-

The market still feels hot, but a slowdown in online searches, home tours and mortgage applications suggests more buyers are getting priced out.

-

Redfin economists predict home-price growth will start to slow in the coming months.

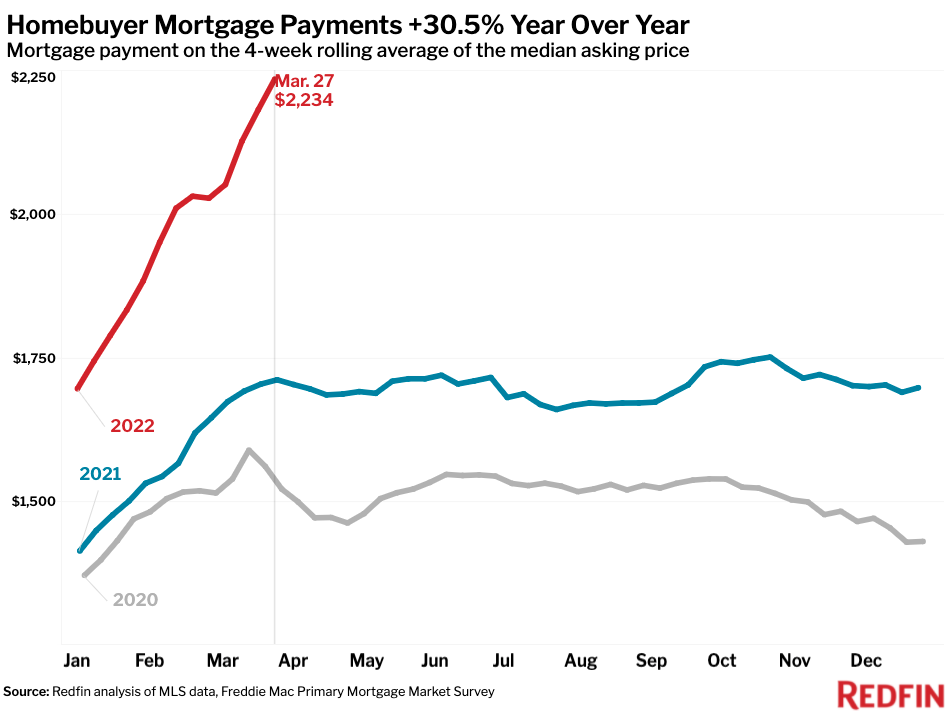

Mortgage rates are shooting up at the fastest pace in history, sending the typical monthly mortgage payment for a homebuyer up more than $500 since the beginning of this year. As rates quickly approach 5%, we expect their impact on homebuyer demand to change from a motivator—driving a sense of urgency to buy before rates rise further—to a deterrent—causing buyers to step back as the cost of homebuying exceeds their budgets. There are a number of early signs that this shift is beginning to take place.

