The median home sale price rose 16% from a year earlier, the largest increase since August. Tensions in Ukraine have stalled the rapid increase in mortgage rates, which will likely intensify homebuying competition.

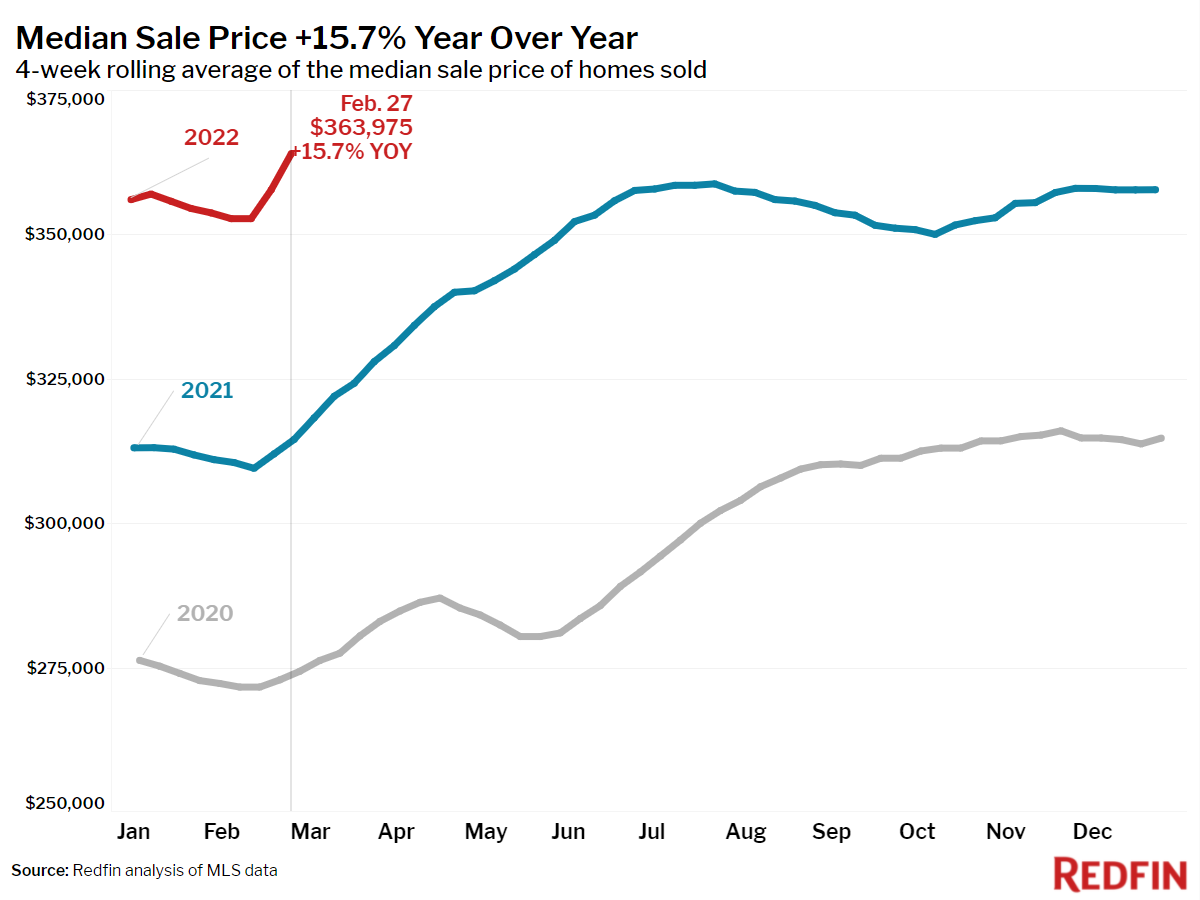

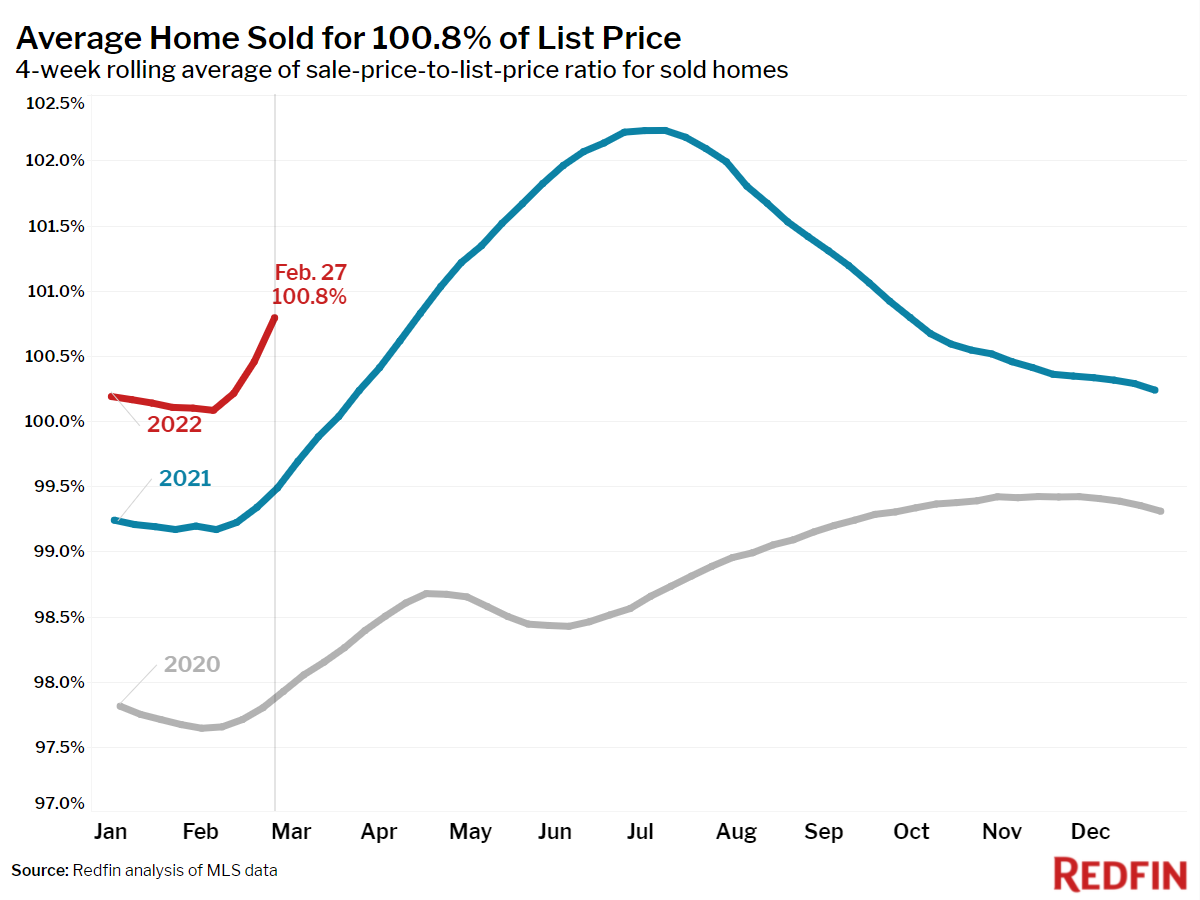

Home prices spiked to an all-time high of $363,975 as the market continued to heat up during the four-week period ending February 27. The median home-sale price was up 16% year over year, the biggest annual gain since August, and the typical home sold for 0.8% above list price, the largest premium since October. Intense competition among buyers driven by an extreme shortage of homes for sale is driving prices up unseasonably fast.

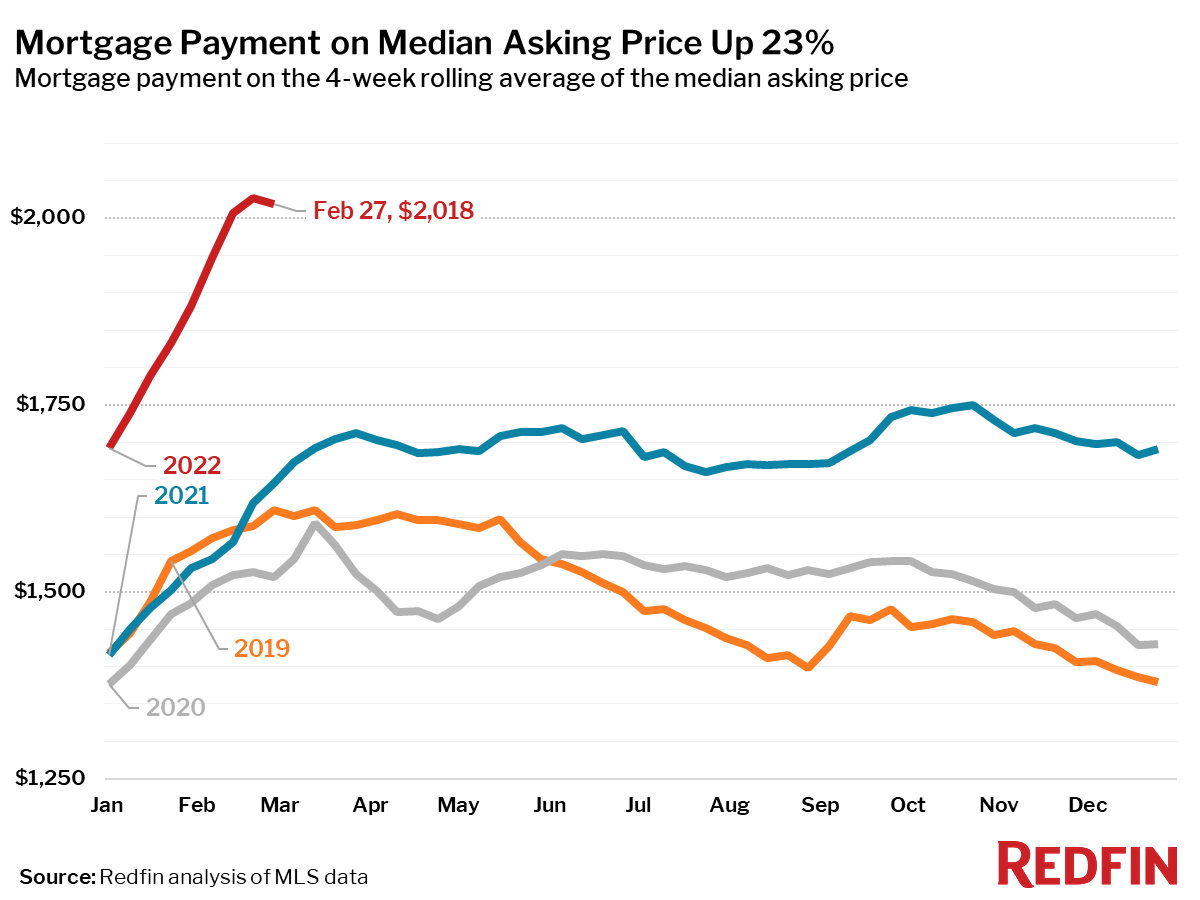

“The war in Ukraine has rattled the global economy, causing mortgage rates to fall after weeks of increases,” said Redfin Deputy Chief Economist Taylor Marr. “The dip in mortgage rates should buoy homebuying demand temporarily, fueling continued price gains. But demand may drop off if the Federal Reserve raises interest rates again as expected.”

Key housing market takeaways for 400+ U.S. metro areas:

Unless otherwise noted, the data in this report covers the four-week period ending February 27. Redfin’s housing market data goes back through 2012.

Data based on homes listed and/or sold during the period:

- The median home sale price was up 16% year over year to a record high of $363,975, and up 33% from the same time in 2020.

