Higher mortgage rates will end double-digit price growth and new listings will hit a 10-year high

Editor’s note: After two of the least predictable years in housing history, we predict that 2022 will be just as unpredictable. But we wouldn’t leave you hanging like that, so Redfin Chief Economist Daryl Fairweather shares below her 10 predictions for the housing market in 2022.

2022 will bring more balance to the housing market. But don’t expect a buyer’s market; just more selection, less frenzy and slower price growth. We will see a rush to buy homes at the start of the year before mortgage rates rise. That early onslaught of demand will deplete the supply of homes for sale. In the second half of the year, a much needed increase in new construction will boost sales slightly. In 2022, there will be 1% more sales than in 2021, and by the end of the year, home price growth will slow to 3%.

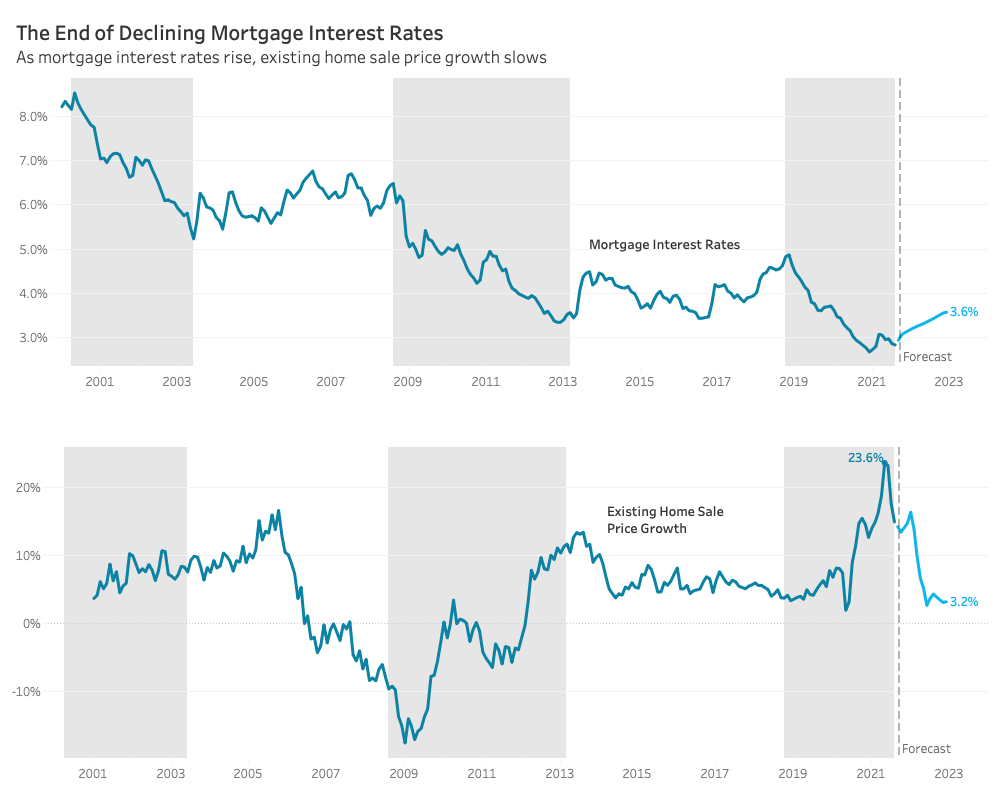

Prediction #1: Mortgage rates will rise to 3.6%, bringing price growth down to earth

We expect 30-year-fixed mortgage rates to rise slowly from around 3% to around 3.6% by the end of 2022, thanks to the pandemic subsiding and lingering inflation. That would mean about $100 more per month in mortgage payments for the median home.

By winter, higher mortgage rates along with already high home prices will likely slow annual price growth down to around 3%, which represents a steep drop from the record 24% increase posted in May 2021. If annual price appreciation falls to 3%, it would only be the second time it will have fallen so low since the end of the housing crash in March 2012. This low price growth will likely discourage speculators from entering the market and allow more first-time buyers to have a chance at winning a home.

Prediction #2: New listings will hit a 10-year high, which will hardly make a dent in the ongoing supply shortage

In 2022, new listings will surpass the 2018 high of 7.6 million homes, setting a new record going back to at least 2012. As the market becomes more balanced, homeowners will find it less daunting to list their home while looking for a new one to buy. Home-sale contingencies, which allow a homeowner to make an offer to buy a new home on the condition that their existing home sells first, will become more common. The end of double-digit price growth will also encourage more homeowners to finally cash-out. This increase in listings of existing homes will coincide with a slight increase in listings of newly constructed homes.

