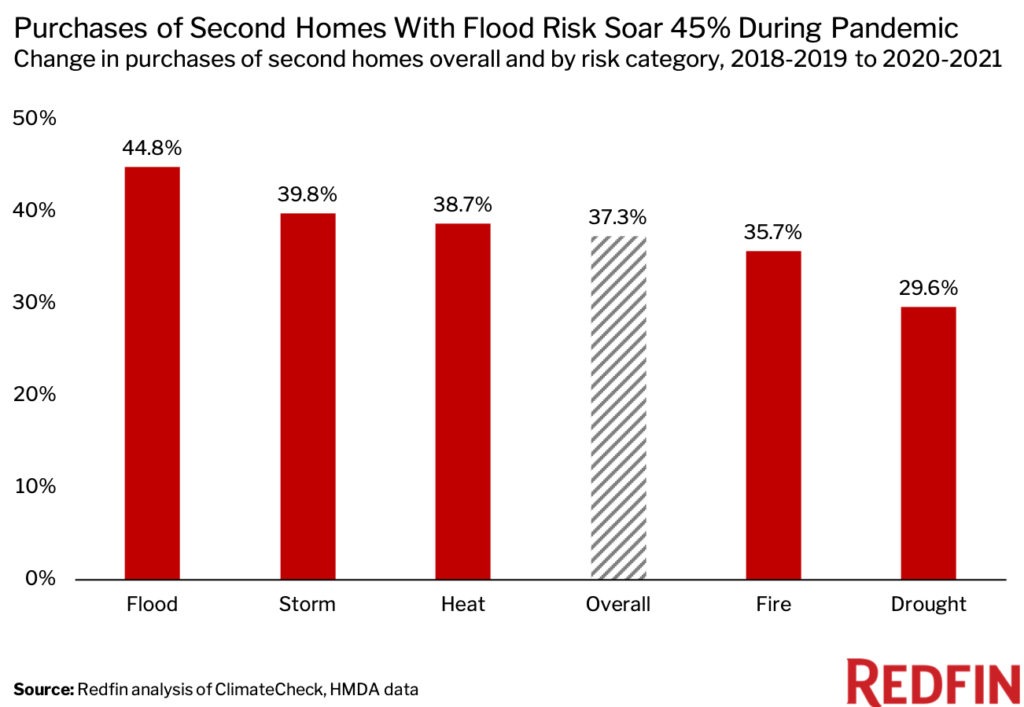

Purchases of second homes with high flood, storm and/or heat risk surged roughly 40% over the past two years.

Many pandemic homebuyers purchased vacation homes, which are frequently vulnerable to natural disasters. In 2020 and 2021, purchases of second homes with high flood risk rose 45% from the prior two-year period (2018-2019), according to a Redfin analysis of ClimateCheck data and public housing records. There were also significant increases in purchases of second homes with high storm risk (40%) and high heat risk (39%).

Demand for second homes surged during the pandemic as low mortgage rates, remote work and the desire to escape the city drove up demand for vacation properties. Overall, purchases of second homes were up 37% in the past two years from the two years before the pandemic. Demand has since fallen back below pre-pandemic levels as life has returned somewhat to normal, but many Americans now own at-risk second homes, which has implications for the future.

“The threat of climate change isn’t the top concern for a lot of homebuyers, which means they often prioritize factors like warm weather and proximity to the beach over avoiding natural-disaster risk. Second-home owners, in particular, have another place to live if disaster strikes—another reason climate danger may not feel like a pressing issue,” said Redfin Senior Economist Sheharyar Bokhari. “But house hunters should be aware that purchasing in a disaster-prone area not only puts them and their home at risk, but their finances as well. Home values in climate-endangered places may fall in the coming years as consumers learn more about the risks to properties in these areas.”

A recent Redfin analysis found that more people have been moving into than out of the U.S. counties with the largest share of homes at high risk from natural disasters. That’s partly because some buyers just aren’t aware of the risks. Redfin.com now publishes climate-risk data for nearly every U.S. home, with the exception of rental listings, to help house hunters make more informed decisions.

