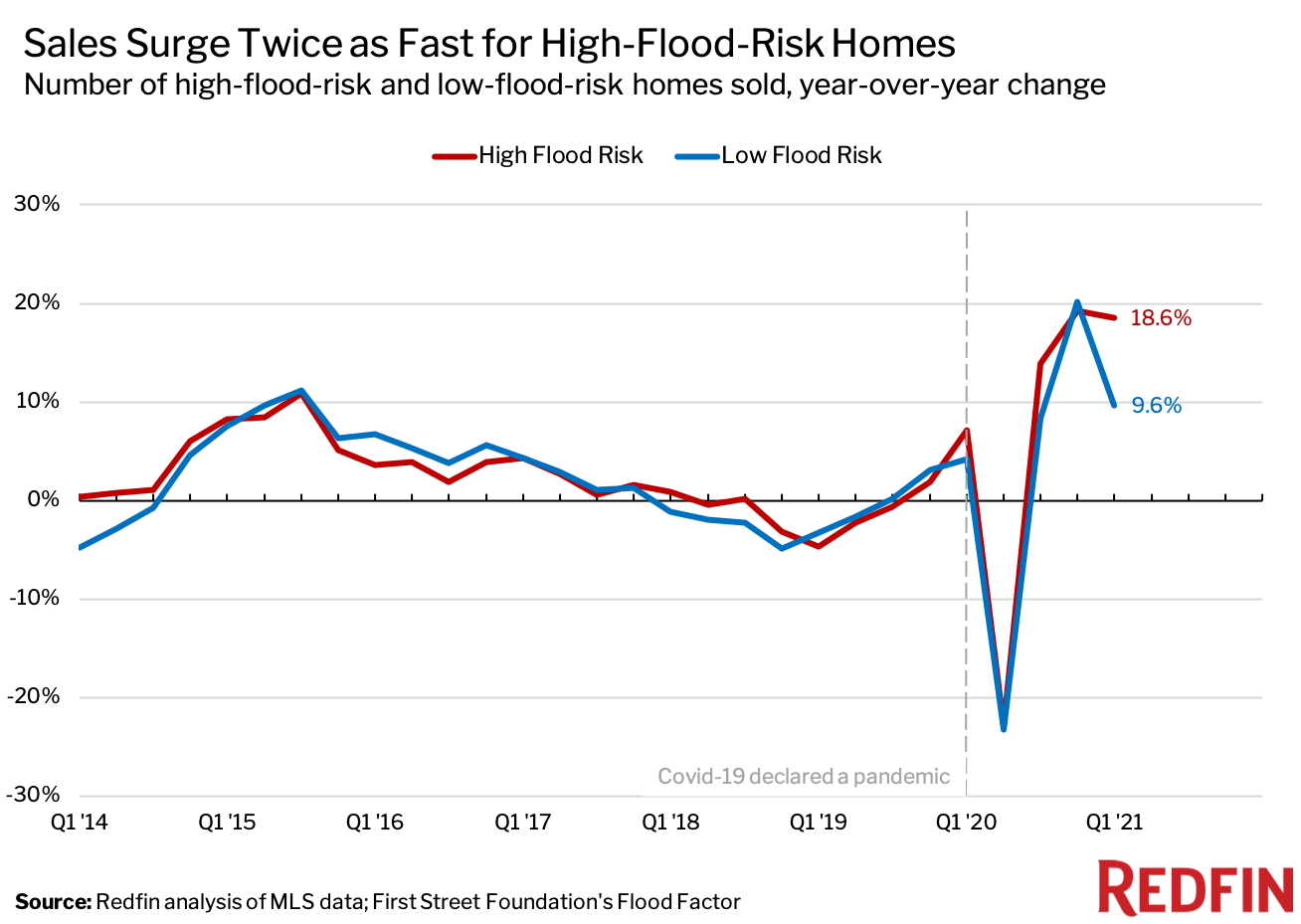

Places that are prone to flooding are also seeing stronger growth in home sales. Sales of high-flood-risk homes rose 18.6% year over year in the first quarter—about double the 9.6% gain in sales of low-flood-risk homes.