“Builders have been doing everything they can to get more homes built to match today’s demand,” said Ali Wolf, chief economist at Zonda, the homebuilding research company. “Still, builders face a lot of roadblocks, which will keep supply from reaching its full potential next year. Labor shortages, lot delays and supply chain challenges are all making it harder and more expensive to build new homes. New home inventory should increase from 2021’s bottom, but we anticipate the market will remain undersupplied. Entry-level home supply in particular will remain extremely constrained. I can’t imagine we get to a point where we are flush with entry-level homes.”

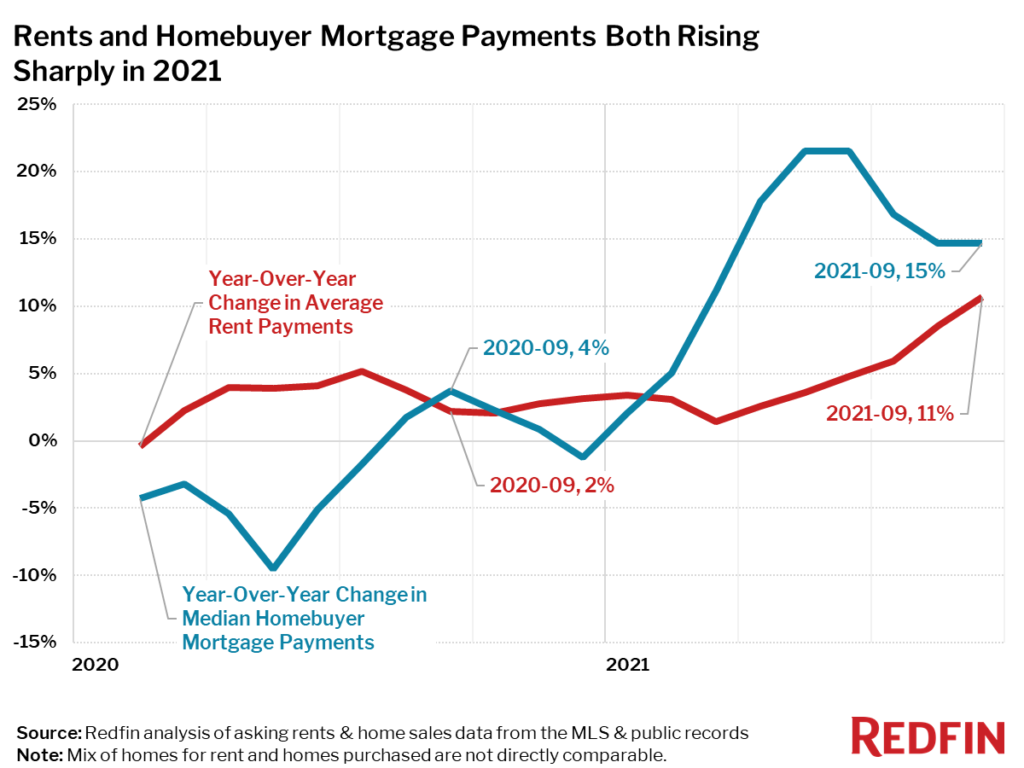

Prediction #3: Rents will increase by 7%

Rents will increase 7% by the end of 2022, more than double the predicted year-over-year growth in home prices of 3%. Demand for rentals will be strong for several reasons. The end of mortgage forbearance will cause many homeowners to sell and rent instead. As the pandemic subsides, more people will choose to live in cities where it is more common to rent. Additionally, the strong labor market will cause more people to move to a new city, and many movers will want to rent so they can get to know their new city before they buy. Since vacancy rates are already at record lows, increased demand for rentals will almost certainly push rents to new heights.

“Millions of millennial renters are on the cusp of buying their first home, but we expect many will still be held back from homeownership due to affordability,” says Redfin Deputy Chief Economist Taylor Marr. “Home prices will remain at record highs requiring hefty down payments at the same time rising mortgage rates will make home buying more expensive, so many potential first-time homebuyers will choose to keep renting.”