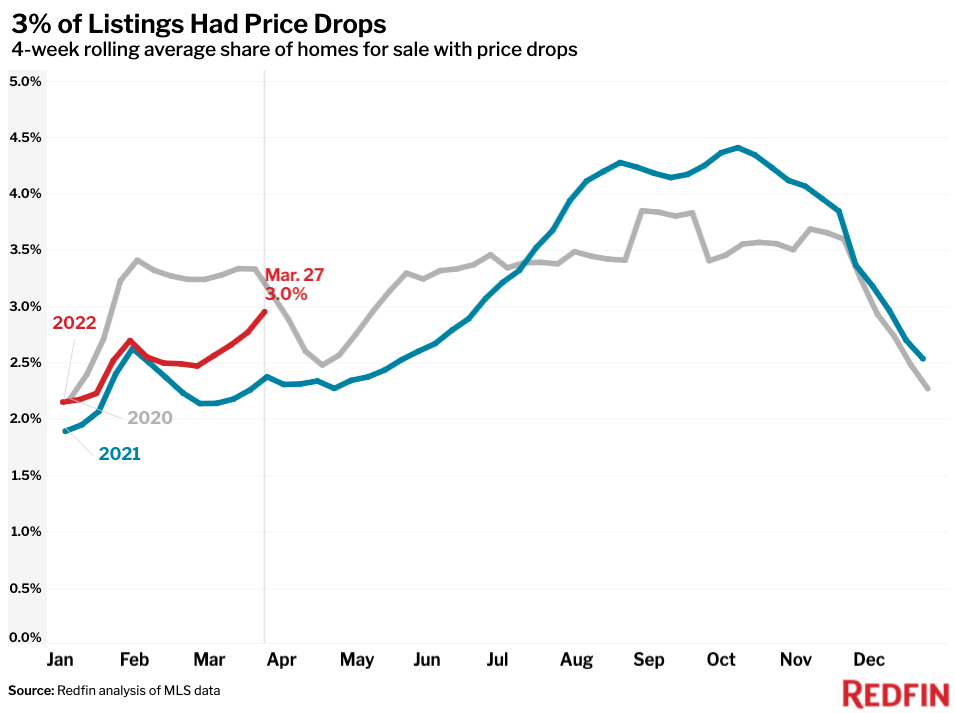

Fewer people are starting online home searches and applying for mortgages than this time last year, and year-to-date growth in home tours remains far below 2021 levels. An increasing share of sellers are also reducing their prices after putting their homes on the market. The share of homes that sell quickly (within 14 days) continues to grow, but at a slower pace than earlier this year.

Still, the market still feels very hot, with homes selling faster and for more money than ever before. That’s largely because supply remains near record lows, with fewer homeowners putting their homes on the market.

“Homebuyers may not feel like the market has gotten any easier. That’s because they’re often competing against investors, all-cash buyers and migrants from expensive cities who aren’t as sensitive to mortgage rates,” said Redfin Chief Economist Daryl Fairweather. “But there are early indicators that the market is turning, and we expect the softening to become more apparent in the coming weeks, eventually causing home-price growth to slow. We’ll be watching closely to see whether the market slows from 100 miles per hour to 90 or 100 miles per hour to 75.”

As of this month, Redfin has started receiving fewer requests than a year ago for agents’ service in pricey coastal markets including Seattle, San Diego, Boston and Washington, D.C. These markets are experiencing year-over-year declines in pending sales, though they’re still seeing homes sell relatively quickly and are not yet seeing outsized growth in the share of sellers cutting their list prices. Declines in searches, touring, and mortgage applications are larger in California than elsewhere.

“I’m starting to see early signs that the housing market is letting off some steam—something I wouldn’t have said a month ago,” said Aaron McCarty, a Redfin real estate agent in the Bay Area. “Bidding wars are still common, but homes that would have brought in 10 or more offers earlier this year are now getting half that many. Homes also aren’t selling as astronomically over the asking price as before. A house that might’ve gone for $700,000 over the list price two months ago may now go for $300,000 or $400,000 over. That’s not the case every time, but I’m finding more opportunities for my clients where the competition is a bit more manageable.”

Redfin agents say they’re starting to see some sellers put their homes up for sale earlier than planned because they’re worried they’ll miss out on the market’s peak if they wait.

“The rise in mortgage rates is top of mind for sellers, too,” said Justin Hess, a Denver Redfin real estate agent who focuses on listings. “If you’ve been considering putting your home on the market, now’s the time. There are still plenty of buyers and mortgage rates are only going to keep climbing, making it more expensive to find your next home.”

Leading indicators of homebuying activity:

- The Mortgage Bankers Association’s unadjusted Purchase Index, which tracks mortgage applications, fell 10% year over year during the week ending March 25. That’s the second-straight week of double-digit annual decreases. It was up 1% week over week.

- For the week ending March 31, 30-year mortgage rates rose to 4.67%—the highest level since December 2018. This was up from 4.42% the prior week.

- Year-to-date growth in touring activity was 16 percentage points behind the same period in 2021, according to home tour technology company ShowingTime.

- Google searches for “homes for sale” were down 9.7% year over year during the week ending March 19, according to Google Trends data; by comparison, searches for this term were flat (0%) as of late January. Searches for “homes for rent” and “real estate” also dropped, falling 9.6% and 5.1%, respectively.