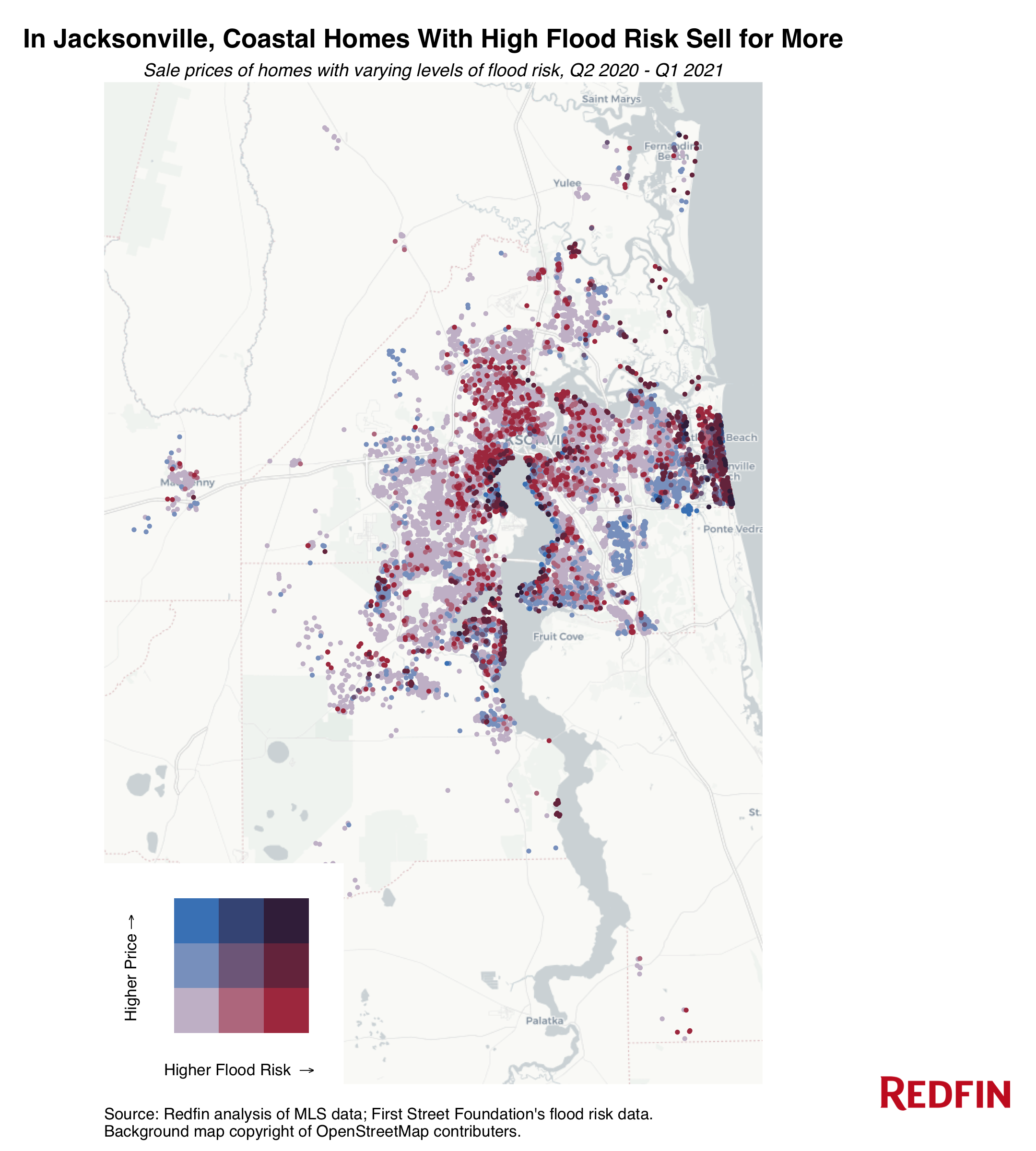

In Jacksonville, FL, homebuyers often inquire about flood risk, but it virtually never causes them to back out, said local Redfin real estate agent Heather Kruayai. Jacksonville, which is on the Atlantic Ocean and has two waterways running through it, has about 43,000 properties facing high flood risk, according to First Street Foundation’s Flood Factor.

“If you buy a home on the water in Florida, flooding is just something that comes with the territory. Most buyers understand that,” Kruayai said. “A lot of out-of-state buyers have been moving here during the pandemic and purchasing waterfront properties, but there are also locals who are looking for space to spread out because the city has become so congested. Even if you wanted to negotiate a lower price due to flood risk, you’d have a tough time because we’re in such a hot seller’s market.”

Kruayai continued: “I just sold a $700,000 beachfront property to a Colorado couple who knew the house would likely flood if a hurricane hit. They bought flood insurance, but weren’t concerned at all. Coming from a landlocked state, they were just excited to be on the beach, so the risk was worth it for them. They beat out several other bids by offering to pay up to $40,000 to cover a low appraisal if necessary.”