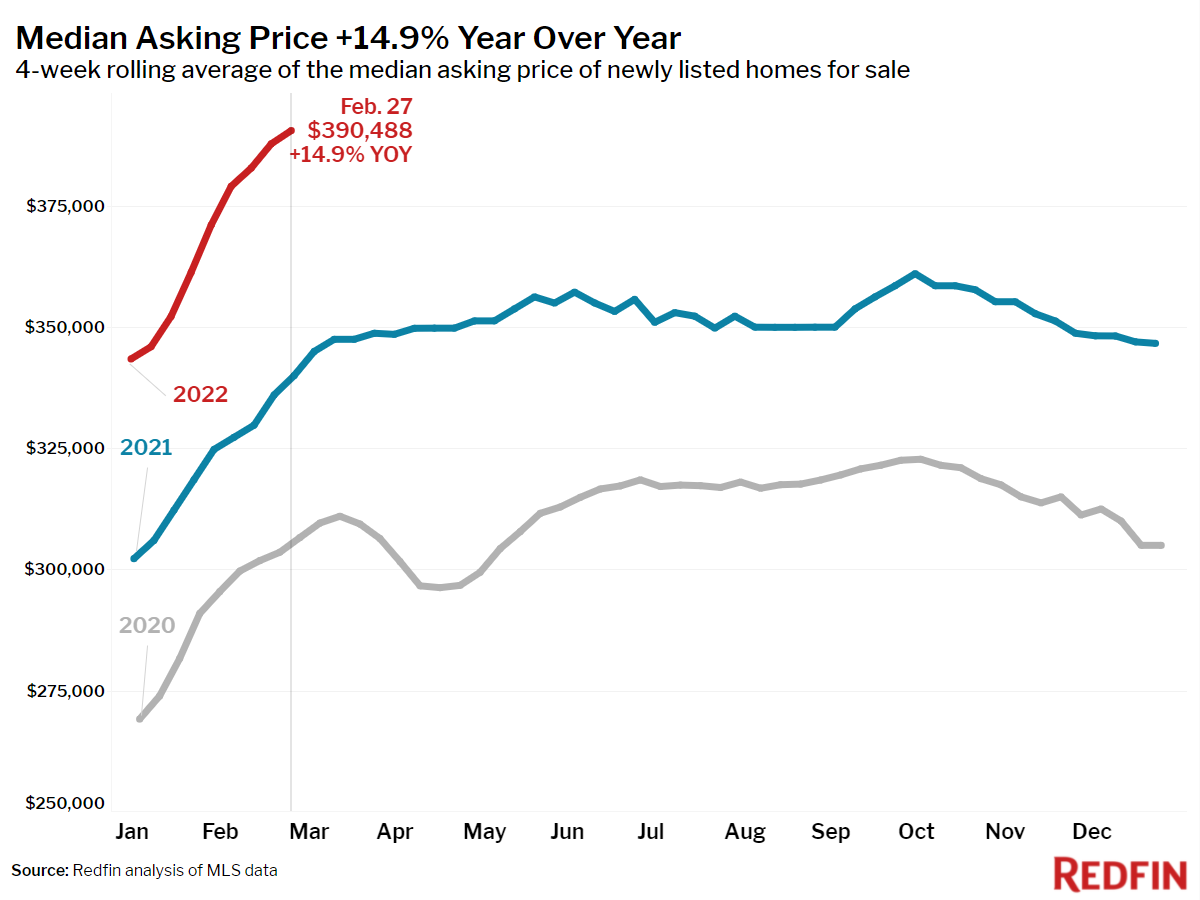

- The median asking price of newly listed homes increased 15% year over year to an all-time high of $390,488, and rose 27% from the same time in 2020.

- The monthly mortgage payment on the median asking price home fell slightly to $2,018 at the current 3.76% mortgage rate. This was up 23% from a year earlier, when mortgage rates were 3.02%, and up 36% from the same period in 2020, when rates were 3.29%.

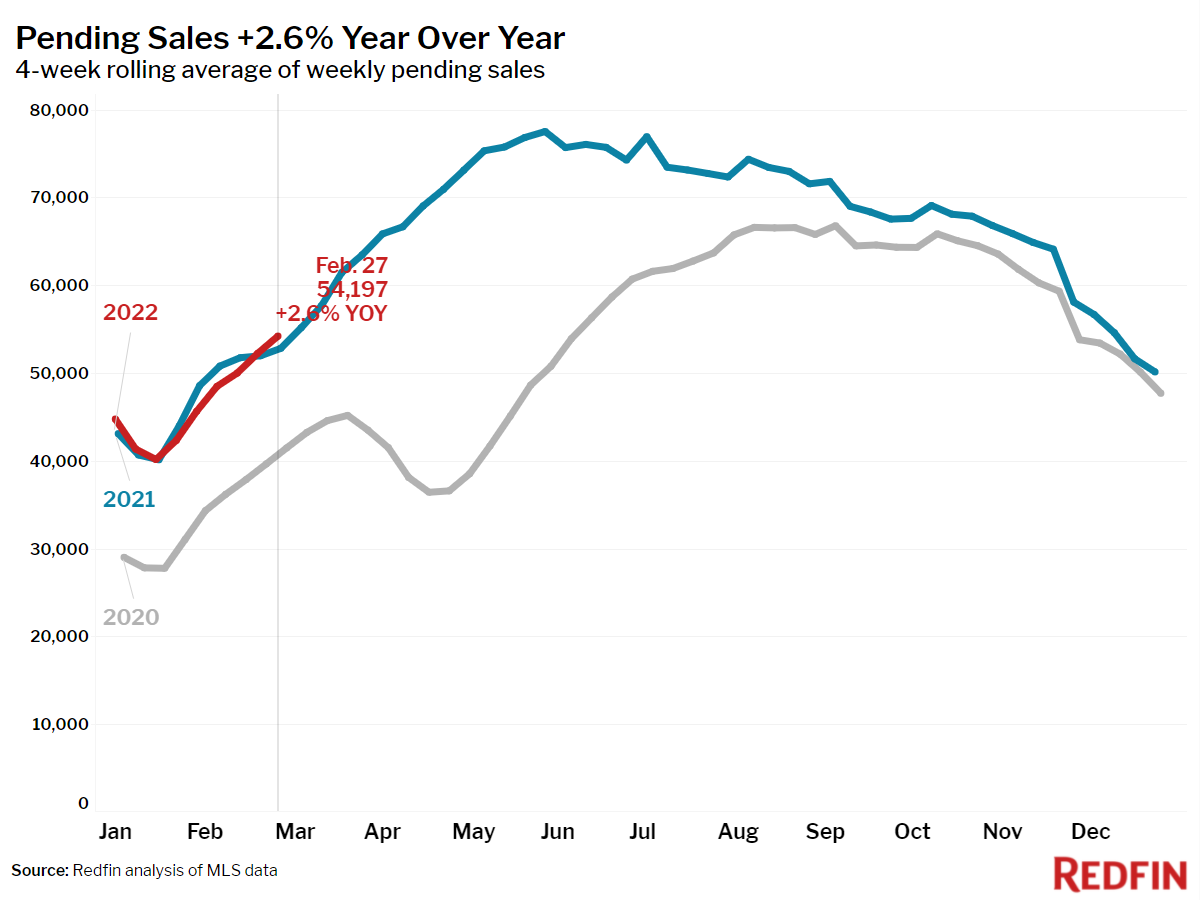

- Pending home sales were up 2.6% year over year and up 31% from the same period in 2020, just prior to the start of the pandemic.

