Declining mortgage rates have pushed the median U.S. housing payment down to $2,534, roughly $300 below April’s record high. But many homebuyers are still sitting on the sidelines. Some are hoping mortgage rates will fall further once the Fed cuts interest rates in a few weeks, and others are waiting for clarity about the new NAR rules or the outcome of the presidential election.

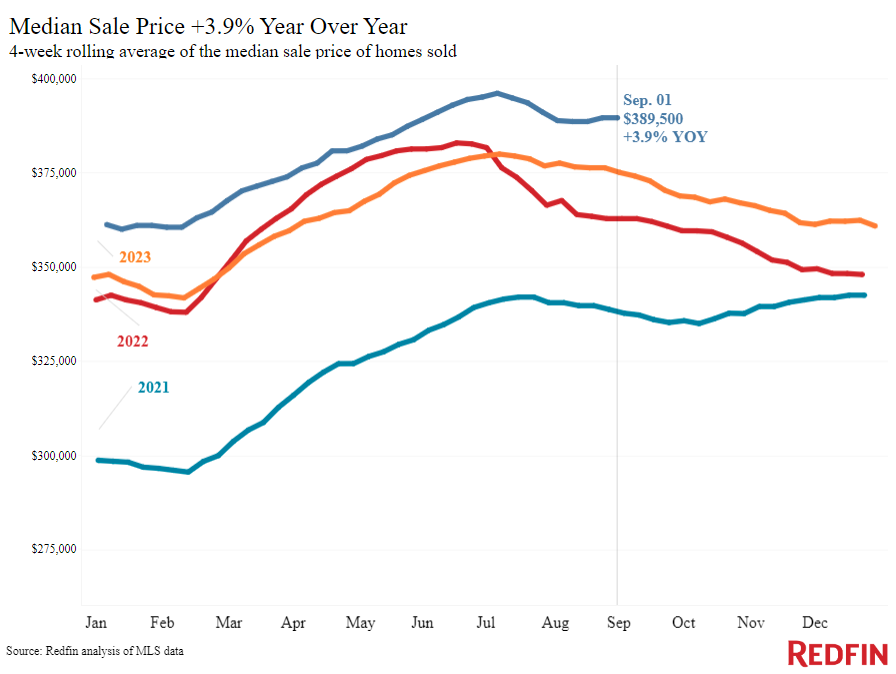

Weekly average mortgage rates have fallen to the lowest level in a year and a half. That’s saving homebuyers money, even though home-sale prices are still near record highs. The median U.S. monthly housing payment fell to $2,534 during the four weeks ending September 1, the lowest level since January and down nearly $300 from April’s all-time high.

But declining housing payments have yet to improve home sales. Pending homes sales fell 8.4% year over year, the biggest decline in nearly a year. Some would-be homebuyers are on the sidelines because they’re still priced out of the market. Redfin agents are also reporting that some buyers are waiting for more clarity on what the new NAR rules mean for real estate agent fees, and others are waiting to buy until after the presidential election.

“There is demand for desirable, move-in ready listings, but some house hunters are in a holding pattern because the industry is in flux,” said Van Welborn, a Redfin Premier agent in Phoenix. “Some buyers are waiting to see how the NAR rules shake out before they get serious. Others believe rates will come down more substantially after the Fed cuts interest rates later this month, and they’re waiting for that to happen before they buy.”

Mortgage rates may not come down much more than they already have. That’s because markets have already priced in interest-rate cuts from the Fed, starting in September and going through 2025. If the cuts are smaller and slower than expected, mortgage rates would rise from where they are today. If the Fed cuts faster than expected, mortgage rates are likely to decline further. If rates do fall substantially more than they already have, that could push up demand, competition and home prices.

There are some signals that more prospective buyers are touring homes and prepping to purchase, even if they’re not yet buying. Mortgage-purchase applications are up 3% week over week. Redfin’s Homebuyer Demand Index–a measure of tours and other buying services from Redfin agents–is up 4% from a month ago, and is near its highest level since May.

The supply of homes for sale is increasing modestly. New listings of homes for sale are up 3.7% year over year, on par with increases over the last few months, and total listings are up 16.6%. Total supply is rising partly because some homeowners who had been locked in by their relatively low mortgage rates are selling now that rates have come down a bit. Also, sluggish homebuyer demand is causing unsold listings to pile up.

For Redfin economists’ takes on the housing market, please visit Redfin’s “From Our Economists” page.

Leading indicators

| Indicators of homebuying demand and activity | ||||

| Value (if applicable) | Recent change | Year-over-year change | Source | |

| Daily average 30-year fixed mortgage rate | 6.38% (Sept. 4) | Near lowest level since spring 2023 | Down from 7.06% | Mortgage News Daily |

| Weekly average 30-year fixed mortgage rate | 6.35% (week ending Aug. 29) | Lowest level since May 2023 | Down from 7.18% | Freddie Mac |

| Mortgage-purchase applications (seasonally adjusted) | Increased 3% from a week earlier (as of week ending Aug. 30) | Down 4% | Mortgage Bankers Association | |

| Redfin Homebuyer Demand Index (seasonally adjusted) | Up 4% from a month earlier; near highest level since May (as of week ending Sept. 1) | Down 7% | Redfin Homebuyer Demand Index a measure of tours and other homebuying services from Redfin agents | |

| Touring activity | Down 4% from the start of the year (as of Sept 3)