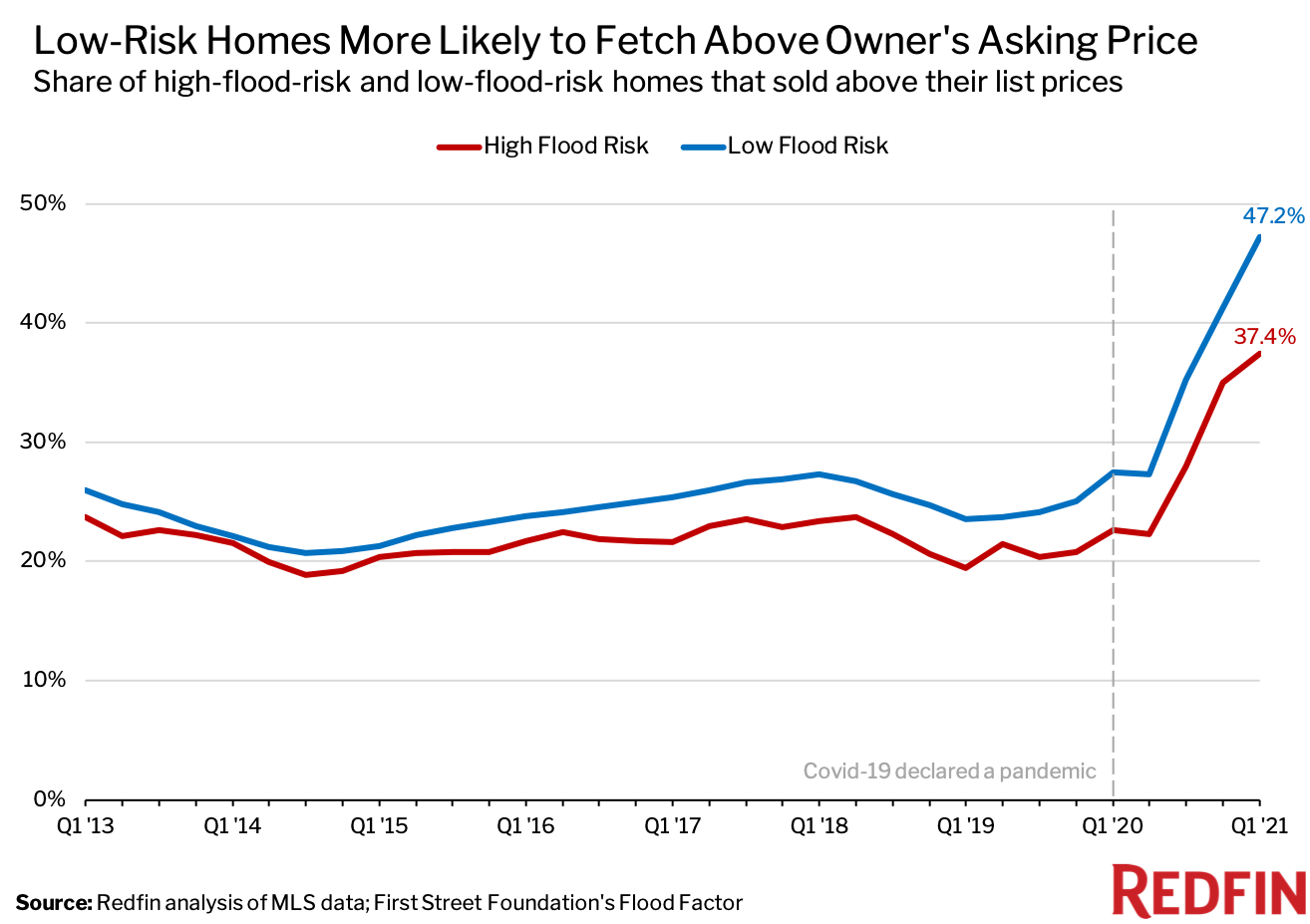

While home prices and sales growth are both higher for high-risk homes, homes with low flood risk are more likely to fetch more than their owners ask for. In the first quarter, 47.2% of low-flood-risk homes went for more than they were listed for, compared with 37.4% of high-flood-risk homes. That 9.8-percentage-point gap is the largest on record. Redfin’s records date back to 2013.

Properties with low flood risk typically cost less than properties with high flood risk because they’re less likely to be on the beach with waterfront views, Bokhari explained. Because low-risk properties are more affordable, they face more competition, which means buyers are more likely to bid up the prices.

Heightened awareness and concern around climate risks could also be a contributing factor, added Bokhari. It may be easy for an affluent buyer to look past flood risk when purchasing a waterfront home. But for a cost-conscious buyer, flood risk could raise red flags because it may mean the home won’t retain its value or will require costly repairs in the future.

Research has shown that many Americans are working to guard their properties against the intensifying risks of climate change. One in five homeowners has invested in making their home more resilient to flooding, according to a recent Redfin survey. The same survey found that nearly half of respondents who plan to move soon indicated that the increasing frequency or intensity of natural disasters played a role in their decision to relocate.

Methodology

Flood-risk data came from First Street Foundation’s Flood Factor, which assigns six different flood-risk categories to properties across the U.S—minimal, minor, moderate, major, severe or extreme. For the purposes of this report, “high-flood-risk” properties are those that fall into the major, severe or extreme categories, while “low-flood-risk” properties are those that fall into the minimal, minor or moderate categories. We matched flood-risk data in the 50 most populous core-based statistical metropolitan areas (CBSAs) with MLS data, allowing us to report on metrics including home sales and prices by flood risk. Housing-market data is seasonally adjusted.

United States

United States Canada

Canada