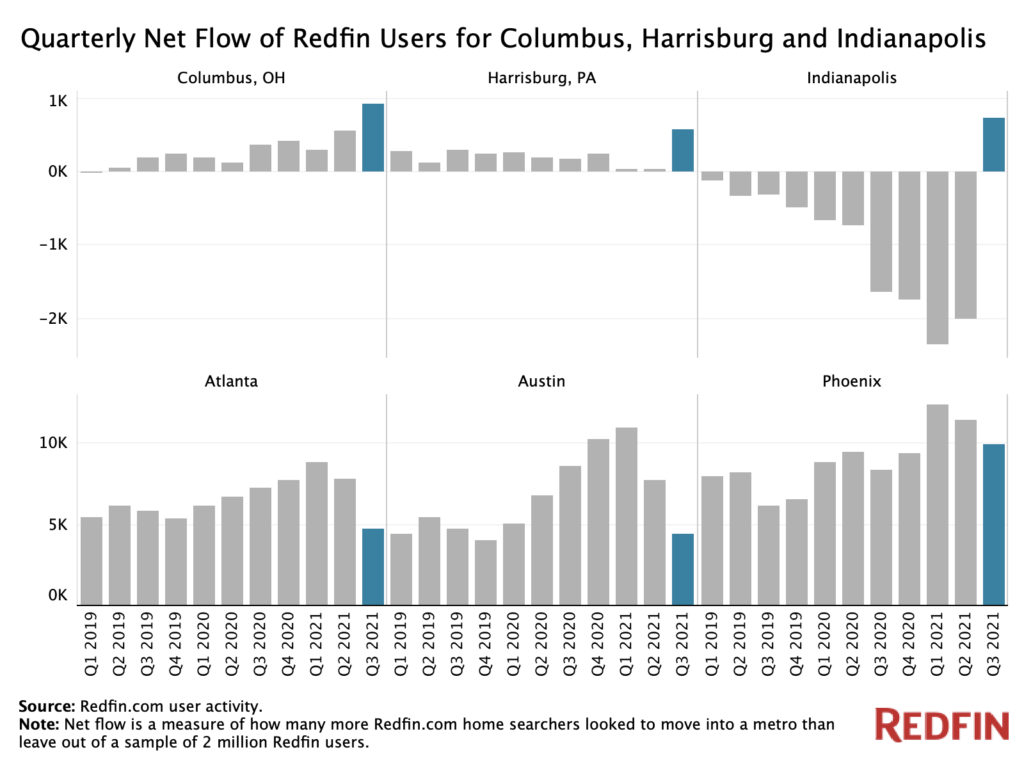

Prediction #4: Homebuyers will relocate to affordable cities like Columbus, OH, Indianapolis and Harrisburg, PA over the Sun Belt

In 2022, people will be less likely to move to Sun Belt cities that dominated the 2021 housing market. Austin, Atlanta and Phoenix have seen home prices increase by 29%, 24% and 35% respectively since the start of the pandemic, making them less attractive to homebuyers that prioritize affordability. The seasonally adjusted median Austin home price is now $462,000, which is above the national median of $376,000. The median home price is $330,000 in Atlanta and $416,000 in Phoenix.

Instead, cost-conscious homebuyers will seek out affordable northern cities like Columbus, OH, Harrisburg, PA and Indianapolis, which all happen to be capital cities with highly educated residents where the median home price is still less than $250,000. Columbus, Indianapolis, and Harrisburg have all seen the number of homebuyers moving in minus the number moving out more than double since last year. Meanwhile, Atlanta, Austin and Phoenix have seen a decline in net-migration since peaking in Q1 2021.

“Homebuyers tend to seek out Columbus for its central location and highly rated schools,” said Columbus Redfin agent Caitlin Mulroy. “And although our climate isn’t perfect, we haven’t had any major natural disasters. I recently helped someone move from Los Angeles to be close to family. He works remotely for a major Hollywood movie studio and is still working on Pacific Time.”