(Down mostly due to Labor Day) |

At this time last year, it was down 4% from the start of 2023 | ShowingTime, a home touring technology company | |

| Google searches for “home for sale” | Up 6% from a month earlier (as of Aug. 26) | unchanged | Google Trends | |

Key housing-market data

| U.S. highlights: Four weeks ending Sept. 1, 2024

Redfin’s national metrics include data from 400+ U.S. metro areas, and is based on homes listed and/or sold during the period. Weekly housing-market data goes back through 2015. Subject to revision. |

|||

| Four weeks ending Sept. 1, 2024 | Year-over-year change | Notes | |

| Median sale price | $389,500 | 3.9% | About $5,000 below all-time high set during the 4 weeks ending July 7 |

| Median asking price | $393,700 | 5.3% | |

| Median monthly mortgage payment | $2,534 at a 6.35% mortgage rate | -1% | Lowest level since January; $291 below all-time high set during the 4 weeks ending April 28 |

| Pending sales | 78,666 | -8.4% | Biggest decline since Oct. 2023 |

| New listings | 87,132 | 3.7% | |

| Active listings | 993,565 | 16.6% | Smallest increase since April |

| Months of supply | 3.6 | +0.8 pts. | 4 to 5 months of supply is considered balanced, with a lower number indicating seller’s market conditions. |

| Share of homes off market in two weeks | 35.3% | Down from 39% | |

| Median days on market | 36 | +6 days | |

| Share of homes sold above list price | 28.1% | Down from 33% | |

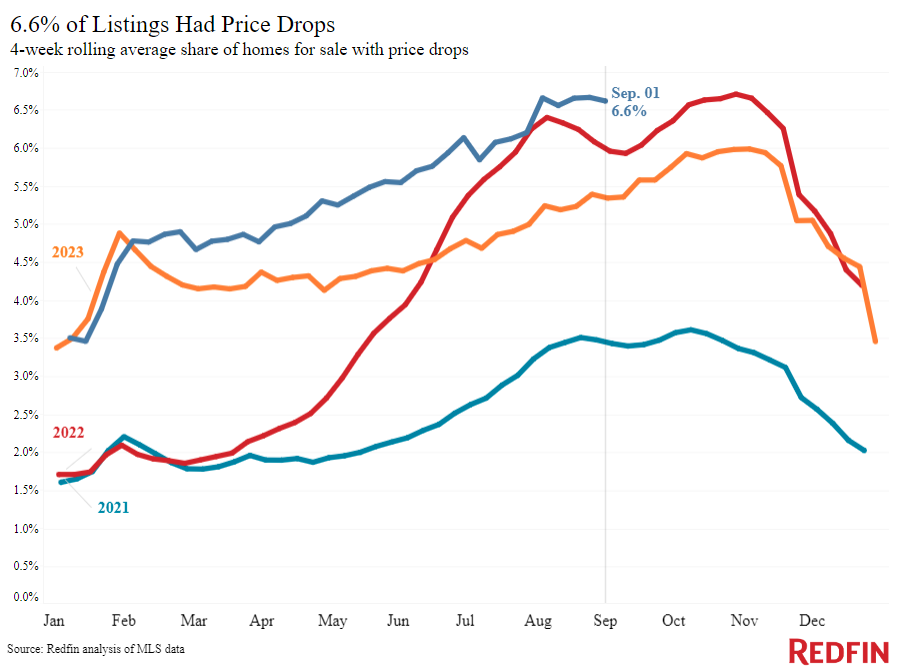

| Share of homes with a price drop | 6.6% | +1.3 pts. | |

| Average sale-to-list price ratio | 99.1% | -0.5 pts. | |

|

Metro-level highlights: Four weeks ending Sept. 1, 2024 Redfin’s metro-level data includes the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy. |

|||

|---|---|---|---|

| Metros with biggest year-over-year increases | Metros with biggest year-over-year decreases |

Notes |

|

| Median sale price | Philadelphia (11.9%)

Milwaukee (11.4%) Nassau County, NY (10.1%) Providence, RI (8.8%) Newark, NJ (7.8%) |

Austin, TX (-4.5%)

Fort Worth, TX (-1.7%) San Francisco, CA (-1.2%) Tampa, FL (-1.1%) San Antonio (-1%) Oakland, CA (-0.9%) Houston (-0.3%) |

Declined in 7 metros |

| Pending sales | San Francisco (7.1%)

Boston (6%) San Jose, CA (4%) Los Angeles (3.9%) Riverside, CA (3.5%) |

Miami (-17.4%)

West Palm Beach, FL (-17%) Fort Lauderdale, FL (-16.9%) Atlanta (-15.1%) Houston (-12.8%) |

Increased in 16 metros |

| New listings | San Diego (17.4%)

Las Vegas (15.4%) Phoenix (14.2%) Anaheim, CA (13.8%) Houston (12%) |

Atlanta (-15.6%)

San Antonio (-13.4%) Newark, NJ (-10.7%) Austin, TX (-10.6%) Chicago (-6.7%) |

Declined in 13 metros |

Refer to our metrics definition page for explanations of all the metrics used in this report.

United States

United States Canada

Canada