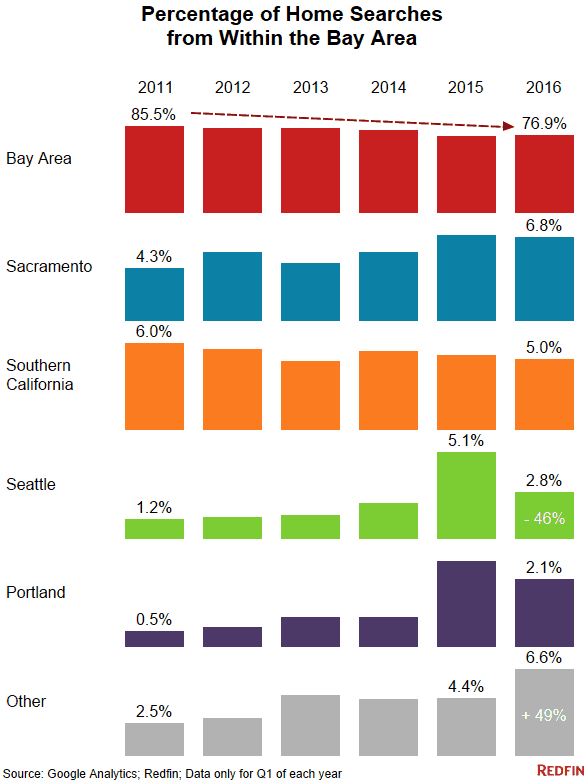

Last year, Redfin discovered that about one in four people who were searching on Redfin from the San Francisco Bay Area were looking for homes in other parts of the country. That was up from about one in seven in 2011, having increased consistently over the four years. As of this spring, the portion of Bay Area buyers looking to move has leveled off, but what’s changed is where they’re looking to go. Most notably, Seattle has become a less popular destination, while “other” cities, which include Washington, D.C., Austin, Denver, and Boston at the top of the list, have become more common havens for those leaving the Bay Area.

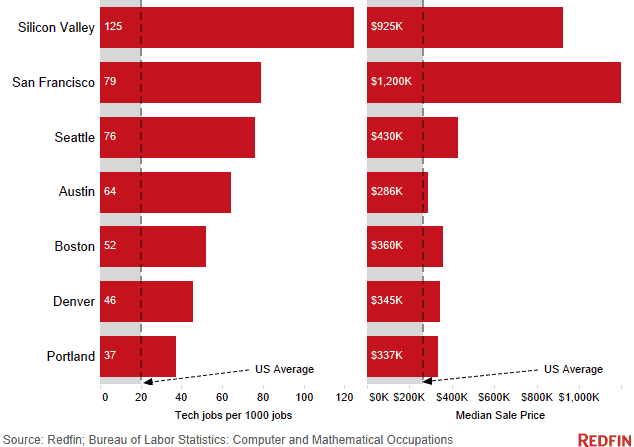

This outward migration is almost certainly due to the growing cost of housing in the Bay Area. As of May this year, the median home sale price in the San Francisco metro area was $1.2 million. The neighboring metros, San Jose and Oakland, are also among the most expensive housing markets in the country at $930,000 and $650,000 as of last month.

The Digital Diaspora

This makes other similar West Coast metros such as Seattle and Portland increasingly attractive, given that their average homes cost half what they would in the Bay Area. But the percentage of Bay Area-based searches for homes in Seattle fell by 45 percent to just 2.8 percent from 5.1 percent last Spring.

Seattle Redfin agent Daniel Burton notes that while searches may be down, he is still working with many buyers from the Bay Area who now live in Seattle.

“It’s quite common for people to begin home searches a year or so before they buy to test the waters and get settled financially, and in their new jobs and cities,” said Burton. “We’re working quite a bit with this second wave of Bay Area homebuyers—people who searched for Seattle homes while still in the Bay Area and decided to rent for a year or two after moving, and are now entering the market to buy.”

Seattle has been adding a lot of tech jobs the last couple years, giving rise to a large tech migration. However, there have been mixed feelings about the city’s growth.

This influx of new jobs has brought many benefits to Seattle’s economy. Yet, over the same period Seattle has grown more unequal, with the portion of families’ incomes at the high and low ends increasing and those in the middle-income range decreasing.

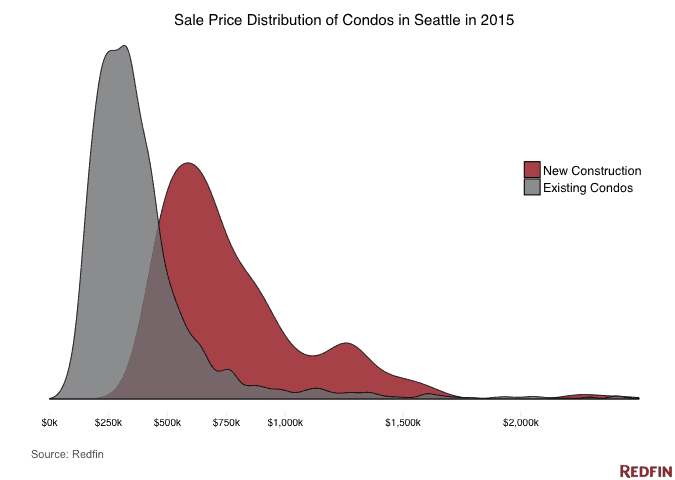

New homes are being built in Seattle to accommodate some of this growth, but the majority are higher-end homes at expensive price points. This has been a trend for years now. In 2010, the average new construction condo cost 50 percent more than the average existing ones. In 2015, new condos cost more than twice as much as existing condos.

While fewer people are looking in Seattle this year than last, the proportion of people searching within the Bay Area remained relatively stable. So where did these searches go? Mostly to other growing and still affordable tech hubs like D.C., Austin, Denver and Boston.