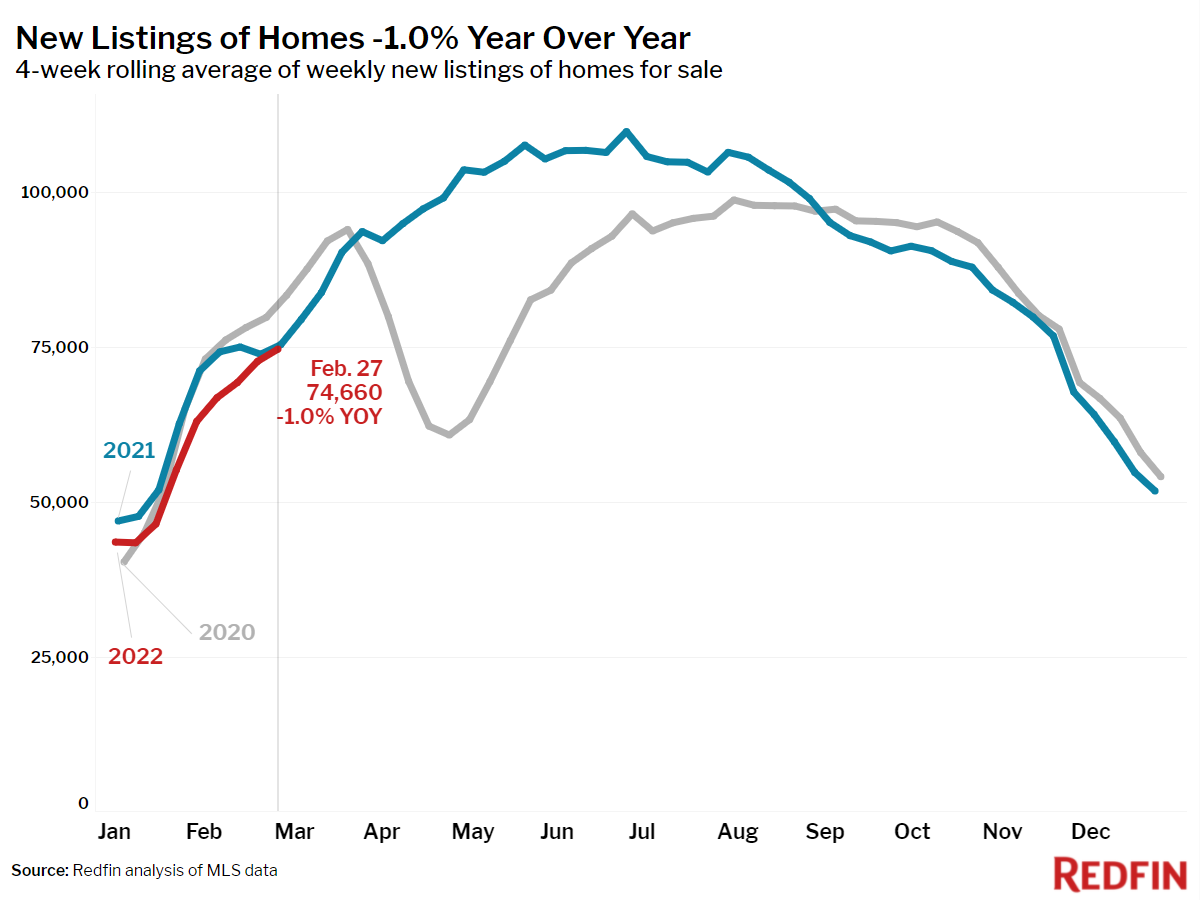

- New listings of homes for sale were down 1% from a year earlier. Compared to 2020, new listings were down 10%.