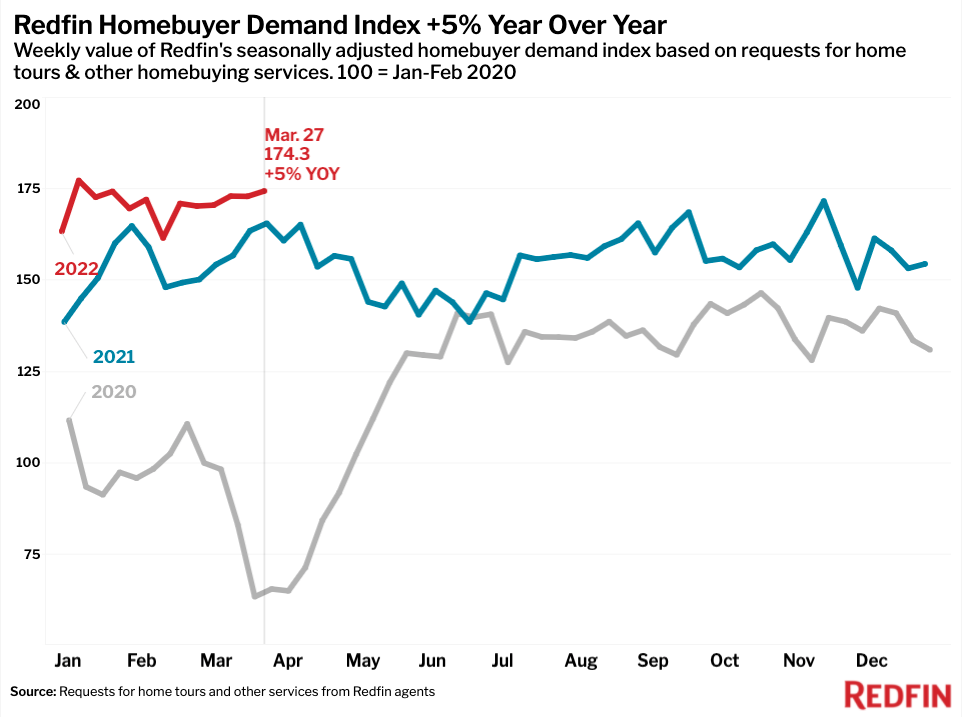

- The Redfin Homebuyer Demand Index rose 5% year over year during the week ending March 27, the smallest gain since the week ending Jan. 30, 2022. The seasonally adjusted Redfin Homebuyer Demand Index is a measure of requests for home tours and other home-buying services from Redfin agents.

Key housing market takeaways for 400+ U.S. metro areas:

Unless otherwise noted, the data below covers the four-week period ending March 27. Redfin’s housing market data goes back through 2015.

Data based on homes listed and/or sold during the period:

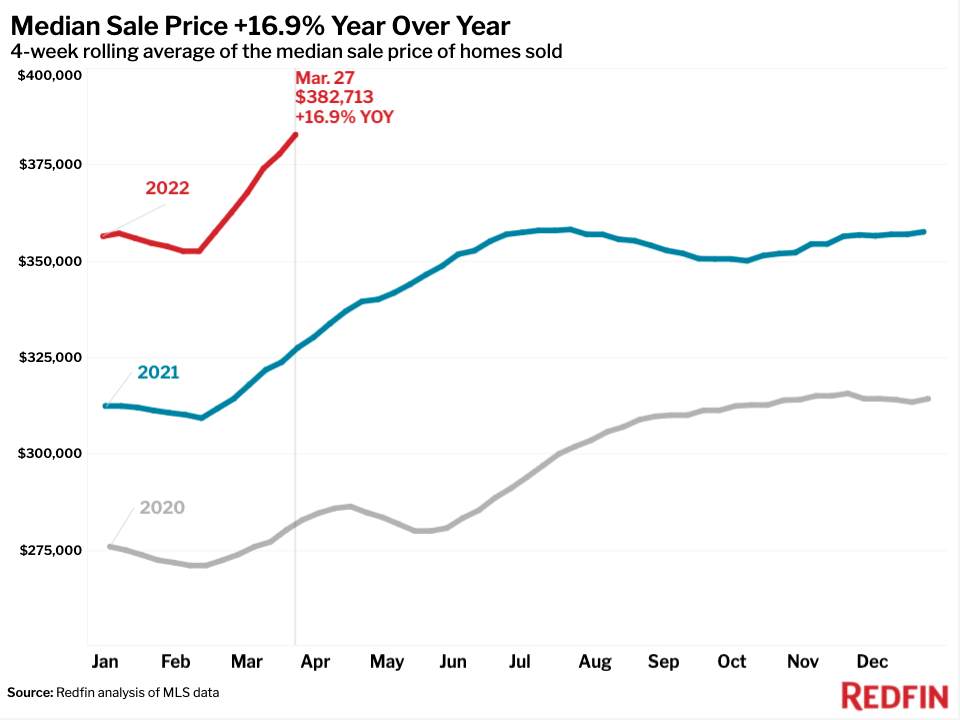

- The median home sale price was up 17% year over year to a record high of $382,713. That’s the biggest jump since the four weeks ending Aug. 1, 2021.

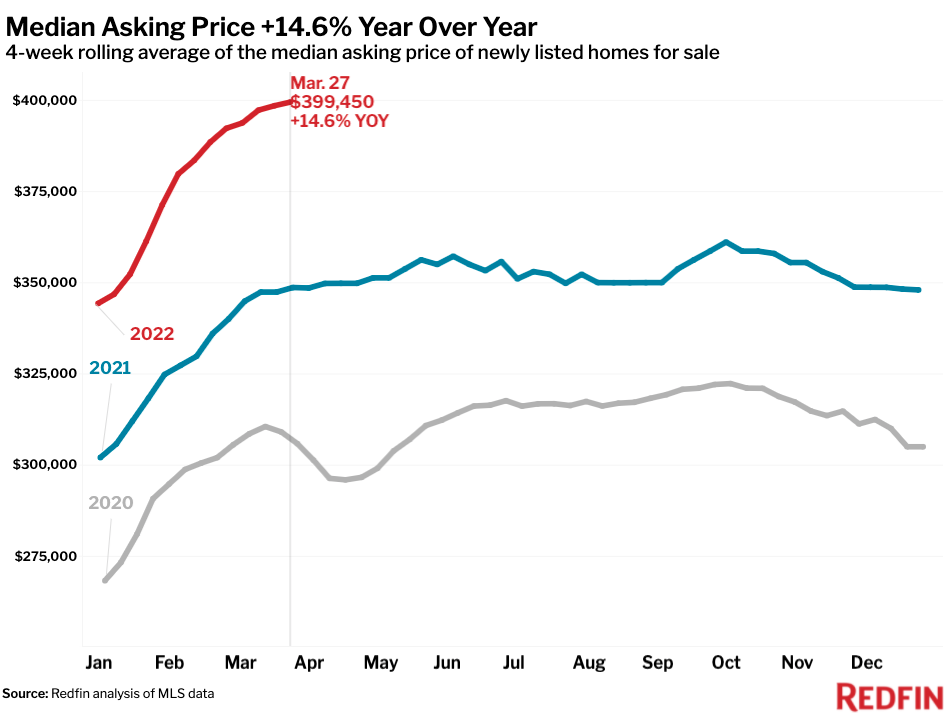

- The median asking price of newly listed homes increased 15% year over year to a record high of $399,450. That marks a slowdown from February, when asking prices were rising at an annual rate of roughly 16%.

- The monthly mortgage payment on the median asking price home rose to a record high of $2,234 at the current 4.67% mortgage rate. This was up 31% from a year earlier, when mortgage rates were 3.18%. The typical monthly mortgage payment is up $537 since the start of the year.