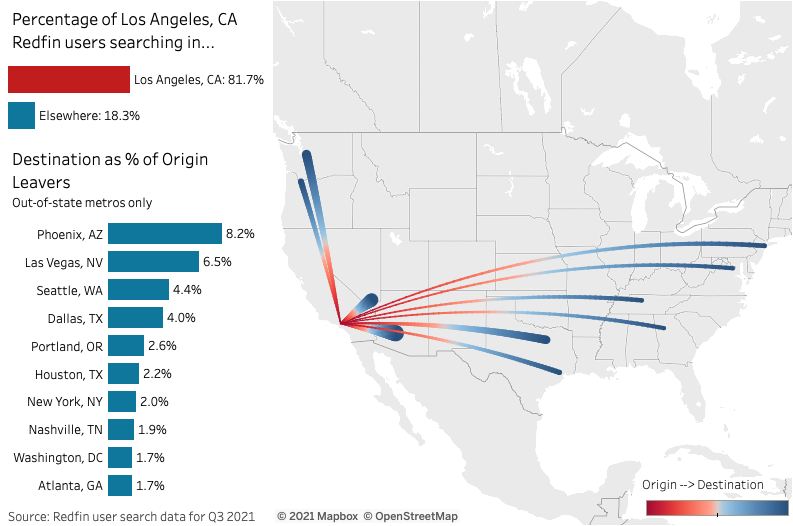

Prediction #5: People will vote with their feet, moving to places that align with their politics

After the Supreme Court decides contentious cases related to abortion rights and gun rights, we will see more migration for political reasons. A recent Redfin survey confirms that a substantial share of homebuyers won’t move to a place where the laws conflict with their political beliefs. For example, 1 in 7 recent movers surveyed said they would refuse to live in a place where abortion is fully legal.

Now that workers have more control over where they live, more people will seek out areas where there are like minded people with laws that fit their political beliefs. People who prefer to live in areas without mask and vaccine mandates will leave cities like New York and Los Angeles. People who are against voter-ID laws will move to places where voting is more accessible. People who are pro-choice will avoid states with restrictive abortion laws. We will also see more blue enclaves grow within red areas and vice versa, as parents select school districts that align with their preferences regarding mask mandates, critical race theory and other controversial issues.

Q3 2021 Migration from Los Angeles to Out-of-State Destinations

This means that red congressional districts will get redder and blue congressional districts will get bluer. Given that newly drawn electoral maps are expected to benefit Republicans in swing-states like Georgia, Texas and North Carolina, this could make it easier for Republicans to retake the house and senate in the 2022 midterm elections.

Prediction #6: Condo demand will take off

In 2022, dense housing will make a comeback. More and more homebuyers are open to buying a condo or townhome for a fraction of the price of a single-family home. That’s a reversal from when the pandemic lockdowns motivated homebuyers to seek out larger homes with big backyards, which caused single family home prices to increase 27% from the start of the pandemic, while condo home prices only increased by 14%.

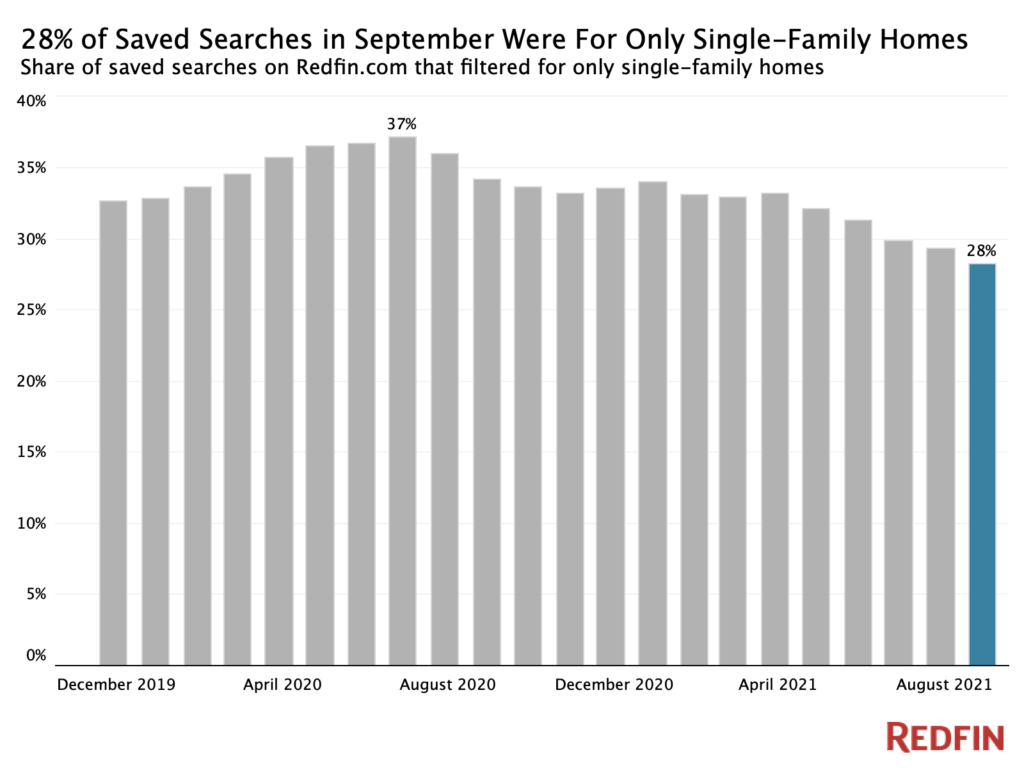

In September 2021, only 28% of Redfin users filtered for only single-family homes (excluding condos and townhomes from their search). That’s down from a peak of 37% in July 2020. At the same time states like California and Oregon have made it much easier to build multiple homes on lots that were previously reserved for just single-family homes.