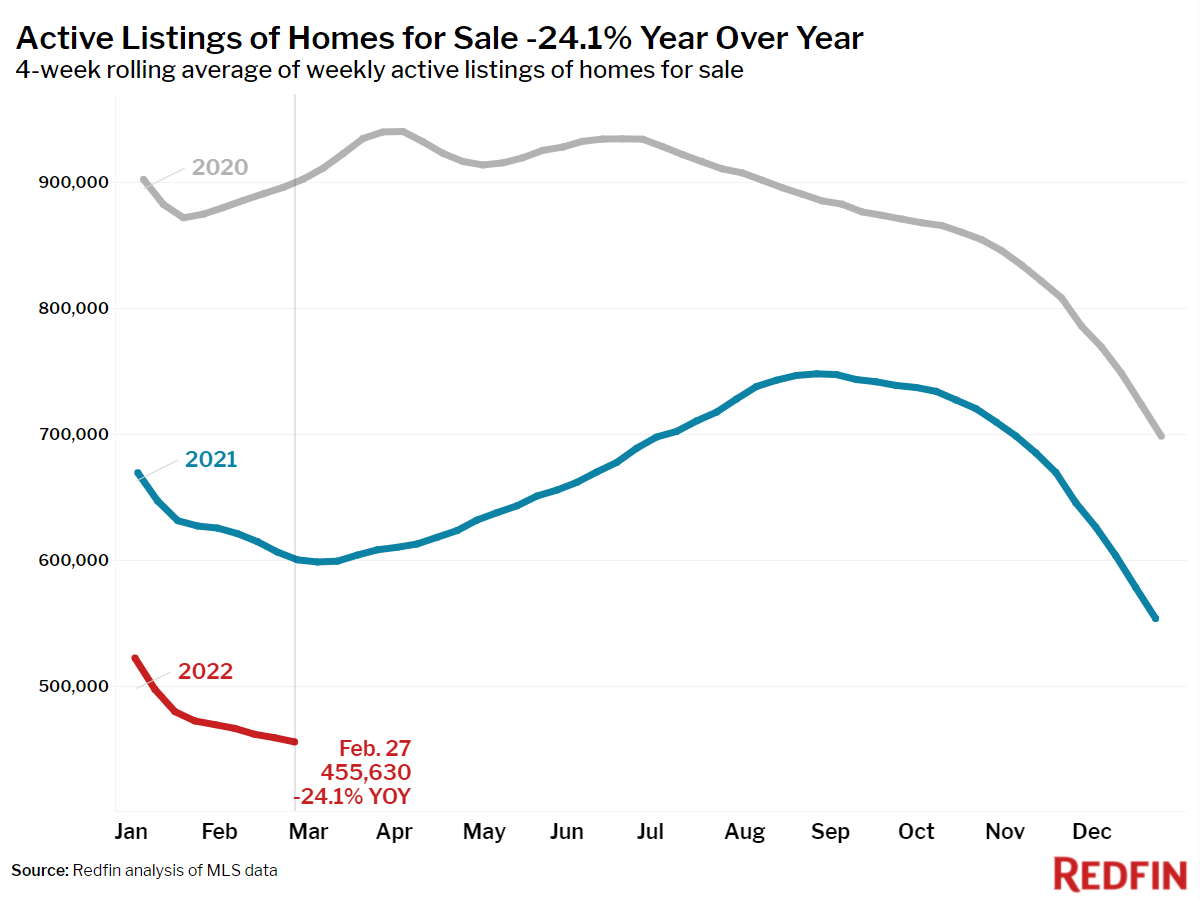

- Active listings (the number of homes listed for sale at any point during the period) fell 24% year over year, dropping to an all-time low of 456,000. Listings were down 50% from the same period in 2020.

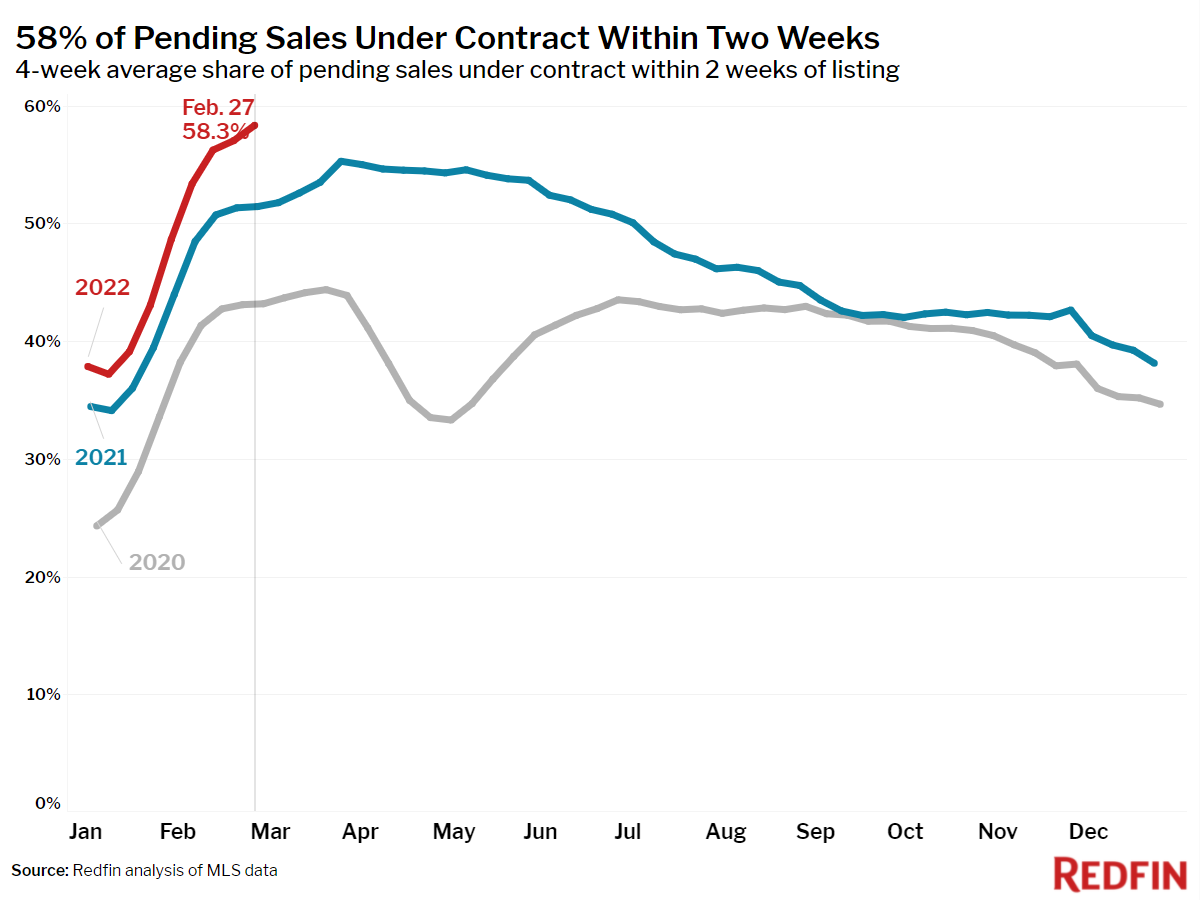

- 58% of homes that went under contract had an accepted offer within the first two weeks on the market, an all-time high. This was up from the 51% rate of a year earlier and 43% in 2020.