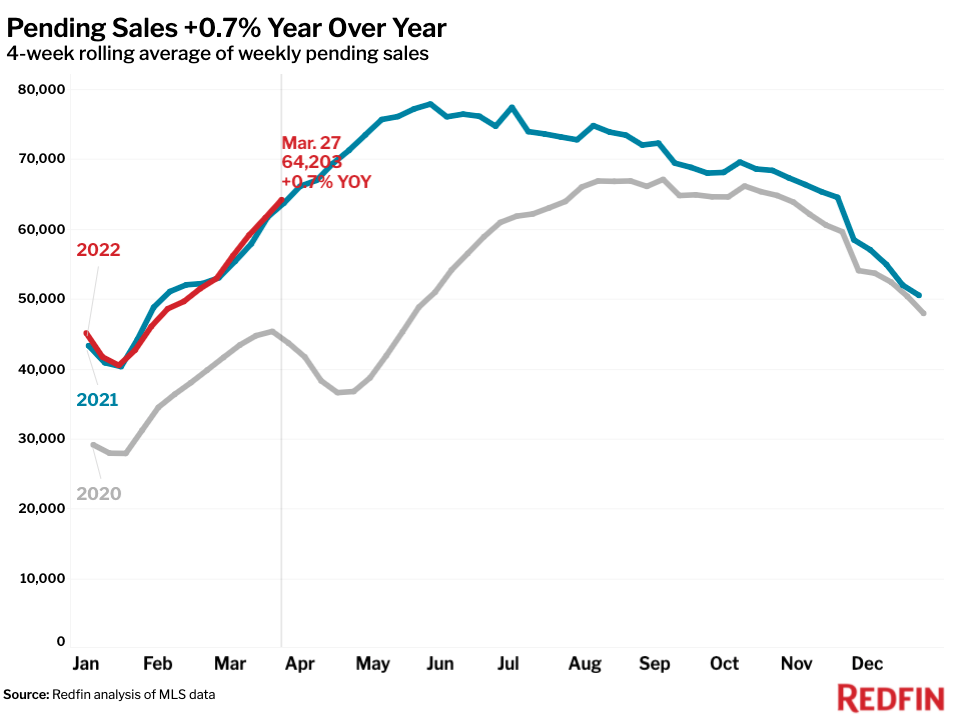

- Pending home sales were up 0.7% year over year, little changed from the 0.1% decline during the four weeks ending March 20, 2022.

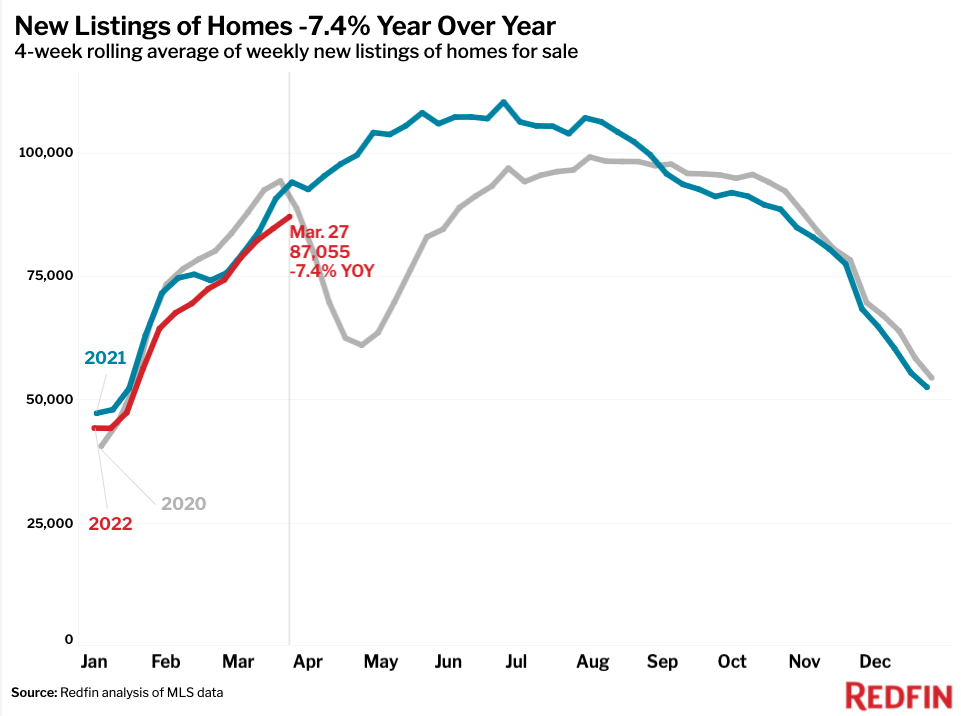

- New listings of homes for sale were down 7% from a year earlier, the biggest drop since the four weeks ending Feb. 13, 2022.