The Other Silicon Valleys

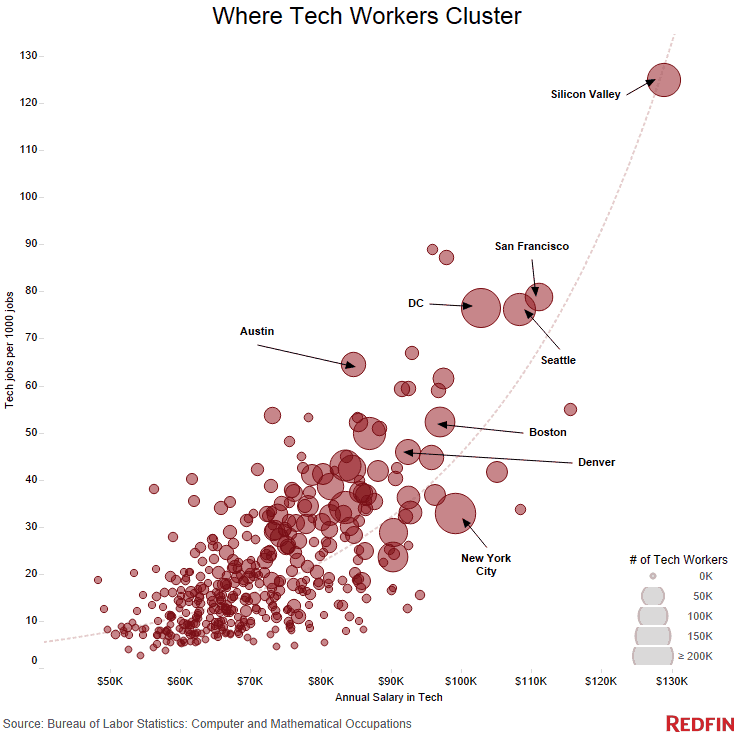

Tech jobs are very fluid as software companies can move employees from, say, San Francisco to Austin, much more easily than a manufacturing plant or retail warehouse would be able to relocate their operations. This also allows tech workers to adapt quickly to where the jobs are located.

Although jobs in technology total only 3.9 million (less than 3 percent of all U.S. workers), they can have large impacts on their cities. The growth of tech jobs in Seattle has brought population changes that outpaced the supply of housing. Many of these migrants to Seattle are young, educated and very well paid–shifting the demand for housing. This, in turn, pushed up housing prices for the whole area.

Zoning regulations holding back the supply of housing growth, however, may be more to blame than the new wealth from tech growth. This is why some new tech hubs are not destined for the same fate as Silicon Valley. A growing and vibrant economy is a great thing, so long as the supply of new housing units meets this influx of workers.

While tech jobs continue to grow in Seattle and Silicon Valley, at 4 percent and 10 percent respectively, they have been rapidly growing in Austin, Boston, D.C. and Denver as well. According to the latest data from the Bureau of Labor Statistics, Austin increased tech sector employment by roughly 9,000 jobs from 2014 to 2015, a 17.6 percent annual growth rate. At the same time the cost for urban living has increased, pushing home sales 1.6 miles (12.3%) farther from the city center since 2011.

“Builders can’t keep up with the demand closer to the central core of Austin, but areas like Pflugerville, Cedar Park and Round Rock are experiencing rapid growth and new-build communities are getting snatched up quickly by buyers moving to the area from more expensive cities like San Francisco,” said Lauren Johnson, Redfin agent in Austin.

“Living 30 minutes outside of the urban core doesn’t faze many of my clients—for a third of the price they’re getting three times the property, so being just outside the city is a fair trade. One of my recent clients was living in a $1 million townhome in San Jose, and purchased a much larger home in Pflugerville for under $400,000.”

Boston‘s tech growth hasn’t played out in the same way as the other cities, though. An influx of tech workers has only offset a longtime outward migration of locals seeking warmer climates, keeping house price appreciation lower than in the other cities.

“With their high incomes and large down payments, tech workers pack a big punch,” said Redfin chief economist Nela Richardson. “Even small numbers of workers moving from the Bay Area can have dramatic effects on high-demand neighborhoods in the urban core near jobs and city amenities. Locals often can’t compete and end up moving farther away from urban tech hubs where they can afford to live.”

Washington, D.C.’s tech sector doesn’t look simply like another Silicon Valley. Instead, D.C.’s tech scene is taking a top down approach and allowing closer ties for tech-companies to the federal government, with a heavy role in defense contracting and other public related spending. The District is using tax breaks and grants for high-tech companies, trying to make it the largest tech hub on the East Coast.

Denver’s tech scene increased 10.7 percent, bringing in 5,603 tech jobs. That growth has accounted for 20 percent of all new jobs produced in the city. The Mile High City’s tech startups are noted to foster growth among one another. Denver’s growth has also been heavier among millennials and more concerned with social good and civic hacking.

High-skilled tech workers benefit greatly from proximity to one another. Software companies can more easily share talent and ideas. A startup scene in one city will attract other software developers to join in and collaborate.

The job growth in these cities is not limited to tech, though. Berkeley Economist Enrico Moretti found that for every new high-tech job in a city, five additional jobs are created outside tech in that city over the subsequent decades.

This growth in tech won’t be slowing anytime soon. The Bureau of Labor Statistics projects that tech jobs will grow at about 12 percent per year, double the average of all occupations. These new tech hubs must get ahead of this growth with a particular focus on housing if they want to avoid repeating the Valley’s mistakes.

_________

Check out these past articles in this series from our CEO, Glenn Kelman: The Digital Diaspora, When Technologist Come to Town, & Second Silicon Valleys.

United States

United States Canada

Canada