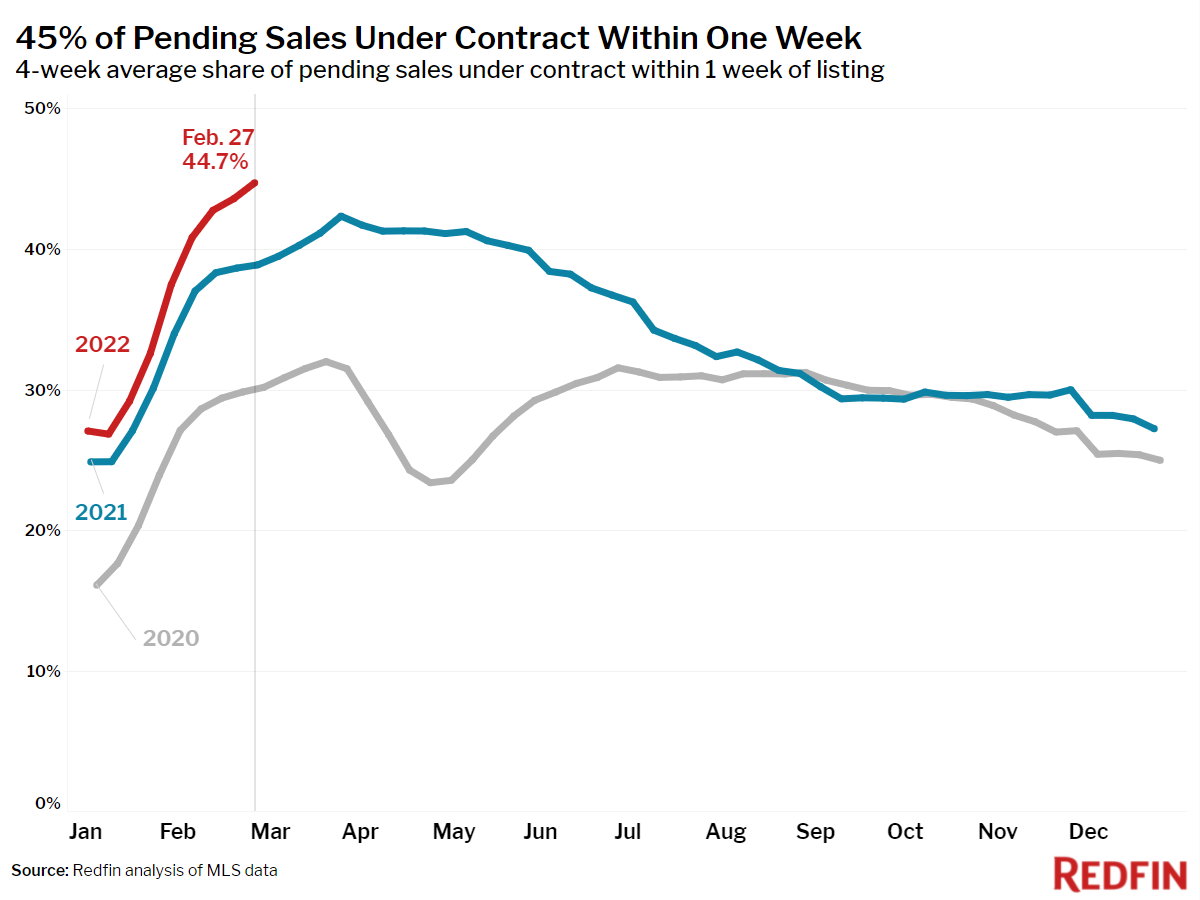

- 45% of homes that went under contract had an accepted offer within one week of hitting the market, an all-time high. This was up from 39% during the same period a year earlier and 30% in 2020.

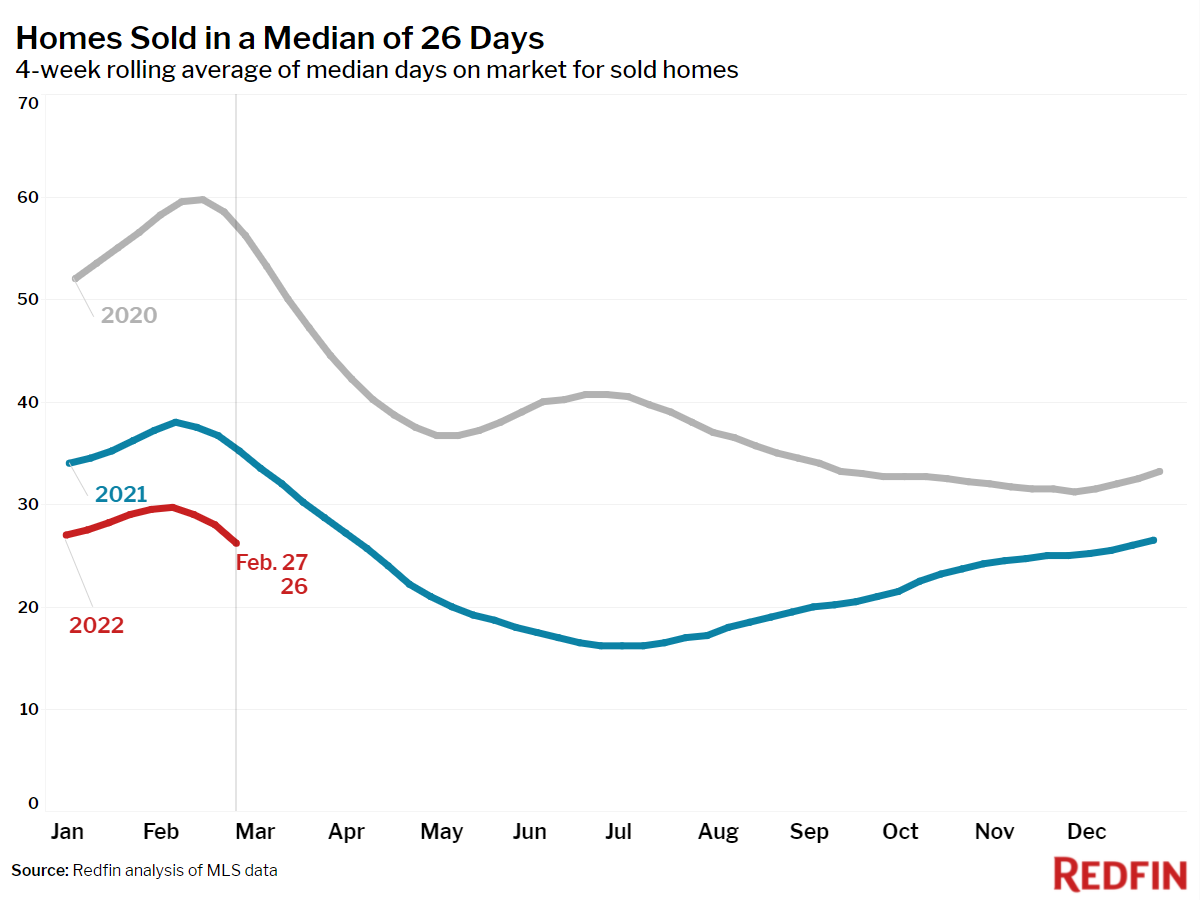

- Homes that sold were on the market for a median of 26 days, down from 35 days a year earlier and 56 days in 2020.