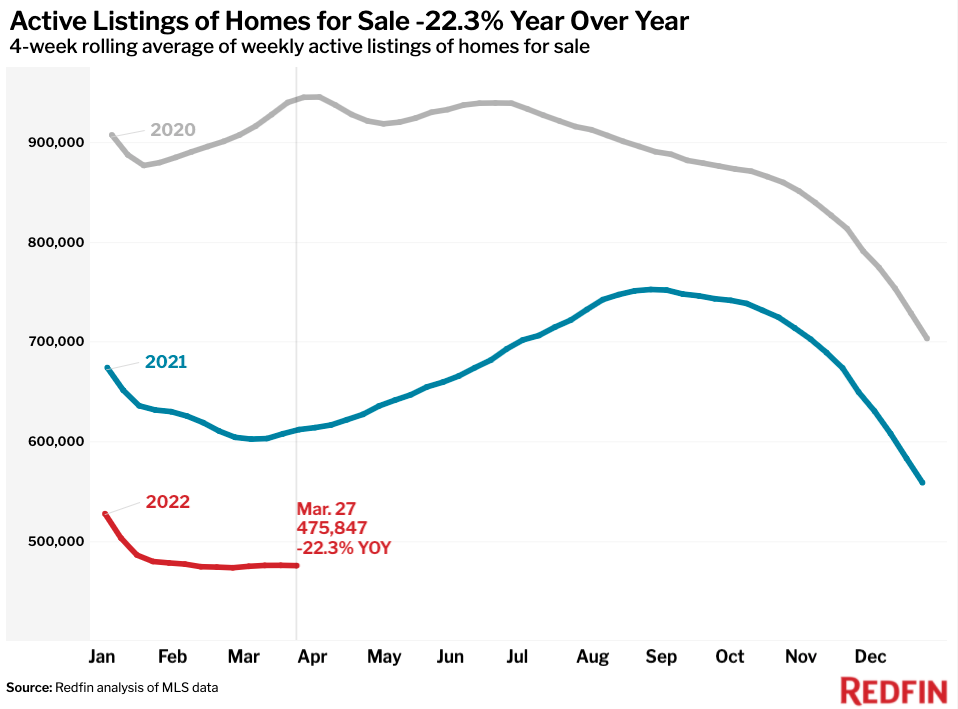

- Active listings (the number of homes listed for sale at any point during the period) fell 22% year over year to 475,800—the fifth-lowest level on record. That’s just shy of the all-time low of 473,700 hit a month earlier.