However, in the least dense parts of the country, the infrastructure plan will bring improved internet access to previously off-the-grid areas causing demand for single-family homes to increase.

Prediction #7: Homebuyers will take climate risks seriously

Now that natural disasters are increasing in frequency and climate risk data is available on real estate websites like Redfin.com, homebuyers are going to come to their agents with questions about climate risk and associated costs. Homebuyers will want to know about a home or neighborhood’s flood and fire risk and how that impacts their insurance costs or the mortgage rate set by their lender (a practice known as blue-lining). Home sellers will make climate resilient investments in order to appeal to climate conscious homebuyers.

Redfin agents in climate risky areas are already having these conversations.

“In Houston, flooding is always a topic of conversation,” said Redfin agent Angela Pachicano. “I used to get asked ‘did the home flood?,’ and now I am asked ‘how many times did the home flood?’”

Prediction #8: Housing policy will become central to political battles about climate change

As natural disasters due to climate change become increasingly frequent, political debates will emerge about who should pay for the damage and what the government should do to minimize future damage.

“We have been stuck as a society in this cycle of storm damage, loss of property, loss of life, recovery, repeat, and we can’t stay in that cycle,” said New Jersey Commissioner of Environmental Protection Shawn LaTourrette to the New Jersey League of Municipalities. “We have to build back better in those places where we should build back at all…The good news is that climate adaptation is cost effective. All of these investments of our time and resources will pay dividends.”

There will be debates about how much local, state and federal governments should spend on climate-resilient infrastructure, on bailing out homeowners whose homes have been damaged, on subsidizing fire and flood insurance, and on relocating residents to more climate-resilient areas. Hundreds of billions of dollars of real estate are at risk from climate disasters like flooding, but we should prioritize protecting people over property. That means building climate resilient communities, and potentially abandoning property that is too expensive to save.

Prediction #9: iBuyers will focus on perfecting a niche service instead of market domination

The major lesson for iBuyers going into 2022 is that if you can’t make money on one home, the answer isn’t to buy a thousand. iBuyers are going to focus their efforts on providing premium service that is truly needed for a portion of home sellers. Sellers who want to move quickly to take advantage of a new job opportunity, sellers who don’t want to deal with the hassle of open houses and home staging, and sellers who want the cash from selling their current home to buy their next all stand to benefit from selling to an iBuyer. The iBuying business model will shift from an aspiration for total market domination to a premium service that serves a small segment of home sellers who value convenience over cost. Rising interest rates and a more balanced housing market will mean increased costs for iBuyers. As a result, the offers they make to home sellers will be lower, and a smaller share of the offers made will be accepted.

Prediction #10: The DOJ will crack down on how real estate agents are paid

In 2022 the Department of Justice will crack down on how agents are paid, and it is possible that buyers will eventually have to pay upfront for their agent instead of the more common setup now where the seller pays the commission for both the buy-side and sell-side agent at closing. If buyers have to pay upfront, many of them will likely pay more attention to the services their agent offers and get more cost-conscious. This could lead to buyers doing most of their home search without an agent, and only hiring an agent to close the deal, or only working with agents who have exclusive access to home listings. As a result, we would see more dual-agency (where the agent represents both the buyer and seller), and more pocket listings (where homes for sale are only shown to an exclusive group of buyers).

“At the very minimum the Department of Justice wants more transparency around how fees for homebuyers and sellers are set,” said NYU Law Professor Scott Hemphill. “The subpoena from the DOJ suggests that the way that home sellers determine how much the buyer’s agent is paid could be in jeopardy. I believe the real estate industry is getting more scrutiny now because it’s clear that technology has made it so homebuyers and sellers can do much more of their own research, and yet fees have not come down.”

The typical buyer’s brokerage commission declined slightly, from 2.71% in 2020 to 2.66% in 2021, according to a Redfin analysis of MLS data.

United States

United States Canada

Canada