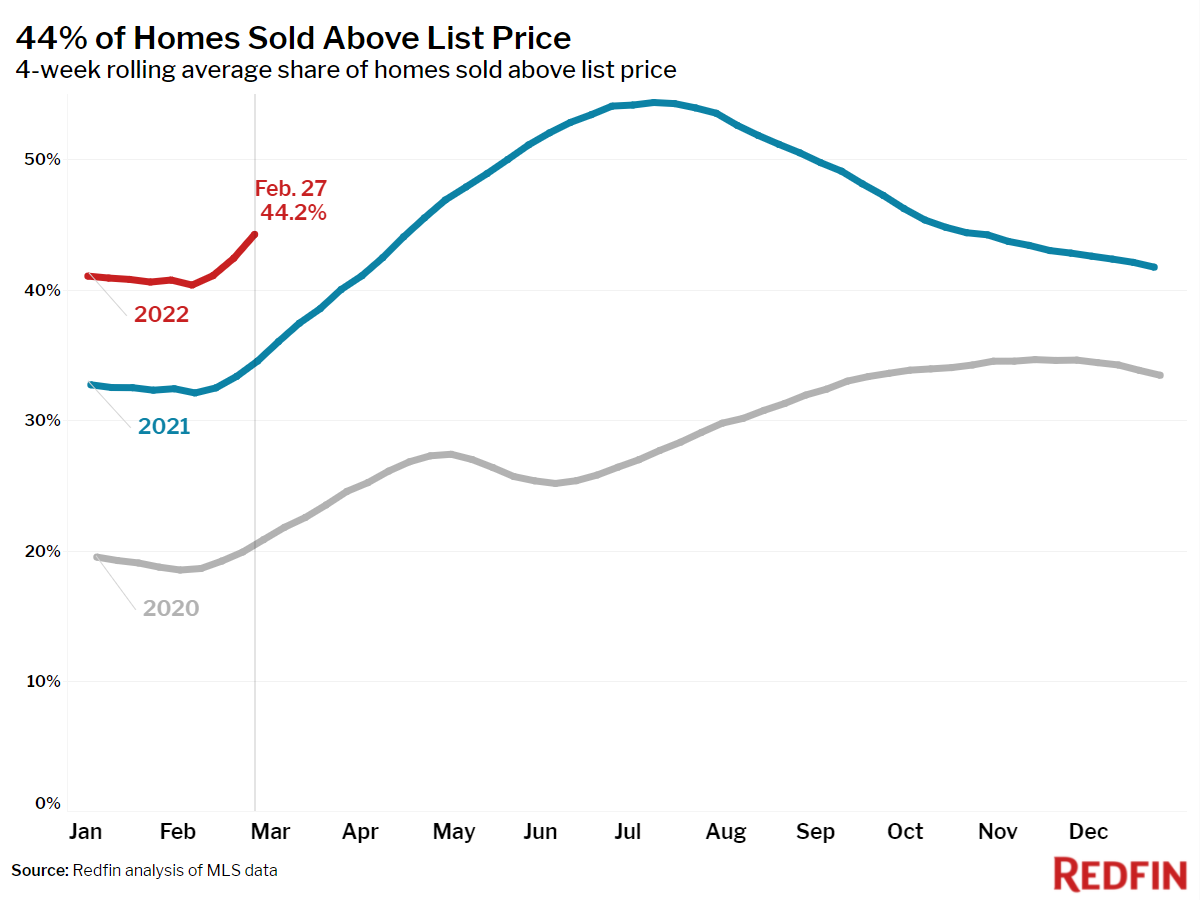

- 44% of homes sold above list price, up from 35% a year earlier and 21% in 2020.