“House hunters from out of town ask about climate change because they’re very concerned about flooding, but most of them don’t change their minds,” said Miami Redfin agent Cristina Llanos. “They hear horror stories of hurricanes, but generally still move forward. People want to talk about it but it typically doesn’t make or break their decision.”

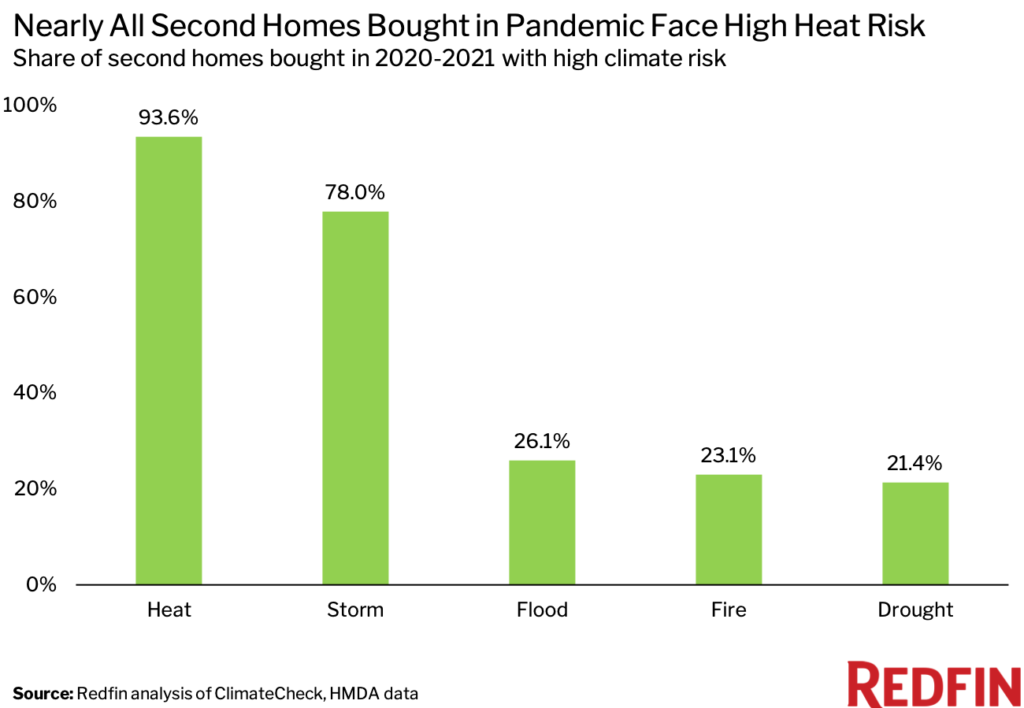

Heat and Storm Are Most Common Risks Second-Home Buyers Face

Overall, heat is the most common risk facing second-home buyers—nearly all (94%) of second homes purchased in the past two years face high heat risk. Next comes high storm risk, which plagues more than three-quarters (78%) of second homes bought in the past two years, followed by high flood risk (26%), high fire risk (23%) and high drought risk (21%).

Many popular second-home destinations, like Florida and Arizona, face significant heat and/or storm risk. The most popular destinations for homebuyers looking to relocate are Miami, Tampa and Phoenix, which attracted scores of affluent out-of-towners in search of vacation homes during the pandemic.

Methodology

To calculate the number and share of second homes purchased with high fire, drought, flood, heat and storm risk, Redfin paired climate-risk data from ClimateCheck with public records data made available by the Home Mortgage Disclosure Act. ClimateCheck assigns six different risk categories to properties across the U.S. (excluding Hawaii and Alaska)—relatively low, low, moderate, high, very high and extreme. For the purposes of this report, a high-risk property is one that falls into the high, very high or extreme category for a given climate risk. The data pairing was conducted by averaging risks at the census-tract level, the most granular geography available for aggregating publicly available second-home purchases. Note that second homes purchased with all cash are excluded from this analysis.

United States

United States Canada

Canada