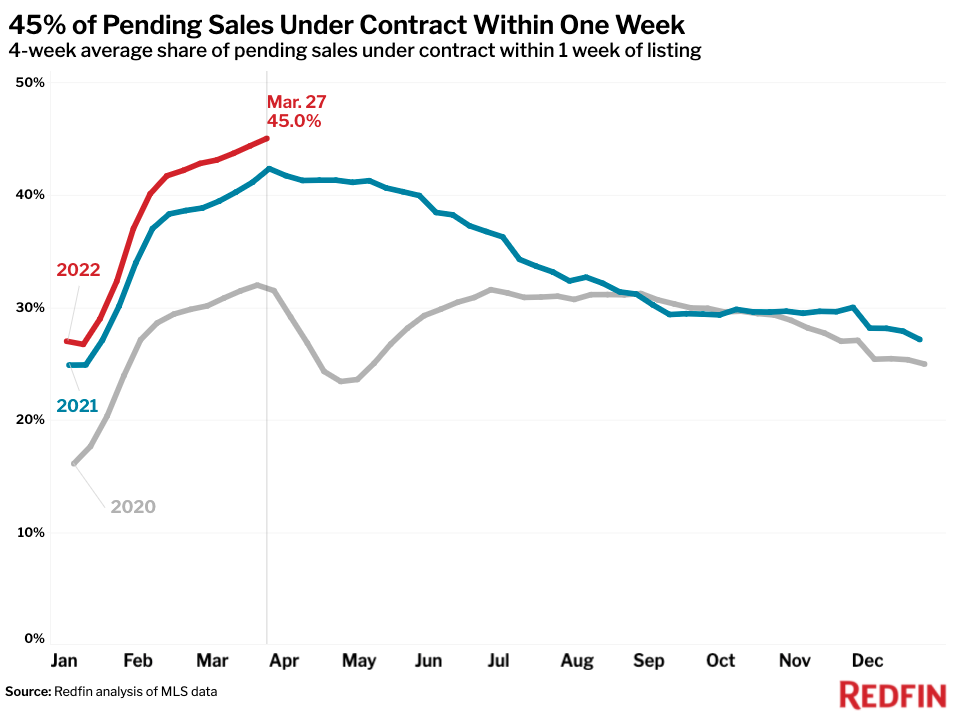

- A record 59% of homes that went under contract had an accepted offer within the first two weeks on the market, up 4 percentage points from a year earlier. This metric’s rate of growth has slowed from a month ago, when it was up nearly 6 percentage points year over year.

- A record 45% of homes that went under contract had an accepted offer within one week of hitting the market, up 3 percentage points from a year earlier. This metric’s rate of growth has slowed from a month ago, when it was up 4 percentage points year over year.

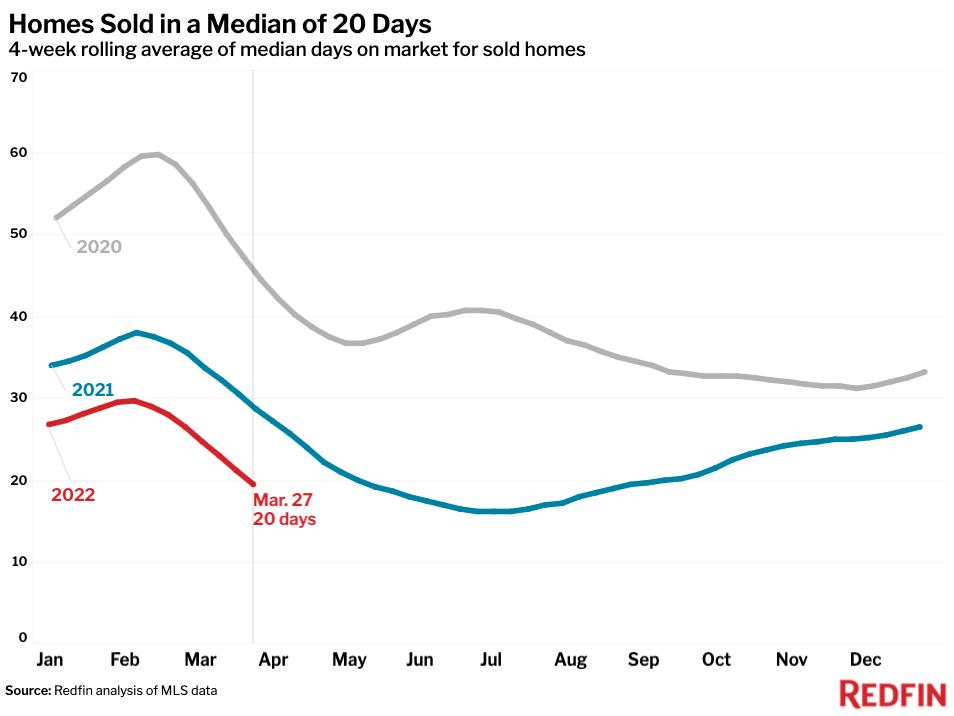

- Homes that sold were on the market for a median of 20 days, down from 29 days a year earlier and a record low for this time of year.