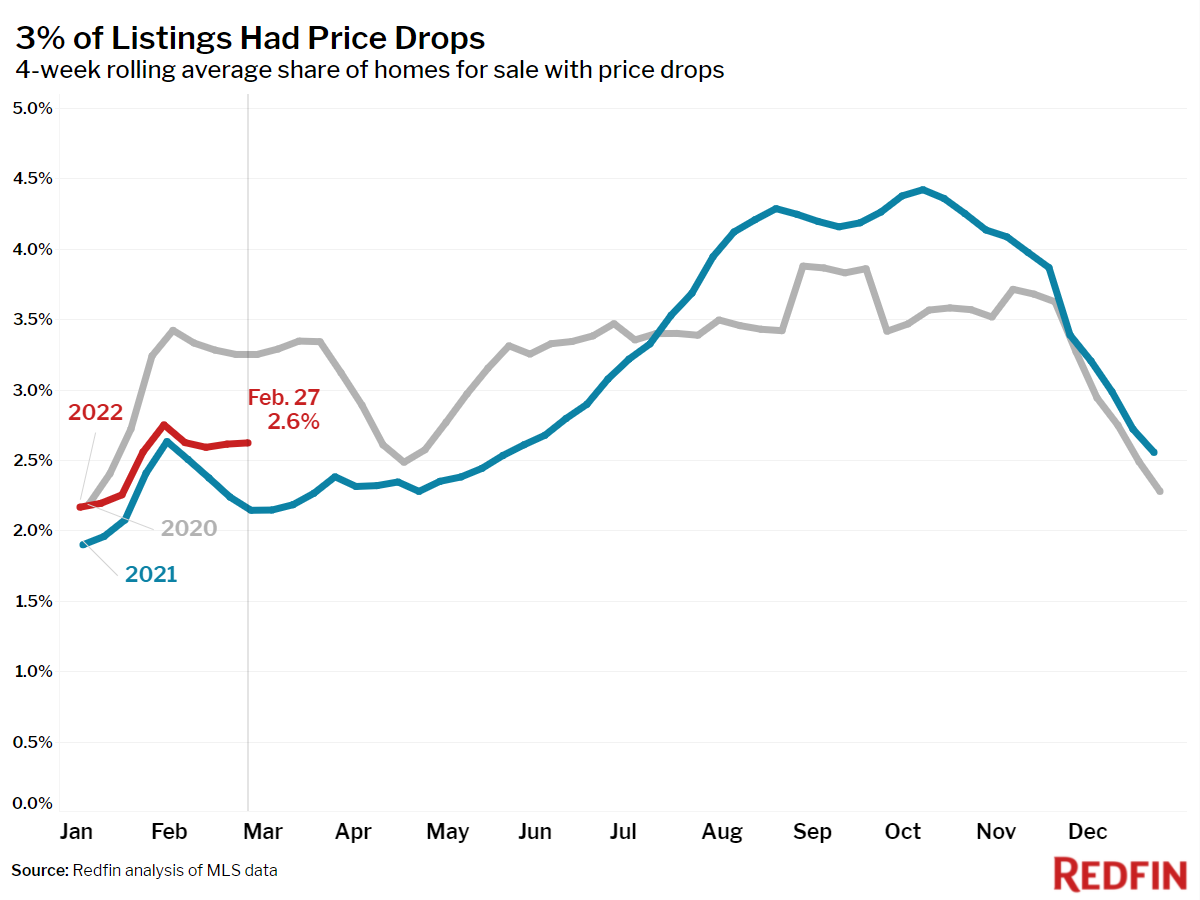

- On average, 2.6% of homes for sale each week had a price drop, up 0.5 percentage points from the same time in 2021, but down 0.6 percentage points from 2020.

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, rose to 100.8%. In other words, the average home sold for 0.8% above its asking price. This was up from 99.5% in 2021 and 97.9% in 2020.

Other leading indicators of homebuying activity:

- Mortgage purchase applications decreased 2% week over week (seasonally adjusted) during the week ending February 25.

- For the week ending March 3, 30-year mortgage rates fell to 3.76% from 3.89% the prior week.

- Touring activity from the first week of January through February 27 was 6 percentage points behind the same period in 2021 and 7 points behind the same period in 2020, according to home tour technology company ShowingTime.

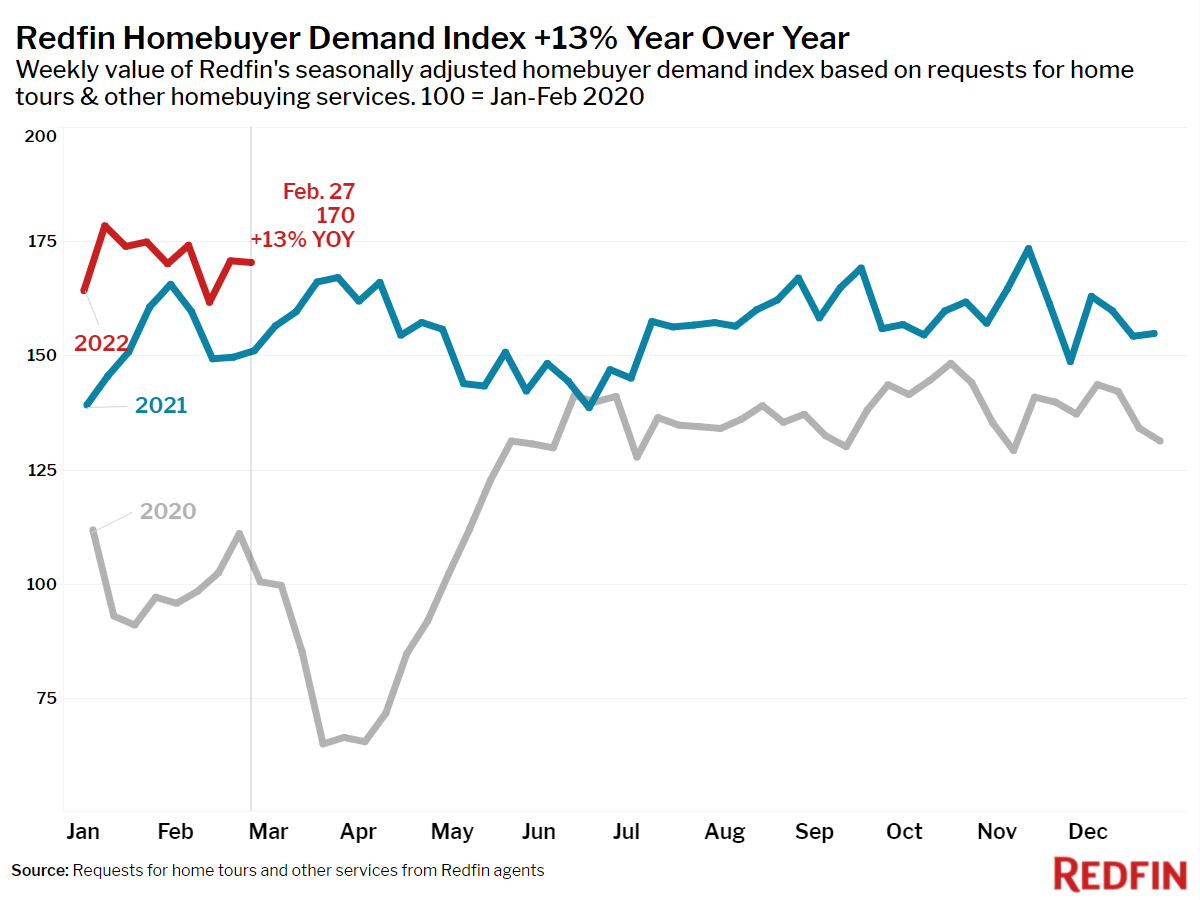

- The Redfin Homebuyer Demand Index fell 0.4% from the previous week during the seven-day period ending February 27 and was up 13% from a year earlier. The seasonally adjusted Redfin Homebuyer Demand Index is a measure of requests for home tours and other home-buying services from Redfin agents.

Refer to our metrics definition page for explanations of all the metrics used in this report.

United States

United States Canada

Canada