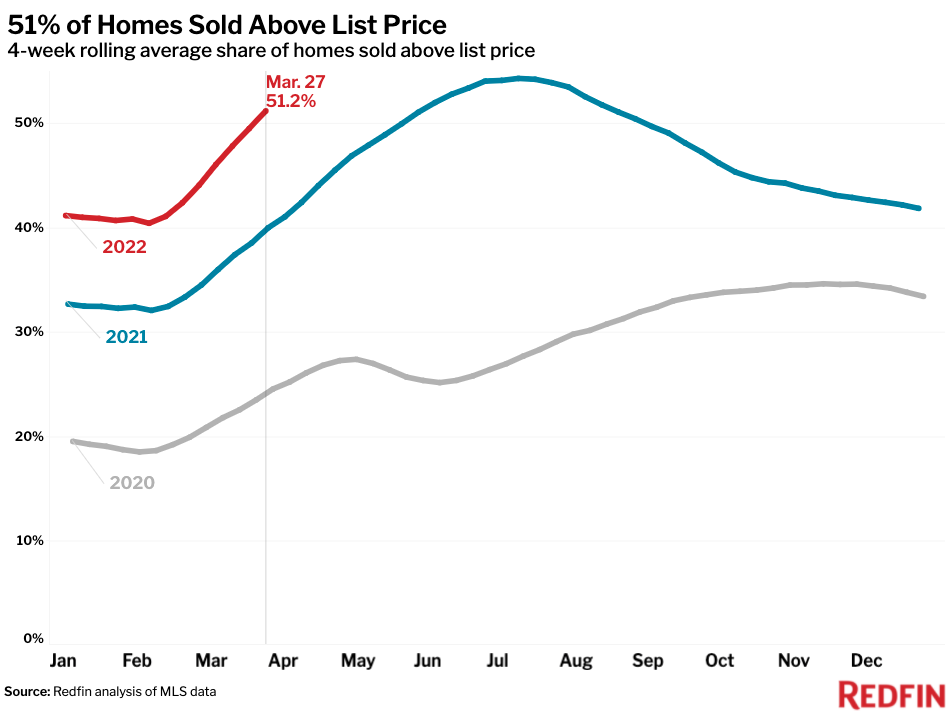

- 51% of homes sold above list price, up from 40% a year earlier and the highest share since the four weeks ending Aug. 15, 2021.

- On average, 3% of homes for sale each week had a price drop, up 0.6 percentage points from a year ago. This metric’s rate of growth has increased from a month ago, when it was up 0.3 percentage points year over year.

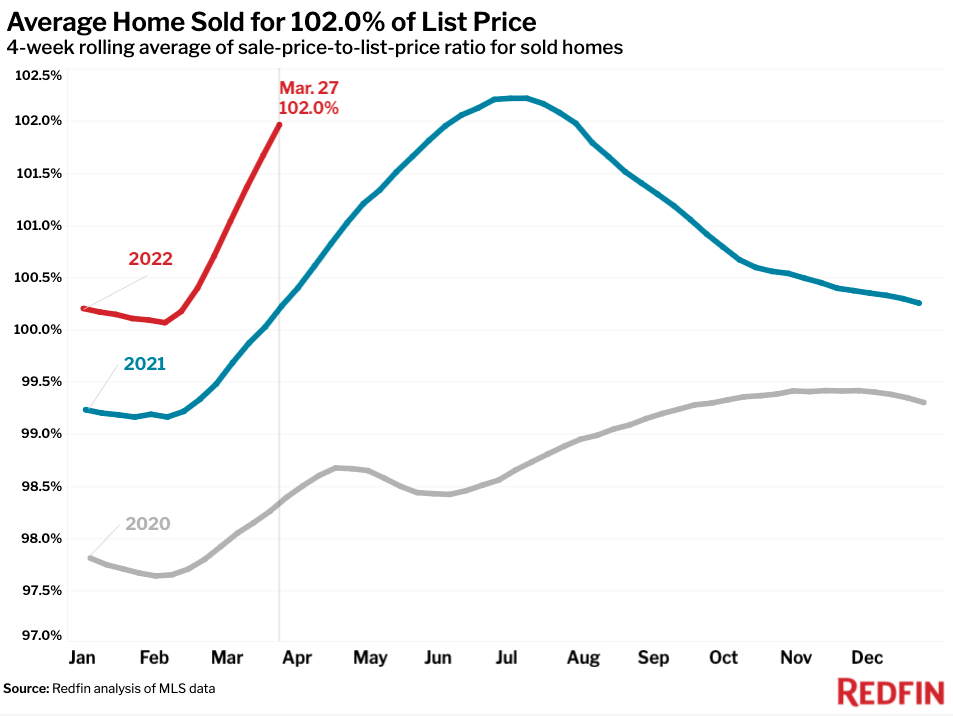

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, rose to 102%. In other words, the average home sold for 2% above its asking price. That’s up from 100.2% a year earlier and is the highest level since the four weeks ending Aug. 1, 2021.

Refer to our metrics definition page for explanations of all the metrics used in this report.

United States

United States Canada

Canada